BMW 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

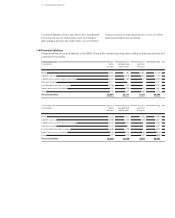

72 Group Financial Statements

72 Income Statements

74 Balance Sheets

76 Cash Flow Statements

78 Statement of Income and

Expenses recognised

in Equity

79 Notes

79 Accounting Principles

and Policies

88 Notes to the Income

Statement

94

Notes to the Balance Sheet

1 1 5 Other Disclosures

1 2 9 Segment Information

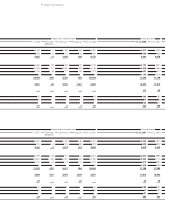

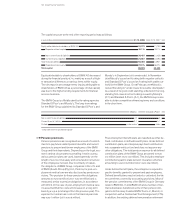

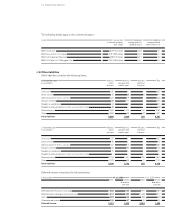

Number of shares issued

At December , common stock issued by BMW AG

was divided into ,, shares with a par-value of

one euro. Preferred stock issued by BMW AG was divided

into ,, shares with a par-value of one euro, also

unchanged from the previous year. Unlike the common

stock, no voting rights are attached to the preferred stock.

All of the Company’s stock is issued to bearer. Preferred

stock bears an additional dividend of euro . per share.

During the financial year , BMW AG acquired ,

treasury shares of preferred stock at an average price of

euro . per share. , of these shares were issued

to employees at a reduced price of euro . per share

in conjunction with an employee share scheme. These

shares are entitled to receive dividends for the financial

year . The remaining , shares of preferred stock

were held by BMW AG as treasury shares at December

. As a result of the buy-back of shares of preferred

stock and their subsequent issue, the preferred stock por-

tion of share capital remained unchanged at euro million.

The effect of applying IFRS (Share-Based Payments)

to the employee share scheme was not material for the

Group.

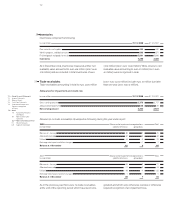

At the Annual General Meeting of BMW AG on May ,

the shareholders again authorised the Board of Manage-

ment to acquire treasury shares via the stock exchange,

up to a maximum of of the share capital in place at the

date of the resolution and to withdraw those shares from

circulation without any further resolution by the Annual

General Meeting. At the same time, the authorisation from

May to acquire treasury shares was rescinded. The

authorisation from May is valid until November

. The authorisation was not exercised in . It has

not yet been decided whether or the extent to which the

authorisation will be used in the future.

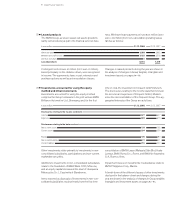

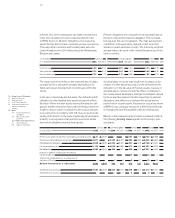

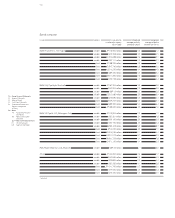

Capital reserves

Capital reserves include premiums arising from the issue

of shares and were unchanged at euro , million.

Revenues reserves

Revenue reserves comprise the post-acquisition and non-

distributed earnings of consolidated companies. In addi-

tion, revenue reserves include both positive and negative

goodwill arising on the consolidation of Group companies

prior to December .

Revenue reserves decreased marginally to euro , mil-

lion during the year under report. They were increased in

by the amount of the net profit attributable to share-

holders of BMW AG amounting to euro million and

were reduced by the payment of the dividend for

amounting to euro million.

The unappropriated profit of BMW AG of euro million

for will be proposed to the Annual General Meeting

for distribution. The proposed distribution must be au-

thorised by the shareholders at the Annual General Meeting

of BMW AG. It is therefore not recognised as a liability in

the Group Financial Statements.

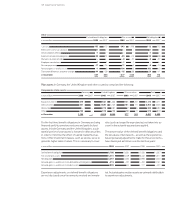

Accumulated other equity

Accumulated other equity consists of all amounts rec-

ognised directly in equity resulting from the translation

of the financial statements of foreign subsidiaries, the

effects of recognising changes in the fair value of de-

rivative financial instruments and marketable securities

directly in equity, actuarial gains and losses relating to

defined benefit pension plans and similar obligations and

deferred taxes.

Minority interest

Equity attributable to minority interests amounted to euro

million (: euro million). This includes a minority

interest of euro million (: euro million) in the results

for the year.

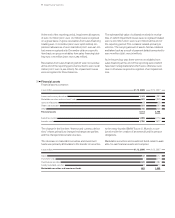

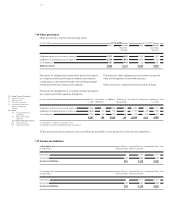

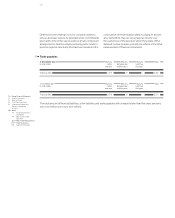

Capital management disclosures

The BMW Group’s objectives when managing capital are

to safeguard the Group’s ability to continue as a going

concern in the long-term and to provide an adequate return

to shareholders.

The BMW Group manages the capital structure and

makes adjustments to it in the light of changes in eco-

nomic conditions and the risk profile of the underlying

assets.

In order to manage its capital structure, the BMW Group

uses various instruments including the amount of divi-

dends

paid to shareholders and share buy-backs.

The BMW Group manages the structure of debt capital

on the basis of a target debt ratio. An important aspect of

the selection of financial instruments is the objective to

achieve matching maturities for the Group’s financing

requirements. In order to reduce non-systematic risk, the

BMW Group uses a variety of financial instruments avail-

able on the world’s capital markets to achieve optimal di-

versification.