Bed, Bath and Beyond 2015 Annual Report Download - page 85

Download and view the complete annual report

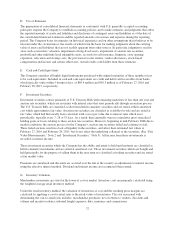

Please find page 85 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At any one time, inventories include items that have been written down to the Company’s best estimate of their

realizable value. Judgment is required in estimating realizable value and factors considered are the age of

merchandise and anticipated demand. Actual realizable value could differ materially from this estimate based

upon future customer demand or economic conditions.

The Company estimates its reserve for shrinkage throughout the year based on historical shrinkage and any

current trends, if applicable. Actual shrinkage is recorded at year end based upon the results of the Company’s

physical inventory counts for locations at which counts were conducted. For locations where physical inventory

counts were not conducted in the fiscal year, an estimated shrink reserve is recorded based on historical

shrinkage and any current trends, if applicable. Historically, the Company’s shrinkage has not been volatile.

The Company accrues for merchandise in transit once it takes legal ownership and title to the merchandise; as

such, an estimate for merchandise in transit is included in the Company’s merchandise inventories.

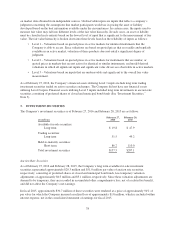

H. Property and Equipment

Property and equipment are stated at cost. Depreciation is computed primarily using the straight-line method over

the estimated useful lives of the assets (forty years for buildings; five to twenty years for furniture, fixtures and

equipment; and three to ten years for computer equipment and software). Leasehold improvements are amortized

using the straight-line method over the lesser of their estimated useful life or the life of the lease. Depreciation

expense is primarily included within selling, general and administrative expenses.

The cost of maintenance and repairs is charged to earnings as incurred; significant renewals and betterments are

capitalized. Maintenance and repairs amounted to $130.9 million, $120.3 million and $111.9 million for fiscal

2015, 2014 and 2013, respectively.

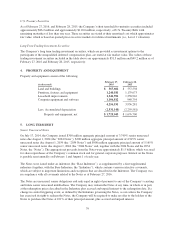

I. Impairment of Long-Lived Assets

The Company reviews long-lived assets for impairment when events or changes in circumstances indicate the

carrying value of these assets may exceed their current fair values. Recoverability of assets to be held and used is

measured by a comparison of the carrying amount of an asset to the estimated undiscounted future cash flows

expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future cash flows,

an impairment charge is recognized for the amount by which the carrying amount of the asset exceeds the fair

value of the assets. Assets to be disposed of would be separately presented in the balance sheet and reported at

the lower of the carrying amount or fair value less costs to sell, and are no longer depreciated. The assets and

liabilities of a disposal group classified as held for sale would be presented separately in the appropriate asset and

liability sections of the balance sheet. The Company has not historically recorded any material impairment to its

long-lived assets. In the future, if events or market conditions affect the estimated fair value to the extent that a

long-lived asset is impaired, the Company will adjust the carrying value of these long-lived assets in the period in

which the impairment occurs.

J. Goodwill and Other Indefinite Lived Intangible Assets

The Company reviews goodwill and other intangibles that have indefinite lives for impairment annually or when

events or changes in circumstances indicate the carrying value of these assets might exceed their current fair

values. Impairment testing is based upon the best information available, including estimates of fair value which

incorporate assumptions marketplace participants would use in making their estimates of fair value. The

Company has not historically recorded an impairment to its goodwill and other indefinite lived intangible assets.

As of February 27, 2016, for goodwill related to the North American Retail operating segment and the

Institutional Sales operating segment and certain other indefinite lived intangible assets, the Company assessed

qualitative factors in order to determine whether any events and circumstances existed which indicated that it was

more likely than not that the fair value of these indefinite lived intangible assets did not exceed its carrying value

73