BMW 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249

|

|

55 Group Management Report

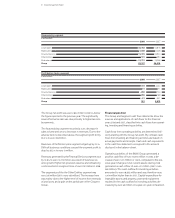

Financial liabilities increased by . in conjunction with

the refinancing of the Group’s financial services business.

Within financial liabilities, bonds increased by . to euro

, million. Liabilities to banks, asset-backed financing

obligations and deposit liabilities were all also up.

Trade payables amounted to euro , million and were

thus . lower than one year earlier.

Other liabilities went up by . to euro , million,

mainly reflecting increases in deferred income relating to

service and repair contracts, deferred income from lease

financing and the valuation of financial instruments.

Compensation Report

The compensation of the Board of Management comprises

fixed and variable components. In addition, benefits are

also payable at the end of members’ mandates, primarily in

the form of pension benefits. Further details, including an

analysis of remuneration by individual, are disclosed in the

Compensation Report which can be found in the “Corpo-

rate Governance” section of the Annual Report on pages

– . The Compensation Report is a sub-section of the

Group Management Report.

Subsequent Events Report

No events have occurred after the balance sheet date which

have a major impact on the earnings performance, financial

position and net assets of the BMW Group.

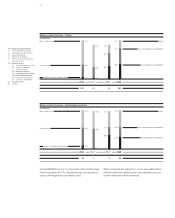

Value Added Statement

The value added statement shows the value of work per-

formed less the value of work bought in by the BMW Group

during the financial year. Depreciation and amortisation,

cost of materials and other expenses are treated as bought-

in costs in the value added calculation. The allocation

statement applies value added to each of the participants

involved in the value added process. It should be noted

that the gross value added treats depreciation as a compo-

nent of value added which, in the allocation statement, is

treated as internal financing.

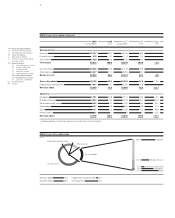

Net value added by the BMW Group in decreased by

. to euro , million. The decrease over the pre-

vious year was largely attributable to the lower level of rev-

enues. The decrease in gross value added, at . , was

less pronounced since it is not affected by depreciation

and amortisation, which are higher than in the previous

year.

Once again, the bulk of the net value added . is ap-

plied to employees. The amount applied to providers of

finance increased to . as a result of the higher funding

volume required for the financial services business. The

government / public sector (including deferred tax expense)

accounted for . . The proportion of net value added

applied to shareholders, at . , was lower than in the pre-

vious year. The remaining proportion of net value added

. will be retained by the BMW Group to finance future

operations. This represents a decrease of . percentage

points.