BMW 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

14 Group Management Report

14 A Review of the Financial Year

16 General Economic Environment

20 Review of Operations

42 BMW Stock and Bonds

45 Disclosures pursuant to § 289 (4)

and § 315 (4) HGB

47 Financial Analysis

47 Internal Management System

49 Earnings Performance

51 Financial Position

52 Net Assets Position

55 Subsequent Events Report

55 Value Added Statement

57 Key Performance Figures

58 Comments on BMW AG

62 Risk Management

68 Outlook

Financial crisis reaches the real economy

The world economy suffered a major setback in . In

the period up to summer the primary causes were the high

prices of raw materials and the consequences of the

re-

cession on the US property market. In the second half of

the year, however, the downturn worsened due to the

massive impact of the financial crisis. The problem was not

confined to the USA, but caused a crisis of confidence on

financial markets worldwide as well as a massive reduction

in lending volumes. The situation led to major disruptions

in the real economy.

The downturn in the US economy, which had already begun

mid-, continued to gather momentum over the course

of . The decline in prices for residential properties and

cutbacks in housing construction

investments worsened

during the year and there was still no

end in

sight by the

end of . The crisis of confidence on the financial mar-

kets triggered by loan defaults on

house mortgages went

on to have a far-reaching impact on the real economy.

American consumers in particular, who had generally been

quite willing to consume in recent years, became extremely

reluctant to spend. Companies increased their level of in-

vestment only slightly in . Only foreign trade volumes

profited from the weakness of the US dollar through to the

middle of the year, allowing the

US

current account deficit

to be reduced further. Although the US economy grew by

. over the full year, it nevertheless registered a downturn

towards the end of the year.

The euro zone was also unable to avoid the effects of the

financial crisis. Since summer , its performance has

been significantly weaker than in preceding years. Only a

very small increase was registered in the area of private

consumer spending. The main aggravating factors were

sharp price rises during the first half of the year and the pe-

tering out of positive developments on the job markets

during the second half of the year. Companies were ex-

tremely reluctant to invest and export figures fell from sum-

mer onwards in the wake of the global downturn, causing

the euro zone current account balance to drop into the

negative zone. Overall, the euro zone recorded a growth

of only . in .

In Germany too, the positive growth rate began to slide

from summer onwards. Exports, which had largely been

responsible for economic growth in recent years, ceased

to be the driving force for the economy when even they

began to drop towards the end of the year. Consumer

spending also remained weak. The positive impetus gen-

erated by the employment market right up to the end

of the year was not enough to relieve consumers of their

sense of uncertainty. It was only because of the robust

performance at the beginning of the year that the German

economy could record a growth rate of . for the full

year.

Although the new EU member states were still growing

robustly in , the growth rates registered were signifi-

cantly lower than in the previous year. This applied both

to domestic demand and to exports. The current account

deficits in these countries deteriorated noticeably.

It was originally thought that the Japanese economy

would only be marginally affected by the financial crisis.

As a result of the global downturn and the appreciation

of the yen, however, Japan too felt the knock-on effects

of the financial crisis, with recent export figures even

showing negative trends. Domestic demand also

weak-

ened perceptibly. As a result economic output decreased

by . .

