Avon 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT51

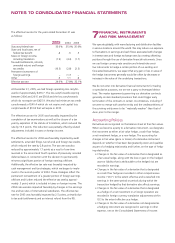

Payments for the purchases, proceeds and gross realized gains and

losses from the sales of these securities totaled $20.0, $28.6, $.4

and $13.9, respectively, during 2004. During the fourth quarter

of 2004, Avon reclassified $13.7 ($12.2 after tax) of unrealized

losses from accumulated other comprehensive loss to other

expense, net, for declines in the fair values of investments in

equity securities below their cost bases that were judged to be

other-than-temporary. These equity securities were available to

fund select benefit plan obligations.

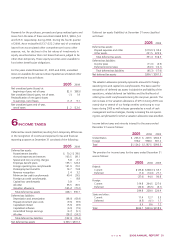

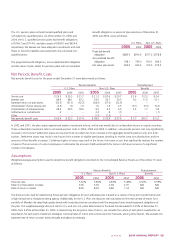

For the years ended December 31, 2005 and 2004, unrealized

losses on available-for-sale securities impacted accumulated other

comprehensive loss as follows:

2005 2004

Net unrealized gains (losses) at

beginning of year, net of taxes $2.0 $(8.5)

Net unrealized (losses) gains, net of taxes (.1) 1.4

Reclassification of net (gains) losses

to earnings, net of taxes (1.7) 9.1

Net unrealized gains end of year,

net of taxes $ .2 $ 2.0

6

INCOMETAXES

Deferred tax assets (liabilities) resulting from temporary differences

in the recognition of income and expense for tax and financial

reporting purposes at December 31 consisted of the following:

2005 2004

Deferred tax assets:

Postretirement benefits $ 70.2 $ 78.5

Accrued expenses and reserves 103.5 89.1

Special and non-recurring charges 5.8 2.1

Employee benefit plans 135.1 124.4

Foreign operating loss carryforwards 141.9 70.0

Postemployment benefits 14.7 15.8

Revenue recognition 2.4 3.2

Minimum tax credit carryforwards 40.4 29.5

Foreign tax credit carryforwards – 8.8

Capital loss carryforwards 3.8 –

All other 55.5 45.5

Valuation allowance (145.2) (70.2)

Total deferred tax assets 428.1 396.7

Deferred tax liabilities:

Depreciation and amortization (68.0) (43.4)

Prepaid retirement plan costs (9.6) (9.9)

Capitalized interest (5.6) (4.9)

Capitalized software (6.9) (7.9)

Unremitted foreign earnings (3.7) (5.1)

All other (28.2) (24.2)

Total deferred tax liabilities (122.0) (95.4)

Net deferred tax assets $ 306.1 $301.3

Deferred tax assets (liabilities) at December 31 were classified

as follows:

2005 2004

Deferred tax assets:

Prepaid expenses and other $119.9 $ 95.4

Other assets 231.5 222.9

Total deferred tax assets 351.4 318.3

Deferred tax liabilities:

Income taxes (11.0) (4.9)

Deferred income taxes (34.3) (12.1)

Total deferred tax liabilities (45.3) (17.0)

Net deferred tax assets $306.1 $301.3

The valuation allowance primarily represents amounts for foreign

operating loss and capital loss carryforwards. The basis used for

recognition of deferred tax assets included the profitability of the

operations, related deferred tax liabilities and the likelihood of

utilizing tax credit carryforwards during the carryover periods. The

net increase in the valuation allowance of $75.0 during 2005 was

mainly due to several of our foreign entities continuing to incur

losses during 2005 as well as losses generated as a result of cash

management and tax strategies, thereby increasing the net operat-

ing loss carryforwards for which a valuation allowance was provided.

Income before taxes and minority interest for the years ended

December 31 was as follows:

2005 2004 2003

United States $ 206.0 $ 249.5 $302.3

Foreign 918.2 938.0 691.2

Total $1,124.2 $1,187.5 $993.5

The provision for income taxes for the years ended December 31

was as follows:

2005 2004 2003

Federal:

Current $ (29.8) $108.4 $ 63.7

Deferred (7.2) (14.4) 27.1

(37.0) 94.0 90.8

Foreign:

Current 319.8 264.5 227.0

Deferred (20.0) (36.5) (6.1)

299.8 228.0 220.9

State and other:

Current 11.4 12.7 5.5

Deferred (4.5) (4.1) 1.7

6.9 8.6 7.2

Total $269.7 $330.6 $318.9