BMW 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

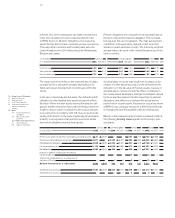

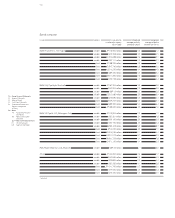

108

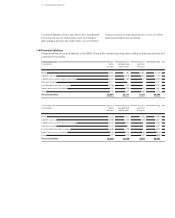

72 Group Financial Statements

72 Income Statements

74 Balance Sheets

76 Cash Flow Statements

78 Statement of Income and

Expenses recognised

in Equity

79 Notes

79 Accounting Principles

and Policies

88 Notes to the Income

Statement

94

Notes to the Balance Sheet

1 1 5 Other Disclosures

1 2 9 Segment Information

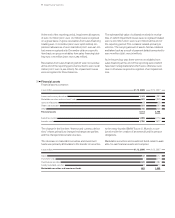

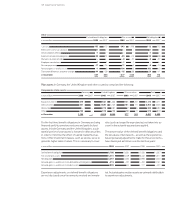

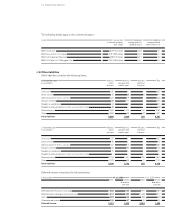

Germany

Defined benefit obligation Plan assets Net obligation

in euro million 2008 2007 2008 2007 2008 2007

January 3,849 4,414 – – 3,849 4,414

Deconsolidation effects – 4 – – – – 4 –

Expense from pension obligations 325 239 – 32 – 293 239

Payments to external funds – – –1,375 – –1,375 –

Employee contributions (deferred remuneration

retirement scheme) 49 52 – 29 – 20 52

Payments on account and pension payments – 99 – 80 3 – – 96 – 80

Actuarial gains (–) and losses (+) – 271 – 776 278 – 7 – 776

Translation differences and other changes –1 – – – –1 –

December 3,848 3,849 –1,155 – 2,693 3,849

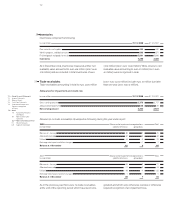

United Kingdom

Defined benefit obligation Plan assets Net obligation

in euro million 2008 2007 2008 2007 2008 2007

January 6,327 6,568 – 5,686 – 6,134 641 434

Deconsolidation effects – 24 – 28 – 4 –

Expense from pension obligations 379 387 – 303 – 335 7 6 52

Payments to external funds – – – 98 – 47 – 98 – 47

Employee contributions 13 15 –13 –15 – –

Pension payments – 285 – 293 285 293 – –

Actuarial gains (–) and losses (+) – 647 211 486 42 – 161 253

Translation differences and other changes – 1,360 – 561 1,242 510 – 118 – 51

December 4,403 6,327 – 4,059 – 5,686 344 641

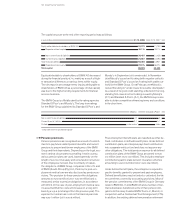

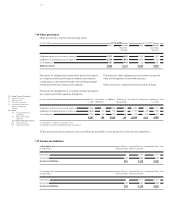

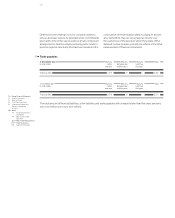

Compared to the expected return of euro million (:

euro million), fund assets actually decreased in the

financial year by euro million (: increase in

fund assets of euro million). This gave rise to actuarial

losses on fund assets of euro million (: euro mil-

lion). The actuarial losses on fund assets compare with

actuarial gains of euro million (: euro million) on

benefit obligations. This offsetting effect was attributable

primarily to the fact that the pension funds’ investment

strategy is based on the structure of the related benefit

obligations.

The level of the pension obligations differs depending on

the pension system applicable in each country. Since the

state pension system in the United Kingdom only pro-

vides a basic fixed amount benefit, retirement benefits are

largely organised in the form of company pensions on

the one hand and arrangements financed by the individual

on the other. The pension benefits in the United Kingdom

therefore contain contributions made by the employee.

The net obligation from pension plans in Germany, the

United Kingdom and other countries changed as follows:

Germany United Kingdom Other

in % 2008 2007 2008 2007 2008 2007

Expected rate of return on plan assets 5.43 – 5.93 5.75 6.99 7.25