BMW 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

14 Group Management Report

14 A Review of the Financial Year

16 General Economic Environment

20 Review of Operations

42 BMW Stock and Bonds

45 Disclosures pursuant to § 289 (4)

and § 315 (4) HGB

47 Financial Analysis

47 Internal Management System

49 Earnings Performance

51 Financial Position

52 Net Assets Position

55 Subsequent Events Report

55 Value Added Statement

57 Key Performance Figures

58 Comments on BMW AG

62 Risk Management

68 Outlook

Group Management Report

A Review of the Financial Year

BMW Group’s performance adversely affected by

economic crisis

The economic climate deteriorated drastically in .

Towards the end of the reporting year, the situation on the

international financial markets reached an unprecedented

pitch. At the same time, the effects of the crisis also spilled

over onto the world’s markets for goods and services.

The

rapid pace of the economic downturn and ongoing

uncertainty as to how the economic crisis might proceed

took a heavy toll on the BMW Group’s performance in .

Especially during the second half of the year, consumer

uncertainty resulted in a cutback in spending, affecting

nearly all of the world’s major car markets. In many coun-

tries, car sales volumes plummeted compared to the pre-

vious year. The ongoing weak state of the used car mar-

kets also had a negative impact on the reported figures of

the BMW Group. The situation was further exacerbated

by the significant increase of refinancing costs on the

in-

ternational capital markets. The weakness of the US dol-

lar

–

particularly during the first half of the year – and the fall

in value of the British pound also had a negative impact.

Despite the sharp drop in raw material prices in the second

half of the year, price levels on the commodity markets

remained above-average for the year as a whole. In addi-

tion to the negative impact of external factors, it was also

necessary for the BMW Group in to recognise the

cost of implementing previously announced measures to

reduce the size of the workforce. Model life cycle factors

also contributed to a reduction in the number of cars sold

by the BMW Group compared to the previous year. In total,

the BMW Group sold ,, BMW, MINI and Rolls-Royce

cars during the year under report, . fewer than in the

previous year.

In its motorcycles business, the BMW Group almost

reached the previous year’s level with , motorcycles

sold in – . , thus strengthening its competitive

position in a generally contracting market.

Financial services business was also severely affected by

the knock-on effects of the global economic and financial

crisis. In particular, the tense situation on the international

used car markets and the higher level of bad debts incurred

necessitated the recognition, over the course of the

year,

of substantial expenses for risk provision. In addition,

refinancing costs on the international capital markets in-

creased to reflect higher net interest spreads.

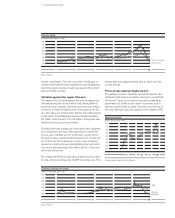

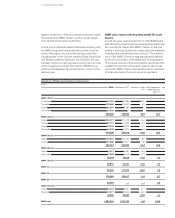

Revenue and earnings hard hit by financial crisis

The BMW Group was unable to avoid the effects of global

economic developments in . A slump in revenues in

the final months of the year meant that Group revenues for

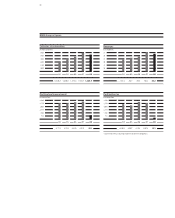

fell by . to euro , million. Excluding the ex-

change rate impact, automobile business revenues would

have fallen by . and Group revenues would have slipped

by . .

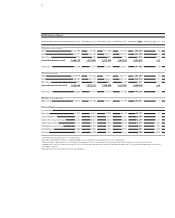

The enormous impact of the economic downturn can be

seen most clearly in the change in reported earnings for

the year. In , the BMW Group recognised an additional

risk provision expense for bad debts and residual value

risks amounting to euro , million. In addition to this,

expenditure in conjunction with previously announced

measures to cut back the size of the workforce reduced

Group earnings by euro million. Under the weight of

these negative factors, the profit before finance result (EBIT)

decreased by . to euro million. These substantial

expenses are also reflected in the profit before tax which

dropped by . to euro million.

In line with its sales volume performance, automobile

busi-

ness revenues in did not come up to the previous

year’s high level. Revenues generated by the Automobiles

segment fell by . to euro , million. The high level

of risk provision expenses for residual value risks in the auto-

mobiles

line of business and expenditure incurred in

conjunction with previously announced measures to

cut

back the size of the workforce meant that the profit before

finance result (EBIT) of the Automobiles segment, at euro

million, was . down on the previous year. The

seg-

ment profit before tax for was euro million

– . .

The Motorcycles segment generated revenues totalling

euro , million in , similar to the previous year’s level

+ . . In the face of difficult business conditions, the

segment profit before finance result

(EBIT)

fell by . to

euro

million and the segment profit before tax came in

at euro million – . .

The total business volume of the Financial Services seg-

ment rose again in . Revenues increased to euro ,

million, . up on the previous year. Particularly during

the second half of the year, increasingly adverse business

conditions had a massive impact on earnings in this line

of business. The Financial Services segment reported a

loss before tax of euro million (: profit before tax of

euro million) primarily as a result of the risk provision

expense recognised for residual value and bad debt risks.

The effective tax rate for the Group, at . , was approxi-

mately percentage points lower than in the previous

year. The income tax expense, at euro million, was down

by . . The Group net profit for the year declined by

. to euro million.