BMW 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91 Group Financial Statements

Deferred taxes are recognised on temporary differences

between the carrying amount of assets and liabilities for

IFRS purposes and their tax bases. Deferred taxes are

computed using enacted or planned tax rates which are

expected to apply in the relevant national jurisdictions

when the amounts are recovered. A uniform corporation

tax rate of . applies in Germany from January .

After taking account of the average multiplier rate (Hebe-

satz) of . for municipal trade tax and the solidarity

charge of . , the overall tax rate for BMW companies in

Germany is . (: . ). This reduced rate was

already applied in the financial year to measure de-

ferred

tax assets and liabilities. The non-deductibility of

municipal trade tax for corporation tax purposes with effect

from the beginning of the financial year has been

taken into account. The tax rates for companies outside

Germany range from . (: . ) to . (:

. ). A valuation allowance is recognised on deferred

tax assets when recoverability is uncertain. In determining

the level of the valuation allowance, all positive and nega-

tive factors concerning the likely existence of sufficient

taxable profit in the future are considered. These estimates

can change depending on the actual course of events.

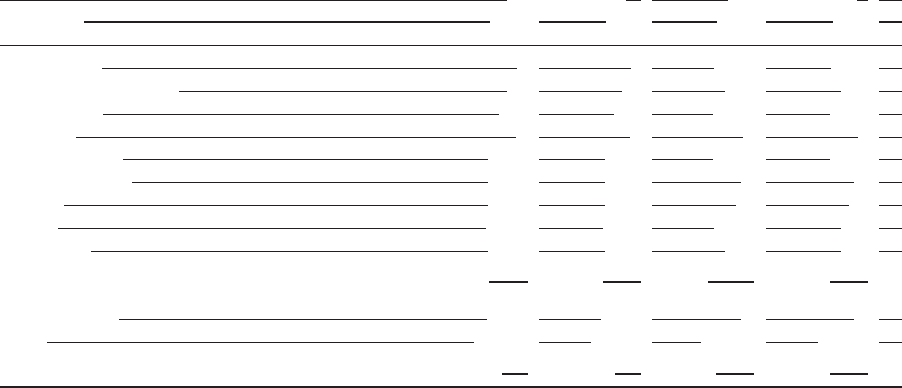

An analysis of deferred tax assets and liabilities by position

at December is shown below:

“Netting” relates to the offset of deferred tax assets and

liabilities within individual separate entities or tax groups.

Deferred tax assets on tax losses available for carryforward

and on capital losses increased on a net basis. Tax losses

available for carryforward, which for the most part can be

carried forward without restriction, totalled euro . billion

at the end of the reporting period (: euro . billion). A

valuation allowance of euro million (: euro million)

was recognised in on deferred tax assets relating to

tax losses available for carryforward. Capital losses in the

United Kingdom decreased to euro . billion in (:

euro . billion) due to exchange rate factors. As in pre-

vious years, these tax losses – amounting to euro mil-

lion at the end of the reporting period (: euro

mil-

lion) – were fully written down since they can only be

utilised against future capital gains. Capital losses are not

connected to on-going business operations.

Deferred tax assets were recognised in for entities

which recorded tax losses in either or . These

deferred tax assets exceed deferred tax liabilities by

euro million (: euro million). Deferred tax

assets are recognised on the basis of management’s

assessment of whether it is probable that the relevant

entities will generate sufficient taxable profits against

which deductible temporary differences can be offset.

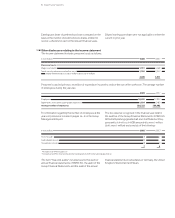

Deferred taxes recognised directly in equity amounted to

euro million (: euro million). The increase of

euro million relates to deferred taxes on gains and losses

arising on items recognised directly in equity, namely on

marketable securities (negative amount of euro million),

on derivative financial instruments (positive amount of

euro million) and on actuarial gains and losses relating

to defined benefit pension plans (negative amount of euro

million). The change also includes a euro million re-

duction in deferred taxes arising from the translation of for-

eign subsidiaries’ financial statements.

Deferred taxes are not recognised on retained profits of

euro , million (: euro , million) of foreign

sub-

sidiaries, as it is intended to invest these profits to maintain

and expand the business volume of the relevant companies.

A computation was not made of the potential impact of

income taxes on the grounds of disproportionate expense.

Deferred tax assets Deferred tax liabilities

in euro million 2008 2007 2008 2007

Intangible assets 1 1 1,541 1,528

Property, plant and equipment 43 43 454 428

Leased products 573 558 4,137 3,205

Investments 3 2 5 1

Other current assets 1,796 1,110 3,196 3,767

Tax loss carryforwards 1,438 1,072 – –

Provisions 1,197 1,145 7 5 51

Liabilities 2,945 3,084 1,296 690

Consolidations 1,736 1,661 406 329

9,732 8,676 11,110 9,999

Valuation allowance – 513 – 671 – –

Netting – 8,353 – 7,285 – 8,353 – 7,285

Deferred taxes 866 720 2,757 2,714