BMW 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47 Group Management Report

Group Internal Management System

In conjunction with the strategy Number ONE, the BMW

Group has also continued to develop its groupwide inter-

nal management system. Processes are now focused even

more sharply on profitability and long-term value growth.

Coherent management of capital employed at all levels

means that the efficient use of capital funds is a prime cri-

terion at project, segment and Group levels. The targets

set

for the Automobiles, Motorcycles and Financial Services

segments all stem from this objective.

Within the Auto-

mobiles and Motorcycles segments, capital employed is

managed at the level of individual product, process and

infrastructure projects. By contrast, the credit and lease

portfolios of the Financial Services segment are managed

primarily on the basis of a cash flow and risk approach.

Minimum rate of return derived from cost of capital

The cornerstone of the value-added management of the

BMW Group is the entity-specific minimum rate of return,

derived from capital market data and based on the weighted

average cost of capital (WACC) as follows:

Cost of equity capital x fair value of equity capital

Fair value of equity and debt capital

WACC = +

Cost of debt capital x fair value of debt capital

Fair value of total capital

The cost of equity capital is measured using the Capital

Asset Pricing Model (CAPM). The cost of debt capital is

based partly on the average interest rate paid for long-term

external debt and partly on the interest rate applicable for

pension obligations.

Value management in the context of project control

Strategic priorities set at a functional level are based on

segment-specific strategies and on the project decisions

reached in accordance with those strategies. The close

link between segment-specific strategies and project

objectives ensures that the project development process

remains effective. Once a positive decision has been

reached for a particular project, it is managed over time

using a value-based approach. Projects are

monitored

continuously and resources reallocated according to re-

quirements.

The project decision and related project selection are

important aspects of value-based management for the

BMW Group. Project decisions are taken on the basis of

net present values (NPVs) and rates of return: this involves

computing the present value of cash flows and the inter-

nal project rate of return (or model rate of return in the case

of vehicle projects) expected to be generated by a project

decision and comparing the results with competitive mar-

ket values.

In this way, the amount by which a project will contribute

to the total value of the segment can be measured when

the project decision is taken. Targets and performance are

controlled using project-related target NPVs and individual

cash-flow-related parameters which have an impact on

those values.

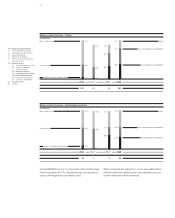

The NPV of a project programme is computed by identi-

fying the cash flows of all related projects and discounting

them back to a specific date. This value serves as an im-

portant target for the Automobiles and Motorcycles seg-

ments. The business value of each segment is measured

after adjusting for the fair value of debt capital. The objec-

tive for the Automobiles and Motorcycles segments is to

increase the value of the business continually.

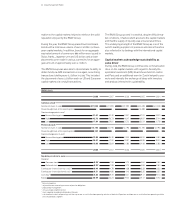

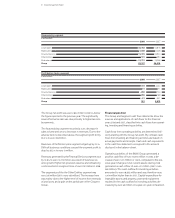

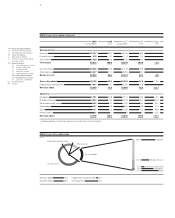

Return on Capital Employed

Earnings for Capital Return on

ROCE purposes employed Capital Employed

in euro million in euro million in %

2008 2007 2008 2007 2008 2007

BMW Group 639 4,193 28,315 27,321 2.3 15.3

Automobiles 690 3,450 14,056 13,953 4.9 24.7

Motorcycles 60 80 432 444 13.9 18.0

Analysis of the Group Financial Statements

Capital employed by BMW Group

in euro million

2008 2007

Group equity 21,766 20,303

+ Financial liabilities 2,832 2,247

+ Pension provisions 3,717 4,771

Capital employed 28,315 27,321