Avon 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’SDISCUSSIONANDANALYSIS

OFFINANCIALCONDITIONANDRESULTSOFOPERATIONS

On August 31, 2005, we increased the size of our existing

commercial paper program from $600.0 to $1,000.0. Under the

program, we may issue from time to time unsecured promissory

notes in the commercial paper market in private placements

exempt from registration under federal and state securities laws,

for a cumulative face amount not to exceed $1,000.0 outstand-

ing at any one time and with maturities not exceeding 270 days

from the date of issue. The commercial paper short-term notes

issued under the program are not redeemable prior to maturity

and are not subject to voluntary prepayment. The commercial

paper program is supported by our credit facilities. Outstanding

commercial paper effectively reduces the amount available for

borrowing under the credit facility. At December 31, 2005, we

had commercial paper outstanding of $756.9.

At December 31, 2005, we were in compliance with all covenants

in our indentures (see Note 4, Debt and Other Financing). Such

indentures do not contain any rating downgrade triggers that

would accelerate the maturity of our debt.

At December 31, 2005, we had an international committed line

of credit of $4.3 of which $.3 was outstanding. The fees on

this line are .25% on the unused portion and the prime rate on

outstanding amounts.

RISKMANAGEMENTSTRATEGIES

ANDMARKETRATESENSITIVE

INSTRUMENTS

The overall objective of our financial risk management program is

to reduce the potential negative effects from changes in foreign

exchange and interest rates arising from our business activities.

We may reduce our exposure to fluctuations in earnings and

cash flows associated with changes in interest rates and foreign

exchange rates by creating offsetting positions through the use of

derivative financial instruments and through operational means.

Since we use foreign currency rate-sensitive and interest rate-

sensitive instruments to hedge a certain portion of our existing

and forecasted transactions, we expect that any loss in value for

the hedge instruments generally would be offset by increases in

the value of the underlying transactions.

We do not enter into derivative financial instruments for trading

or speculative purposes, nor are we a party to leveraged deriva-

tives. The master agreements governing our derivative contracts

generally contain standard provisions that could trigger early

termination of the contracts in certain circumstances, including if

we were to merge with another entity and the creditworthiness of

the surviving entity were to be “materially weaker” than that of

Avon prior to the merger.

Interest Rate Risk

Our long-term, fixed-rate borrowings are subject to interest rate

risk. We use interest rate swaps, which effectively convert the

fixed rate on the debt to a floating interest rate, to manage our

interest rate exposure. At December 31, 2005 and 2004, we held

interest rate swap agreements that effectively converted approxi-

mately 60% and 75%, respectively, of our outstanding long-term,

fixed-rate borrowings to a variable interest rate based on LIBOR.

Avon’s total exposure to floating interest rates at December 31,

2005 and December 31, 2004 was 81% and 77%, respectively.

At December 31, 2005, we had a treasury lock agreement with

a notional amount of $250.0 designated as a cash flow hedge

of the anticipated issuance of five-year bonds (see Note 19,

Subsequent Events).

Our long-term borrowings and interest rate swaps were analyzed

at year-end to determine their sensitivity to interest rate changes.

Based on the outstanding balance of all these financial instruments

at December 31, 2005, a hypothetical 50 basis point change (either

an increase or a decrease) in interest rates prevailing at that date,

sustained for one year, would not represent a material potential

change in fair value, earnings or cash flows. This potential change

was calculated based on discounted cash flow analyses using inter-

est rates comparable to our current cost of debt.

Foreign Currency Risk

We operate globally, with operations in various locations around

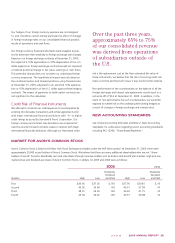

the world. Over the past three years, approximately 65% to 75%

of our consolidated revenue was derived from operations of

subsidiaries outside of the U.S. The functional currency for most

of our foreign operations is the local currency. We are exposed to

changes in financial market conditions in the normal course of our

operations, primarily due to international businesses and transac-

tions denominated in foreign currencies and the use of various

financial instruments to fund ongoing activities. At December 31,

2005, the primary currencies for which we had net underlying for-

eign currency exchange rate exposures were the Argentine peso,

Brazilian real, British pound, Chinese renminbi, the Euro, Japanese

yen, Mexican peso, Polish zloty, Russian ruble, Turkish lira and

Venezuelan bolivar.

We may reduce our exposure to fluctuations in earnings and

cash flows associated with changes in foreign exchange rates by

creating offsetting positions through the use of derivative financial

instruments. Additionally, certain of our subsidiaries held U.S. dol-

lar denominated assets, primarily to minimize foreign-currency risk

and provide liquidity.