Bed, Bath and Beyond 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROPOSAL 1—ELECTION OF DIRECTORS

Governance Guidelines and Policies; Additional Information

The Board has adopted Corporate Governance Guidelines that are available in the Investor Relations section of the

Company’s website at www.bedbathandbeyond.com, where you may also find the Company’s policies on director attendance

at the Annual Meeting and how shareholders can communicate with the Board of Directors. In addition, the Board has adopted

a Policy of Ethical Standards for Business Conduct that applies to all directors and employees. This Policy also can be found

in the Investor Relations section of the Company’s website noted above. The Company intends to post on this website any

amendments to, or waivers from, the Code of Ethics that applies to the principal executive officer, financial officer and

accounting officer.

The Company maintains directors and officers indemnification insurance coverage. This insurance covers directors and

officers individually where exposures exist other than those for which the Company is able to provide indemnification. This

coverage is from June 1, 2015 through June 1, 2016, at a total cost of approximately $251,000. The primary carrier is Arch

Insurance Company. Although no assurances can be provided, the Company intends to obtain similar coverage from June 1,

2016 through June 1, 2017.

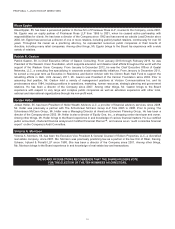

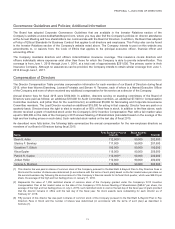

Compensation of Directors

The Director Compensation Table provides compensation information for each member of our Board of Directors during fiscal

2015, other than Warren Eisenberg, Leonard Feinstein and Steven H. Temares, each of whom is a Named Executive Officer

of the Company and none of whom received any additional compensation for his service as a director of the Company.

Annual director fees for fiscal 2015 were $100,000. In addition, directors serving on standing committees of the Board of

Directors were paid as follows: an additional $10,000 for Audit Committee members, an additional $7,500 for Compensation

Committee members, and (other than for the Lead Director) an additional $5,000 for Nominating and Corporate Governance

Committee members. The Lead Director received an additional $15,000 for acting in that capacity. Director fees are paid on a

quarterly basis. Directors have the right to elect to receive all or 50% of their fees in stock. In addition to the fees above, each

director received a grant of restricted stock under the Company’s 2012 Incentive Compensation Plan with a fair market value

equal to $90,000 on the date of the Company’s 2015 Annual Meeting of Shareholders (calculated based on the average of the

high and low trading prices on such date). Such restricted stock vested on the last day of fiscal 2015.

As described more fully below, the following table summarizes the annual compensation for the non-employee directors as

members of our Board of Directors during fiscal 2015.

Name

Fees Earned or Paid in

Cash ($)

Stock Awards

($)(2) Total ($)

Dean S. Adler 112,500(1) 90,000 202,500

Stanley F. Barshay 117,500 90,000 207,500

Geraldine T. Eilliott 100,000 90,000 190,000

Klaus Eppler 115,000 90,000 205,000

Patrick R. Gaston 110,000(3) 90,000 200,000

Jordan Heller 110,000 90,000 200,000

Victoria A. Morrison 112,500 90,000 202,500

(1) This director fee was paid in shares of common stock of the Company pursuant to the Bed Bath & Beyond Plan to Pay Directors Fees in

Stock and the number of shares was determined (in accordance with the terms of such plan) based on the fair market value per share on

the second business day following the announcement of the Company’s financial results for its fiscal third quarter, which was $46.23 per

share, the average of the high and low trading prices on January 11, 2016.

(2) Represents the value of 1,296 restricted shares of common stock of the Company granted under the Company’s 2012 Incentive

Compensation Plan at fair market value on the date of the Company’s 2015 Annual Meeting of Shareholders ($69.47 per share, the

average of the high and low trading prices on July 2, 2015), such restricted stock to vest on the last day of the fiscal year of grant provided

that the director remains in office until the last day of the fiscal year. No stock awards were outstanding for each director as of

February 27, 2016.

(3) Fifty percent of this director fee was paid in shares of common stock of the Company pursuant to the Bed Bath & Beyond Plan to Pay

Directors Fees in Stock and the number of shares was determined (in accordance with the terms of such plan) as described in

footnote (1).

13