BMW 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

72 Group Financial Statements

72 Income Statements

74 Balance Sheets

76 Cash Flow Statements

78 Statement of Income and

Expenses recognised

in Equity

79 Notes

79 Accounting Principles

and Policies

88 Notes to the Income

Statement

94

Notes to the Balance Sheet

1 1 5 Other Disclosures

1 2 9 Segment Information

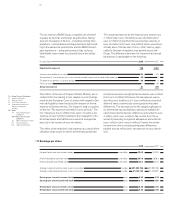

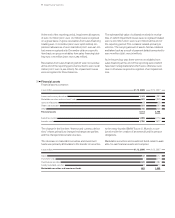

in euro million 2008 2007

Expected tax expense 106 1,506

Variances due to different tax rates 24 – 731

Tax reductions (–) / tax increases (+) as a result of non-taxable income and non-deductible expenses

– 49 4

Tax expense (+) / benefits (–) for prior periods – 60 – 4

Other variances – – 36

Actual tax expense 2 1 739

The tax returns of BMW Group companies are checked

regularly by German and foreign tax authorities. Taking

account of a variety of factors – including existing inter-

pretations,

commentaries and legal decisions taken relat-

ing to the various tax jurisdictions and the BMW Group’s

past experience – adequate provision has, as far as

identifiable,

been made for potential future tax obliga-

tions.

The effects of the sale of Cirquent GmbH, Munich, are in-

cluded in the line relating to non-taxable income. Rulings

made by the European Court of Justice with regard to Ger-

man tax legislation have had a positive impact on the tax

expense of German entities. The impact in is included

on the line “Tax expenses / benefits for prior periods”. The

line “Variances due to different tax rates” includes a tax

expense of euro million relating to the revaluation of de-

ferred tax assets and liabilities as a result of changed tax

rates (: tax income of euro million).

The effect of the reduction in tax expense as a result of the

utilisation of tax losses for which deferred tax assets had

The actual tax expense for the financial year of euro

million (: euro million) is euro million (:

euro million) lower than the expected tax expense of

euro million (: euro , million) which would theo-

retically arise if the tax rate of . (: . ), appli-

cable for German companies, was applied across the

Group. The difference between the expected and actual

tax expense is attributable to the following:

not previously been recognised amounted to euro million

(: euro million). Moreover, the tax expense was re-

duced by euro million (: euro million) as a result of

deferred taxes on previously unrecognised temporary

differences. The tax expense for the valuation allowance

on deferred tax assets relating to tax losses available for

carryforward and temporary differences amounted to euro

million (: euro million). Tax income from the

re-

versal of previously recognised allowances amounted to

euro million (: euro million). Overall, the net tax

income from new or reversing temporary differences

totalled euro million (: tax expense of euro mil-

lion).

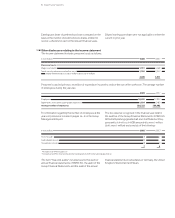

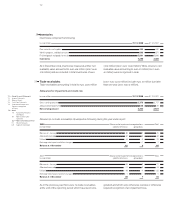

17

2008 2007

Net profit for the year after minority interest euro million 324.3 3,125.9

Profit attributable to common stock euro million 297.9 2,878.4

Profit attributable to preferred stock euro million 26.4 247.5

Average number of common stock shares in circulation number 601,995,196 601,995,196

Average number of preferred stock shares in circulation number 51,296,162 51,535,857

Earnings per share of common stock euro 0.49 4.78

Earnings per share of preferred stock euro 0.51 4.80

Dividend per share of common stock euro 0.30 1.06

Dividend per share of preferred stock euro 0.32 1.08

Earnings per share