BMW 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53 Group Management Report

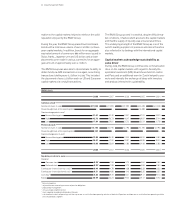

have increased by euro , million or . . The main

factors behind the increase on the assets side were the

increased level of cash and cash equivalents + . ,

re-

ceivables from sales financing + . and leased products

+ . . On the equity and liabilities side of the balance

sheet, the main increase related to financial liabilities

+ . .

Intangible assets amounted to euro , million, slightly

below their level one year earlier. Within this line item,

capitalised

development costs went up by . to euro

, million. Development costs recognised as assets

during the year under report amounted to euro , million

– . , equivalent to a capitalisation ratio of . :

. . The lower level of additions to capitalised develop-

ment costs in was due to the smaller number of

projects in the series development phase. Amortisation on

intangible assets amounted to euro , million + . .

The carrying amount of property, plant and equipment

increased slightly by . to euro , million. Capital

expenditure increased by euro , million or . , with

the main focus on product investments for production

start-ups and infrastructure improvements. Depreciation

on property, plant and equipment totalled euro , million

– . . Balances brought forward for subsidiaries being

consolidated for the first time amounted to euro million.

Total capital expenditure as a percentage of revenues was

. : . .

The amount reported for leased products in the balance

sheet rose sharply compared to the end of the previous

year, reflecting a general increase in business volumes as

well as the integration of the – previously off-balance-

sheet – vehicle portfolio of a leasing company which had

included a part of the leasing business for Germany.

Leased products rose by . to euro , million. Ad-

justed for changes in exchange rates, they would have

risen by . .

The carrying amount of other investments increased by

. to euro million, mainly as a result of capital in-

creases at non-consolidated companies.

Receivables from sales financing were up by . to euro

, million due to higher business volumes. Of this

amount, customer and dealer financing accounted for euro

, million + . and finance leases accounted for

euro , million + . . Inventories decreased by euro

million – . to euro , million. Trade receivables

were . lower than at December .

Financial assets increased by . to euro , million,

mainly as a result of the higher fair values of derivative finan-

cial instruments.

Liquid funds increased by . to euro , million. Mar-

ketable securities and investment funds decreased as a

result of the transfer of assets to the newly founded BMW

Trust e. V., Munich, in conjunction with the creation of an

external fund for pension obligations.

Cash and cash equivalents rose by euro , million.

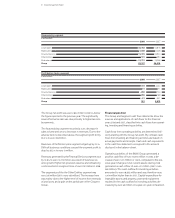

On the equity and liabilities side of the balance sheet,

equity decreased by . to euro , million. The profit

for the year attributable to shareholders of BMW AG in-

creased

equity by euro million. Fair value changes

rec-

ognised directly in accumulated other equity reduced

equity by euro , million (: euro million). The latter

comprises translation differences, fair value gains and losses

on financial instruments and available-for-sale securities

as well as actuarial gains and losses on pension plans.

Translation differences reduced accumulated other equity

by euro million. The fair values of derivative financial

in-

struments decreased by a further euro million. Actu-

arial

gains and losses within accumulated other equity

increased by euro million. The fair values of marketable

securities fell marginally by euro million. Deferred taxes

on fair value gains and losses recognised directly in equity

increased equity by euro million in .

Minority interests amounted to euro million. The equity

ratio of the BMW Group fell by . percentage points to

. .

The equity ratio for the Automobiles segment was .

compared to . at the end of the previous year. The

equity ratio for the Financial Services segment fell from

. to . .

The amount recognised in the balance sheet for pension

provisions went down by . to euro , million. In the

case of pension plans with fund assets, the fair value of

fund assets is offset against the defined benefit obligation.

The reduction in pension obligations resulted primarily

from the transfer of pension obligations to the newly