Avon 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

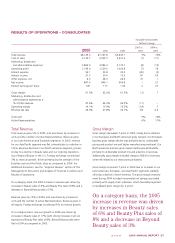

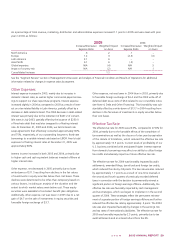

As a percentage of total revenue, marketing, distribution and administrative expenses increased 1.1 points in 2005 and were level with prior

year in 2004, as follows:

2005 2004

Increase/(Decrease) Weighted Impact Increase/(Decrease) Weighted Impact

Expense Ratio on Avon Expense Ratio on Avon

North America .6 .2 .1 –

Europe 1.2 .3 (2.3) (.6)

Latin America 2.1 .6 – –

Asia Pacific 4.1 .6 (.2) –

Global expenses N/A (.4) N/A .5

Impact of country mix N/A (.2) N/A .1

Consolidated increase 1.1 –

See the “Segment Review” section of Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional

information related to changes in expense ratios by segment.

Other Expenses

Interest expense increased in 2005, mainly due to increases in

domestic interest rates, as well as higher commercial paper borrow-

ings to support our share repurchase programs. Interest expense

increased slightly in 2004 as compared to 2003 as a result of inter-

est on a tax-related liability in Latin America, partially offset by a

decrease in debt-related interest. The 2004 decrease in debt-related

interest was primarily due to the retirement of $447.2 of convert-

ible notes in July 2003, partially offset by the issuance of $250.0

of fixed-rate debt that was later swapped to a floating interest

rate. At December 31, 2005 and 2004, we held interest rate

swap agreements that effectively converted approximately 60%

and 75%, respectively, of our outstanding long-term, fixed-rate

borrowings to a variable interest rate based on LIBOR. Avon’s total

exposure to floating interest rates at December 31, 2005 was

approximately 80%.

Interest income increased in both 2005 and 2004, primarily due

to higher cash and cash equivalent balances invested offshore at

higher interest rates.

Other expense, net decreased in 2005 primarily due to lower

write-downs of $11.5 resulting from declines in the fair values

of investments in equity securities below their cost bases. These

declines were determined to be other-than-temporary based on

various factors, including an analysis of the duration and the

extent to which market values were below cost. These equity

securities were available to fund select benefit plan obligations.

Additionally, other expense, net was lower in 2005 due to a net

gain of $4.7 on the sale of investments in equity securities and

favorable foreign exchange of $3.7.

Other expense, net was lower in 2004 than in 2003, primarily due

to favorable foreign exchange of $6.4 and the 2003 write-off of

deferred debt issue costs of $6.4 related to our convertible notes

(see Note 4, Debt and Other Financing). This favorability was sub-

stantially offset by a write-down of $13.7 in 2004 resulting from

declines in the fair values of investments in equity securities below

their cost bases.

Effective Tax Rate

The effective tax rate for 2005 was 24.0%, compared to 27.8% for

2004, primarily due to the favorable effects of the completion of

tax examinations as well as the closure of a tax year by expiration

of the statute of limitations, which reduced the effective tax rate

by approximately 10.5 points. Current levels of profitability of our

U.S. business combined with anticipated higher interest expense

from domestic borrowings may affect our ability to utilize foreign

tax credits and adversely impact our future effective tax rate.

The effective tax rate for 2004 was favorably impacted by audit

settlements, amended filings, tax refunds and foreign tax credits,

which reduced the rate by 2.8 points. The tax rate was also reduced

by approximately 1.7 points as a result of one-time reversals in

the second and fourth quarters of previously recorded deferred

taxes in connection with the decision to permanently reinvest a

significant portion of foreign earnings offshore. Additionally, the

effective tax rate was favorably impacted by cash management

and tax strategies, which we began to implement in the second

quarter of 2004. These strategies reflect the permanent reinvest-

ment of a greater portion of foreign earnings offshore and further

reduced the effective tax rate by approximately .5 point. The 2004

rate was also impacted favorably by changes in the earnings mix

and tax rates of international subsidiaries. The effective tax rate for

2003 was favorably impacted by 2.5 points, primarily due to tax

audit settlements and an interest refund from the IRS.

2005ANNUALREPORT29