BMW 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

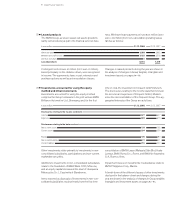

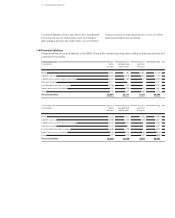

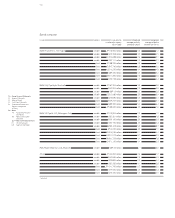

107 Group Financial Statements

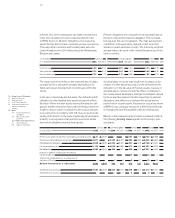

Germany United Kingdom Other Total

in euro million 2008 2007 2008 2007 2008 2007 2008 2007

Balance sheet amounts at January 3,849 4,414 647 439 127 164 4,623 5,017

Deconsolidation effects – 4 – 4 – – – – –

Expense from pension obligations 293 239 7 6 52 30 28 399 319

Pension payments or transfers to external funds –1,471 – 80 – 98 – 47 –14 – 67 –1,583 –194

Actuarial gains (–) and losses (+)

on defined benefit obligations – 271 – 776 – 647 211 –1 8 – 919 – 557

Actuarial gains (–) and losses (+) on plan assets 278 – 486 42 104 2 868 44

Employee contributions to the deferred

remuneration retirement scheme 20 52 – – – – 20 52

Translation differences and other changes –1 – –123 – 50 27 – 8 – 97 – 58

Balance sheet amounts at December 2,693 3,849 345 647 273 127 3,311 4,623

thereof pension provision 2,693 3,849 345 651 276 127 3,314 4,627

thereof pension assets (–) – – – – 4 – 3 – – 3 – 4

Pension provisions relating to pension plans in other coun-

tries amounted to euro million (: euro million).

This includes euro million (: euro million) relating

to externally funded plans.

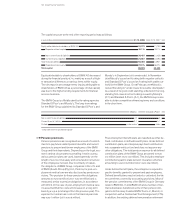

The change in the defined benefit obligations was attribut-

able mainly to changes in the discount rates used in the

actuarial computation. In addition, exchange rate changes,

in particular the depreciation of the British pound, had a

substantial impact on the measurement of the defined

benefit obligations and fund assets.

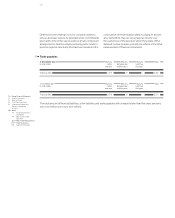

The changes in the pension provision and pension as-

sets

(reimbursement claims or right to reduce future

contributions

to the funds) as disclosed in the balance

sheet can be derived as follows:

The defined benefit plans of the BMW Group give rise to

an expense from pension obligations in the financial year

The expense from reversing the discounting of pension

obligations and the income from the expected return on

plan

assets are reported as part of the financial result. All

other components of pension expense are included in the

relevant income statement under costs by function.

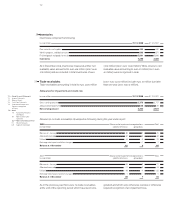

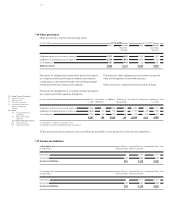

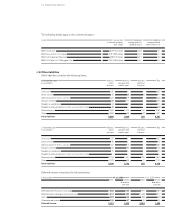

Depending on the risk structure of the pension obligations

involved, pension plan assets are invested in various in-

vestment classes, the most predominant one being bonds.

of euro million (: euro million), comprising

the following components:

Other equity instruments, property and alternative invest-

ments (e. g. infrastructure funds) are also considered.

The expected rate of return is derived on the basis of the

specific investment strategy applied to each individual

pension fund. This is determined on the basis of the rates

of return from the individual investment classes taking

account of costs and unplanned risks. This approach re-

sulted in the following expected rates of return on plan

assets (disclosed on the basis of weighted averages).

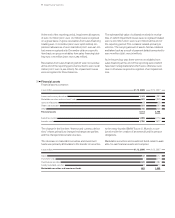

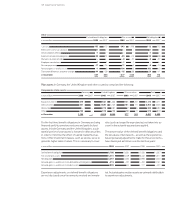

Germany United Kingdom Other Total

in euro million 2008 2007 2008 2007 2008 2007 2008 2007

Current service cost 117 150 59 64 31 29 207 243

Expense from reversing the discounting of pension obligations 209 192 316 323 25 22 550 537

Past service cost –1 –103 4 – –1 – 2 –103

Expected return on plan assets (–) – 32 – – 303 – 335 – 25 – 23 – 360 – 358

Expense from pension obligations 293 239 76 5 2 30 2 8 399 319