Bed, Bath and Beyond 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

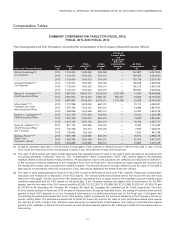

PROPOSAL 3—APPROVAL, BY NON-BINDING VOTE, OF 2015 EXECUTIVE COMPENSATION

Below is a summary of our executive compensation practices that we have implemented to drive performance, as well as

practices we avoid because we do not believe they serve investors’ long-term interests.

What We Do

Provide a majority of pay in equity and performance-based

compensation.

Use an independent compensation consulting firm,

which provides no other services to Bed Bath & Beyond,

and independent counsel.

Pay for performance based on measurable goals tied to

Company strategy.

Engage in shareholder outreach.

Apply multi-year vesting to equity awards. Require significant stock ownership for CEO and each

outside director with a value of at least $6,000,000 and

$300,000, respectively.

Include caps on individual payouts in incentive plans. Subject incentive pay to compensation recovery “claw-

back” policy.

Conduct an annual advisory vote on executive

compensation.

Limit outside board memberships.

Have a lead director and a high proportion of independent

directors.

What We Don’t Do

Design compensation programs using cash bonuses, to

avoid short-termism.

Have excessive perquisites, or allow tax gross-ups for

perquisites or upon a change in control.

Allow hedging and unrestricted pledging of the Company’s

securities.

Allow re-pricing of stock options.

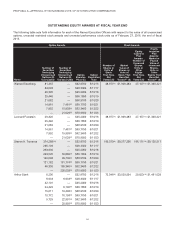

Methodology for Determining Executive Compensation

The Compensation Committee has engaged the services of an independent compensation consultant, retaining Arthur J.

Gallagher & Co. Human Resources & Compensation Consulting Practice (Gallagher) or its predecessor to conduct a

compensation review for the Named Executive Officers and certain other executives. Gallagher has not served the Company

in any other capacity except as consultants to the Compensation Committee. The Compensation and the Nominating and

Corporate Governance Committees also receive advice and assistance from the law firm of Chadbourne & Parke LLP, which

has acted as counsel only to the Company’s independent directors and its Board committees. The Compensation Committee

has concluded that no conflict of interest exists that prevents Gallagher or Chadbourne from being independent advisors to the

Compensation Committee.

The Compensation Committee charter, which describes the Compensation Committee’s function, responsibilities and duties, is

available on the Company’s website at www.bedbathandbeyond.com under the Investor Relations section. The Compensation

Committee consists of three independent members of our Board of Directors. The Compensation Committee meets on a

regular basis and met 10 times in fiscal 2015.

Under the direction of the Compensation Committee, the compensation review included a peer group competitive market

review of executive compensation and total compensation recommendations by Gallagher. The peer group developed by

Gallagher, agreed upon by the Compensation Committee and upon which Gallagher based its recommendations for fiscal

2015 compensation, consisted of 19 retail companies of a size range in revenue and net income relatively closely aligned with

the Company’s revenue and net income. The peer group remained the same from fiscal 2014 to fiscal 2015.

24