BMW 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

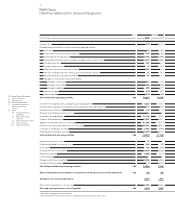

14 Group Management Report

14 A Review of the Financial Year

16 General Economic Environment

20 Review of Operations

42 BMW Stock and Bonds

45 Disclosures pursuant to § 289 (4)

and § 315 (4) HGB

47 Financial Analysis

47 Internal Management System

49 Earnings Performance

51 Financial Position

52 Net Assets Position

55 Subsequent Events Report

55 Value Added Statement

57 Key Performance Figures

58 Comments on BMW AG

62 Risk Management

68 Outlook

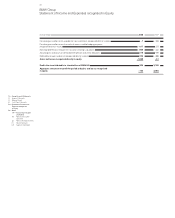

Outlook

The economic environment in

The BMW Group forecasts that the global economic down-

turn will continue throughout the whole of . Economic

output in most industrial countries is likely to shrink in the

current year. The dynamism of emerging markets is also

likely to slacken noticeably. An end to the downturn is not

likely to come until confidence in the credit markets is re-

stored and the property markets recover. This, however, is

unlikely to happen before the end of .

The turmoil on the property and credit markets in the USA

will have a massive impact on the real economy in .

The situation cannot be expected to calm down until the

second half of the year at the earliest. Consumer spending

in particular will remain weak in the USA. Both the US

Reserve Bank and the US Government are endeavouring

with all means available to them to prevent the recession

becoming any worse. These measures will, however, not

be able to prevent a drop in economic output on a full year

basis.

Europe will also suffer heavily in from the consequences

of the economic and financial crisis. The gross domestic

product is likely to shrink in this region too. Exports will

drop further in the wake of the global economic downturn

and consumer spending will falter in the face of uncertainty

as to how the future will unfold. Governments and central

banks in Europe will also apply countermeasures in the

form of fiscal and monetary policies.

The growth rate in Germany in is also likely to be

negative. Consumer spending will once again fail to gen-

erate any growth, while shrinking exports will also have a

negative impact.

The Japanese economy will also contract in . The

negative trend with exports and the weakness of domestic

demand will continue. Due to its policy of low interest

rates

to date, the Japanese Reserve Bank does not have

the option of reducing interest rates further. Manoeuvring

room for fiscal measures is also restricted due to the high

level of national debt.

Growth rates in the emerging markets of Asia, Latin America

and Eastern Europe are also likely to weaken significantly

in . In these regions, the global economic downturn

will primarily have a negative impact on exports.

Euro likely to remain strong

The value of the US dollar against the euro increased sig-

nificantly in the course of . However, lower growth and

lower interest rates plus the very high current account defi-

cit in the USA suggest that the US dollar will depreciate in

value once again. The British pound lost significant ground

against the euro in . In contrast, the Japanese yen

appreciated sharply against the euro over the course of

the

year. In , the Japanese yen is forecast to remain

stable.

Risks affecting economic growth

The greatest risk for the global economy continues to

come from the world’s financial crisis and its knock-on

impact on markets for goods and services. If confidence in

the credit markets is restored more slowly than is currently

being predicted, the impact for the global economy would

be even more severe. The global recession will then be

longer and have more serious consequences.

Although energy and raw material prices fell sharply in ,

they still remain above long-term average levels. At present,

the global economic downturn is preventing higher prices

on the energy and commodity markets. Nevertheless, the

risk remains of excessive price reactions caused by specu-

lative forces.

Car markets in

The financial crisis will again have a massively adverse

impact on the global automotive economy in . Overall,

the slump in the world’s industrial countries is expected to

be at least as severe as in .

Impetus from the triad of traditional markets (the USA,

Japan and Western Europe) will once again be extremely

weak in . Passenger car sales are again likely to drop

sharply. In Germany, the negative growth rate will probably

be even higher than in .

Lower volumes, in some cases reflecting quite substantial

reductions, are also predicted for the majority of emerging

markets. Even markets such as China and India which

have

experienced extreme high growth rates up to now

are likely

to see fewer new registrations. In Russia the

reduction could even reach the double-digit range. The

same applies to most markets in Eastern Europe and

Latin America.

Motorcycle markets in

One of the features of the motorcycle business is that

most

sales are recorded by the middle of the year. Largely

because of this seasonal pattern, the BMW Group does

not now expect to see a recovery of the motorcycles mar-

kets in . Since the financial crisis and resulting crisis in