Avon 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’SDISCUSSIONANDANALYSIS

OFFINANCIALCONDITIONANDRESULTSOFOPERATIONS

The discount rate used for determining future pension obligations

for each individual plan is based on a review of long-term bonds

that receive a high rating from a recognized rating agency. The

discount rate at December 31, 2005 for the U.S. plan was 5.5%,

which was based on the internal rate of return for a portfolio

of Moody’s Aa-rated high quality bonds with maturities that are

consistent with the projected future benefit payment obligations

of the plan. The weighted-average discount rate for U.S. and

non-U.S. plans determined on this basis has decreased to 5.2% at

December 31, 2005, from 5.65% at December 31, 2004.

Future effects of pension plans on our operating results will depend

on economic conditions, employee demographics, mortality rates,

the number of associates electing to take lump-sum payments,

investment performance and funding decisions, among other fac-

tors. However, given current assumptions (including those noted

above), 2006 pension expense related to the U.S. plan is expected

to increase in the range of $8.0 to $10.0.

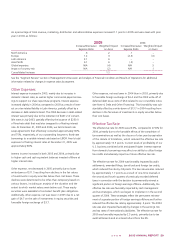

A 50 basis point change (in either direction) in the expected rate

of return on plan assets, the discount rate or the rate of compen-

sation increases, would have had the following effect on 2005

pension expense:

Increase/(Decrease) in

Pension Expense

50 basis point 50 basis point

Increase Decrease

Rate of return on assets $ (5.1) $ 5.1

Discount rate (12.3) 12.9

Rate of compensation

increase 4.0 (3.8)

Taxes

We record a valuation allowance to reduce our deferred tax assets

to an amount that is more likely than not to be realized. While we

have considered projected future taxable income and ongoing tax

planning strategies in assessing the need for the valuation allow-

ance, in the event we were to determine that we would be able to

realize a net deferred tax asset in the future, in excess of the net

recorded amount, an adjustment to the deferred tax asset would

increase earnings in the period such determination was made.

Likewise, should we determine that we would not be able to realize

all or part of our net deferred tax asset in the future, an adjustment

to the deferred tax asset would decrease earnings in the period

such determination was made. We establish additional provisions

for income taxes when, despite the belief that our tax positions are

fully supportable, there remain certain positions that are likely to

be challenged and may or may not be sustained on review by tax

authorities. We adjust these additional accruals in light of changing

facts and circumstances. We file income tax returns in many jurisdic-

tions. In 2006, a number of income tax returns are scheduled to

close by statute and it is possible that a number of tax examinations

may be completed. If Avon’s filing positions are ultimately upheld,

it is possible that the 2006 provision for income taxes may reflect

adjustments. Depending on the number of filing positions ulti-

mately upheld, the impact of the adjustments could be significant

to 2006 net income.

Stock-based Compensation

Historically, we have applied the recognition and measurement

principles of Accounting Principles Board (“APB”) Opinion 25,

“Accounting for Stock Issued to Employees,” in accounting for our

long-term stock-based incentive plans. No compensation cost

related to grants of stock options was reflected in net income, as all

options granted under the plans had an exercise price equal to the

market price on the date of grant. Net income in each of the years

of 2005, 2004 and 2003 would have been lower by $31.1, $26.3

and $28.7, respectively, if we had applied the fair value recognition

provisions of Statement of Financial Accounting Standards (“FAS”)

No. 123, “Accounting for Stock-Based Compensation” (see Note

1, Description of Business and Summary of Significant Accounting

Policies). Beginning January 1, 2006, in accordance with the

recently issued FAS 123(R), “Share-Based Payment,” we will record

expense for all grants of stock-based awards, utilizing the modified

prospective method (see Note 2, New Accounting Standards).

The impact of the adoption of FAS 123(R) will depend on levels of

share-based payments granted in the future.

Loss Contingencies

In accordance with FAS No. 5, “Accounting for Contingencies,” we

determine whether to disclose and accrue for loss contingencies

based on an assessment of whether the risk of loss is remote,

reasonably possible or probable. Our assessment is developed

in consultation with our outside counsel and other advisors

and is based on an analysis of possible outcomes under various

strategies. Loss contingency assumptions involve judgments that

are inherently subjective and can involve matters that are in litiga-

tion, which, by its nature is unpredictable. We believe that our

assessment of the probability of loss contingencies is reasonable,

but because of the subjectivity involved and the unpredictable

nature of the subject matter at issue, our assessment may prove

ultimately to be incorrect, which could materially impact the

Consolidated Financial Statements.

Beginning January 1, 2006,

we will record expense for

all grants of stock-based

awards, utilizing the modified

prospective method.