The emerging economies of Latin America and Eastern

Asia continued to register the fastest growth rates along

with the Eastern European markets. Here too, however,

the negative factors outweighed the positive, resulting in

lower growth rates. While the credit markets in those re-

gions were far less affected than those of the industrial na-

tions, these countries were nevertheless hit by the finan-

cial crisis, particularly due to the outflow of capital and

lower export demand. The growth rate in China slowed

down, albeit still at a high level, and the export surplus

General Economic Environment

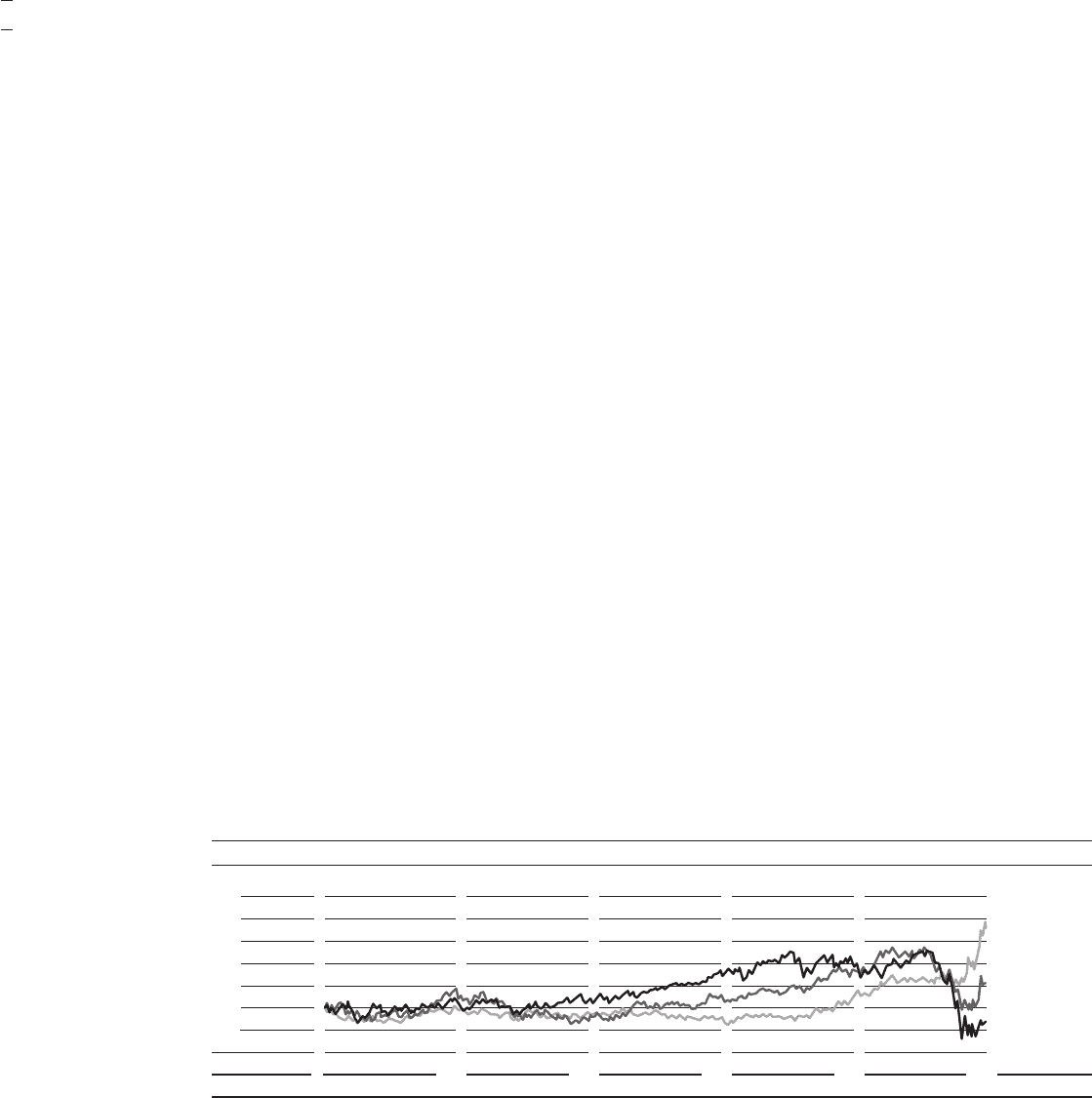

Exchange rates compared to the Euro

(Index: December = )

150

140

130

120

110

100

90

04 05 06 07 08

Source: Reuters

British Pound

Japanese Yen

US Dollar