BMW 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

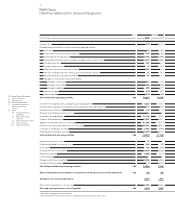

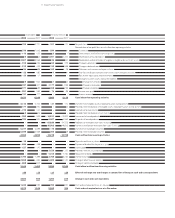

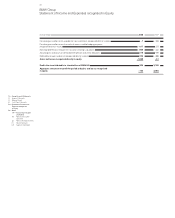

72 Group Financial Statements

72 Income Statements

74 Balance Sheets

76 Cash Flow Statements

78 Statement of Income and

Expenses recognised

in Equity

79 Notes

79 Accounting Principles

and Policies

88 Notes to the Income

Statement

94

Notes to the Balance Sheet

1 1 5 Other Disclosures

1 2 9 Segment Information

4

5 Foreign currency translation

The financial statements of consolidated companies which

are drawn up in a foreign currency are translated using

the functional currency concept (IAS : The Effects of

Changes in Foreign Exchange Rates) and the modified

closing rate method. The functional currency of a sub-

sidiary is determined as a general rule on the basis of the

primary economic environment in which it operates and

corresponds therefore to the relevant local currency. In-

come and expenses of foreign subsidiaries are translated

in the Group Financial Statements at the average

ex-

change rate for the year, and assets and liabilities are trans-

lated at the closing rate. Exchange differences arising from

the translation of shareholders’ equity are offset directly

against accumulated other equity. Exchange differences

arising from the use of different exchange rates to translate

the income statement are also offset directly against accu-

mulated other equity.

Foreign currency receivables and payables in the single

entity accounts of BMW AG and subsidiaries are recorded,

at the date of the transaction, at cost. Exchange gains and

losses computed at the end of the reporting period are

recognised as income or expense.

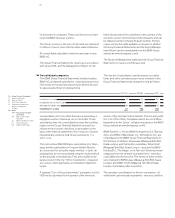

The exchange rates of those currencies which have a

material impact on the Group Financial Statements were

as follows:

Consolidation principles

The equity of subsidiaries is consolidated in accordance

with IFRS (Business Combinations). IFRS requires that

all business combinations are accounted for using the

purchase method, whereby identifiable assets and liabili-

ties acquired are measured initially at their fair value. The

excess of the Group’s interest in the net fair value of the

identifiable assets and liabilities acquired over cost is

recognised as goodwill and is subjected to a regular review

for possible impairment. Goodwill of euro million which

arose prior to January is netted against reserves.

The companies BMW Roma S. r. l., Rome, and BMW de

Argentina S. A., Buenos Aires, were consoli dated for the

first time with effect from January . The equivalent

date for BMW Lease (Malaysia) Sdn Bhd, Kuala Lumpur,

and BMW Credit (Malaysia) Sdn Bhd, Kuala Lumpur, was

April , and that for BMW of Manhattan, Inc., Wilming-

ton, Del., was October .

Receivables, liabilities, provisions, income and expenses

and profits between consolidated companies (intragroup

profits) are eliminated on consolidation.

Under the equity method, investments are measured at

the BMW Group’s share of equity taking account of fair

value adjustments on acquisition, based on the Group’s

shareholding. Any difference between the cost of invest-

ment and the Group’s share of equity is accounted for in

accordance with the purchase method. Investments in

other companies are accounted for as a general rule using

the equity method when significant influence can be exer-

cised (IAS Investments in Associates). This is normally

the case when voting rights of between and are

held (associated companies).

Accounting principles

The financial statements of BMW AG and of its subsidiar-

ies in Germany and elsewhere have been prepared for

consolidation purposes using uniform accounting policies

in accordance with IAS .

Revenues from the sale of products are recognised when

the risks and rewards of ownership of the goods are trans-

ferred to the customer, the sales price is agreed or deter-

minable and receipt of payment can be assumed. Rev-

enues are stated net of discounts, allowances, settlement

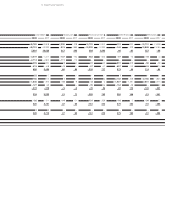

Closing rate Average rate

31.12. 2008 31.12. 2007 2008 2007

US Dollar 1.40 1.46 1.47 1.37

British Pound 0.95 0.73 0.80 0.68

Chinese Renminbi 9.54 10.70 10.23 10.42

Japanese Yen 126.74 163.77 152.29 161.28

Australian Dollar 2.03 1.67 1.74 1.64

6