Avon 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT27

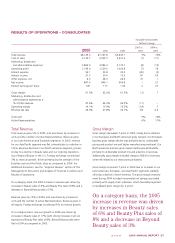

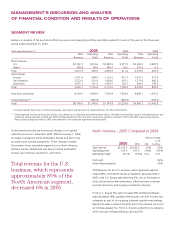

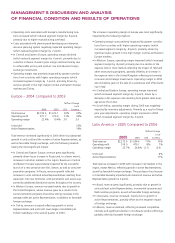

Total Revenue

Total revenue grew 5% in 2005, and was driven by increases in

units and the number of active Representatives. Revenue grew

in our Latin American and European segments. In 2005, revenue

for our Asia Pacific segment was flat, primarily due to a decline in

China. Revenue declined in our North American segment, primar-

ily due to a decline in Beauty sales and our ongoing reposition-

ing of Beyond Beauty in the U.S. Foreign exchange contributed

3% to revenue growth, driven primarily by the strength of the

Brazilian real and the Polish zloty as compared to 2004. For

additional discussion, see the “Segment Review” section of this

Management’s Discussion and Analysis of Financial Condition and

Results of Operations.

On a category basis, the 2005 increase in revenue was driven by

increases in Beauty sales of 6% and Beauty Plus sales of 8% and a

decrease in Beyond Beauty sales of 3%.

Revenue grew by 13% in 2004, and was driven by increases in

units and the number of active Representatives. Revenue grew in

all regions. Foreign exchange contributed 3% to revenue growth.

On a category basis, revenue growth in 2004 was driven by

increases in Beauty sales of 17% (with strong increases in all cat-

egories) and Beauty Plus sales of 8%. Beyond Beauty sales were

flat in 2004 as compared to 2003.

Gross Margin

Gross margin decreased .7 point in 2005, mainly due to declines

in our European and North American gross margins. Our European

business gross margin decline was primarily due to unfavorable

pricing and product mix and higher manufacturing overhead. Our

North American business gross margin decline was attributable

primarily to unfavorable product mix and a decline in revenues.

Additionally, gross margin included charges of $8.4 for inventory

write-offs related to our restructuring initiatives.

Gross margin improved .7 point in 2004 due to increases in our

Latin American, European, and Asia Pacific segments, partially

offset by a decline in North America. The gross margin improve-

ment during 2004 included incremental net savings associated

primarily with supply chain initiatives, which favorably impacted

consolidated gross margin by .2 point.

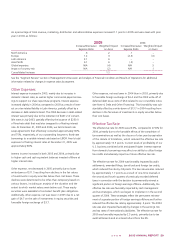

RESULTSOFOPERATIONS–CONSOLIDATED

Favorable (Unfavorable)

%/Point Change

2005 vs. 2004 vs.

2005 2004 2003 2004 2003

Total revenue $8,149.6 $7,747.8 $6,845.1 5% 13%

Cost of sales 3,133.7 2,932.5 2,631.6 (7) (11)

Marketing, distribution

and administrative expenses 3,866.9 3,586.3 3,170.7 (8) (13)

Operating profit 1,149.0 1,229.0 1,042.8 (7) 18

Interest expense 54.1 33.8 33.3 (60) (2)

Interest income 37.3 20.6 12.6 81 63

Other expense, net 8.0 28.3 28.6 72 1

Net income 847.6 846.1 664.8 – 27

Diluted earnings per share 1.81 1.77 1.39 2 27

Gross margin 61.5% 62.2% 61.5% (.7) .7

Marketing, distribution and

administrative expenses as a

% of total revenue 47.4% 46.3% 46.3% (1.1) –

Operating margin 14.1% 15.9% 15.2% (1.8) .7

Effective tax rate 24.0% 27.8% 32.1% 3.8 4.3

Units sold 3% 13%

Active Representatives 6% 11%

On a category basis, the 2005

increase in revenue was driven

by increases in Beauty sales

of 6% and Beauty Plus sales of

8% and a decrease in Beyond

Beauty sales of 3%.