BMW 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

14 Group Management Report

14 A Review of the Financial Year

16 General Economic Environment

20 Review of Operations

42 BMW Stock and Bonds

45 Disclosures pursuant to § 289 (4)

and § 315 (4) HGB

47 Financial Analysis

47 Internal Management System

49 Earnings Performance

51 Financial Position

52 Net Assets Position

55 Subsequent Events Report

55 Value Added Statement

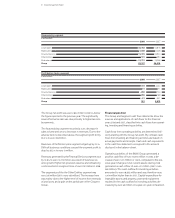

57 Key Performance Figures

58 Comments on BMW AG

62 Risk Management

68 Outlook

Comments on the Financial Statements of BMW AG

Whereas the Group Financial Statements are drawn up in

accordance with IFRSs issued by the IASB, the financial

statements of BMW AG are drawn up in accordance with

the provisions of the German Commercial Code (HGB).

Where it is permitted and considered sensible, the princi-

ples and policies of IFRSs are also applied in the individual

company financial statements. The pension provision in

the individual company financial statements, for example,

is also determined in accordance with IAS and the full

defined benefit obligation recognised. In numerous other

cases, however, the accounting principles and policies in

the individual company financial statements of BMW AG

differ from those applied in the Group Financial State-

ments.

The main differences relate to the recognition of

intangible assets, depreciation and amortisation methods,

the measurement of inventories and provisions as well as

the treatment of financial instruments.

BMW AG develops, manufactures and sells cars and mo-

torcycles manufactured by itself and foreign subsidiaries.

These vehicles are sold through the Company’s own

branches, independent dealers, subsidiaries and import-

ers. The number of cars manufactured at German and

foreign plants in decreased by . to ,, units.

At December , BMW AG had , employees,

, fewer than one year earlier. This is largely due to the

implementation of previously reported measures to re-

duce the size of the workforce. The expenditure incurred

in this context increased administrative costs.

Consumer reluctance to spend in the face of the current

financial crisis as well as model life cycle factors caused a

reduction in the number of cars sold by BMW AG. As a con-

sequence,

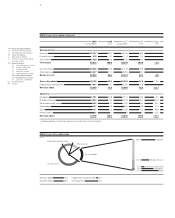

revenues fell in by . . Sales to foreign

group sales companies accounted for euro . billion or

approximately . of the total revenues of euro . bil-

lion. In percentage terms, the decrease in cost of sales was

slightly more pronounced than the decrease in revenues.

Gross profit fell by euro . billion – . and amounted to

euro . billion.

Adverse currency factors relating to the US dollar and

Japanese yen as well as continued intense competition on

the automobile markets had a negative impact on BMW

AG’s earnings.

In conjunction with measures to optimise the structure

of investments within the BMW Group, BMW AG incurred

a loss of the disposal of subsidiaries and a higher profit on

an existing profit and loss transfer agreement. Investments

were reduced as a result of this transaction.

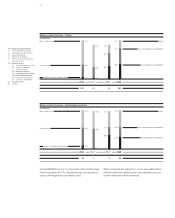

Capital expenditure on intangible assets and property,

plant and equipment amounted to euro , million (:

euro , million), up . compared to the previous

year. The increase was mainly related to high product in-

vestments for the new BMW 7 Series and the new Z4.

Depreciation and amortisation amounted to euro , mil-

lion.

In order to secure obligations resulting from pre-retirement

part-time work arrangements and a part of the Company’s

pension obligations, an amount of euro , million was

transferred to the newly founded

BMW

Trust e. V., Munich,

in conjunction with a Contractual Trust Arrangement

(CTA).

Equity decreased by euro million to euro , million.

The existing authorisation to acquire treasury common

stock shares was not exercised during the financial year

. Of the preferred stock treasury shares acquired dur-

ing , , shares were held by the Company at the

end of the reporting period. The equity ratio decreased

from . to . . Long-term external capital (registered

profit-sharing certificates, pension provisions, the liability

to the BMW Unterstützungsverein e. V. and liabilities due

later than one year) increased by . to euro , mil-

lion. Despite the heightening of the financial crisis during

the second half of , BMW AG had access to the credit

and financial markets at all times and was able to increase

its liquid funds significantly.