Bed, Bath and Beyond 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.distribution; potential supply chain disruption; and the ability to find suitable locations at acceptable occupancy

costs and other terms to support the Company’s plans for new stores. The Company cannot predict whether,

when or the manner in which these factors could affect the Company’s operating results.

The results of operations for the fiscal year ended February 27, 2016 include Of a Kind since the date of

acquisition in the second quarter of fiscal 2015.

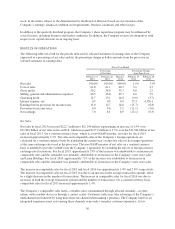

The following represents an overview of the Company’s financial performance for the periods indicated:

• Net sales in fiscal 2015 increased approximately 1.9% to $12.104 billion; net sales in fiscal 2014

increased approximately 3.3% to $11.881 billion over net sales of $11.504 billion in fiscal 2013. On a

constant currency basis, which is a non-GAAP measure, net sales increased approximately 2.3%, as

compared with fiscal 2014. Net sales and comparable sales of the Company’s foreign operations are

calculated on a constant currency basis by translating the current year’s respective sales of its foreign

operations at the same exchange rates used in the prior year. The non-GAAP measure of net sales on a

constant currency basis is intended to provide visibility into the Company’s operations by excluding

the effects of foreign currency exchange rate fluctuations.

• Comparable sales in fiscal 2015 increased by approximately 1.0%, as compared with an increase of

approximately 2.4% for both fiscal 2014 and fiscal 2013. On a constant currency basis, comparable

sales for fiscal 2015 increased by 1.4%. For fiscal 2015, comparable sales consummated through

customer facing online websites and mobile applications increased in excess of 25% over the

corresponding period in the prior year, while comparable sales consummated in-store declined

approximately 1% over the corresponding period in the prior year. For fiscal 2014, comparable sales

consummated through customer facing online websites and mobile applications increased in excess of

50%, over the corresponding period in the prior year, while comparable sales consummated in-store

were relatively flat to the corresponding period in the prior year.

Comparable sales include sales consummated through all retail channels which have been operating for

twelve full months following the opening period (typically four to six weeks). The Company is an

omnichannel retailer with capabilities that allow a customer to use more than one channel when making

a purchase, including in-store, online, with a mobile device or through a contact center, and have it

fulfilled, in most cases, either through in-store customer pickup or by direct shipment to the customer

from one of the Company’s distribution facilities, stores or vendors.

Sales consummated on a mobile device while physically in a store location are recorded as customer

facing online websites and mobile applications sales. Customer orders reserved online and picked up in

a store are recorded as in-store sales. In-store sales are reduced by sales originally consummated from

customer facing online websites and mobile applications and subsequently returned in-store.

Stores relocated or expanded are excluded from comparable sales if the change in square footage would

cause meaningful disparity in sales over the prior period. In the case of a store to be closed, such

store’s sales are not considered comparable once the store closing process has commenced. Of a Kind

is excluded from the comparable sales calculation for fiscal 2015, and will continue to be excluded

until after the anniversary of the acquisition. Cost Plus World Market was excluded from the

comparable sales calculation through the end of the fiscal first half of 2013, and is included beginning

with the fiscal third quarter of 2013. Linen Holdings is excluded from the comparable sales

calculations and will continue to be excluded on an ongoing basis as it represents non-retail activity.

• Gross profit for fiscal 2015 and fiscal 2014 was $4.620 billion; fiscal 2015 gross profit was 38.2% of

net sales compared with 38.9% of net sales for fiscal 2014. Gross profit for fiscal 2013 was $4.566

billion or 39.7% of net sales.

• Selling, general and administrative expenses (“SG&A”) for fiscal 2015 were $3.205 billion or 26.5% of

net sales compared with $3.065 billion or 25.8% of net sales for fiscal 2014 and $2.951 billion or

25.7% of net sales for fiscal 2013.

54