Bed, Bath and Beyond 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

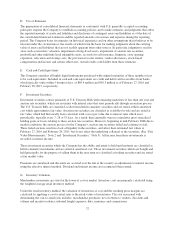

on market data obtained from independent sources. Unobservable inputs are inputs that reflect a company’s

judgment concerning the assumptions that market participants would use in pricing the asset or liability

developed based on the best information available under the circumstances. In certain cases, the inputs used to

measure fair value may fall into different levels of the fair value hierarchy. In such cases, an asset or liability

must be classified in its entirety based on the lowest level of input that is significant to the measurement of fair

value. The fair value hierarchy is broken down into three levels based on the reliability of inputs as follows:

• Level 1 – Valuations based on quoted prices in active markets for identical instruments that the

Company is able to access. Since valuations are based on quoted prices that are readily and regularly

available in an active market, valuation of these products does not entail a significant degree of

judgment.

• Level 2 – Valuations based on quoted prices in active markets for instruments that are similar, or

quoted prices in markets that are not active for identical or similar instruments, and model-derived

valuations in which all significant inputs and significant value drivers are observable in active markets.

• Level 3 – Valuations based on inputs that are unobservable and significant to the overall fair value

measurement.

As of February 27, 2016, the Company’s financial assets utilizing Level 1 inputs include long term trading

investment securities traded on active securities exchanges. The Company did not have any financial assets

utilizing Level 2 inputs. Financial assets utilizing Level 3 inputs included long term investments in auction rate

securities consisting of preferred shares of closed end municipal bond funds (See “Investment Securities,”

Note 3).

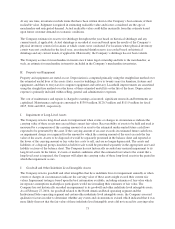

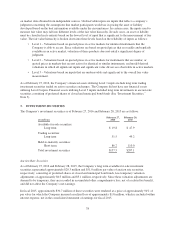

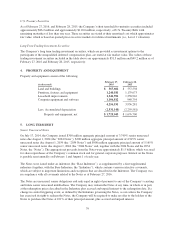

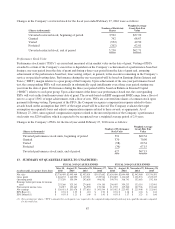

3. INVESTMENT SECURITIES

The Company’s investment securities as of February 27, 2016 and February 28, 2015 are as follows:

(in millions)

February 27,

2016

February 28,

2015

Available-for-sale securities:

Long term $ 19.8 $ 47.9

Trading securities:

Long term 51.5 49.2

Held-to-maturity securities:

Short term 86.2 110.0

Total investment securities $157.5 $207.1

Auction Rate Securities

As of February 27, 2016 and February 28, 2015, the Company’s long term available-for-sale investment

securities represented approximately $20.3 million and $51.0 million par value of auction rate securities,

respectively, consisting of preferred shares of closed end municipal bond funds, less temporary valuation

adjustments of approximately $0.5 million and $3.1 million, respectively. Since these valuation adjustments are

deemed to be temporary, they are recorded in accumulated other comprehensive loss, net of a related tax benefit,

and did not affect the Company’s net earnings.

In fiscal 2015, approximately $30.7 million of these securities were tendered at a price of approximately 94% of

par value for which the Company incurred a realized loss of approximately $1.8 million, which is included within

interest expense, net in the consolidated statement of earnings for fiscal 2015.

78