BMW 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123 Group Financial Statements

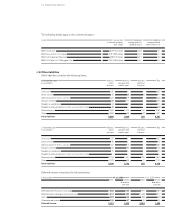

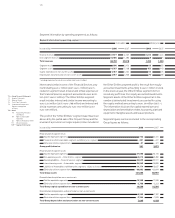

in euro million 31.12. 2008 31.12. 2007

Euro / US Dollar 3,631 6,140

Euro / British Pound 2,291 3,484

Euro / Japanese Yen 835 1,263

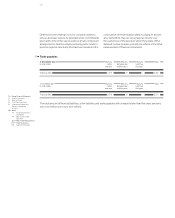

The cash flows shown comprise principal repayments and

the related interest. The amounts disclosed for interest

rate and currency derivatives include all cash flows relating

to derivatives that have a negative fair value at the balance

sheet date as well as all cash flows relating to derivatives

that have a positive fair value at the balance sheet date but

which are part of a hedging relationship with a financial

liability.

Solvency is assured at all times by managing and monitor-

ing the liquidity situation on the basis of a rolling cash flow

forecast. The resulting funding requirements are secured

by a variety of instruments placed on the world’s financial

markets. The objective is to minimise risk by matching

maturities for the Group’s financing requirements within

the framework of the target debt ratio. The long-term ratings

published by Standard & Poor’s (A) and Moody’s (A2)

enable the BMW Group to obtain financing on competitive

terms and conditions. Against the background of the

current financial market and economic crisis and the re-

sulting impact on the automobile sector, Moody’s revised

the rating on February to “under review for pos-

sible downgrade”. The BMW Group will continue to be

able to raise sufficient funds to refinance its business

even after taking account of forthcoming rating adjust-

ments.

Short-term liquidity is managed primarily by issuing

money

market instruments (commercial paper). As a result

of its good credit standing, reflected in the first-class

short-term

ratings issued by Moody’s (P-1) and Standard

& Poor’s (A-1), the BMW Group is also able to obtain com-

petitive terms and conditions in this area.

Also reducing liquidity risk, additional secured and un-

secured lines of credit are in place with first-class interna-

tional banks. Intragroup cash flow fluctuations are evened

out by the use of daily cash pooling arrangements.

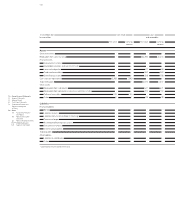

Market risks

The principal market risks to which the BMW Group is ex-

posed are currency risk and interest rate risk.

Protection against such risks is provided at first instance

through natural hedging which arises when the values of

non-derivative financial instruments have matching matu-

rities and amounts (netting). Derivative financial instru-

ments are used to reduce the risk remaining after netting.

Financial instruments are only used to hedge underlying

positions or forecast transactions.

The scope of permitted transactions, responsibilities,

financial reporting procedures and control mechanisms

used for financial instruments are set out in detailed inter-

nal guidelines. This includes, above all, a clear separation

of duties between trading and processing. Currency and

interest rate risks are managed at a corporate level.

Further disclosures relating to risk management are pro-

vided in the Group Management Report.

Currency risk

As an enterprise with worldwide operations, business is

conducted in a variety of currencies, from which currency

risks arise. Since a significant portion of Group revenues

are generated outside the euro currency region and the

procurement of production material and funding is also or-

ganised on a worldwide basis, the currency risk is an ex-

tremely important factor for Group earnings.

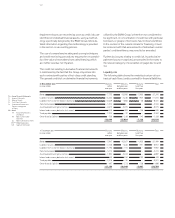

At December , derivative financial instruments were

in place to hedge exchange rate risks, in particular for the

currencies US dollar, British pound, Canadian dollar and

Japanese yen. The hedging contracts comprise mainly

option and forward currency contracts.

A description of how these risks are managed is provided

in the Group Management Report on page . The BMW

Group measures currency risks using a cash-flow-at-risk

model.

The starting point for analysing currency risk with this

model is the identification of forecast foreign currency

transactions or “exposures”. At the end of the reporting

period, exposures for the coming year were as follows: