Avon 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT65

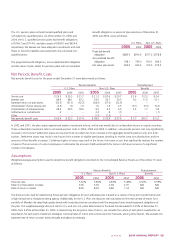

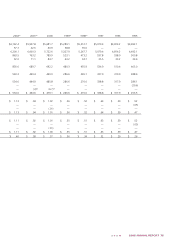

The liability balances for these charges were as follows:

Employee

Related Asset Inventory AFCT Contract

Costs Write-offs Write-offs Write-offs Termination Total

2005 Charges $30.4 $ 1.4 $ 8.4 $11.4 $ – $ 51.6

Cash payments (.5) – – – – (.5)

Non-cash write-offs (.7) (1.4) (8.4) (11.4) – (21.9)

Foreign exchange – – – – – –

Ending Balance $29.2 $ – $ – $ – $ – $ 29.2

Total charges incurred to date $30.4 $ 1.4 $ 8.4 $11.4 $ – $ 51.6

Total expected charges $32.7 $ 1.8 $ 8.4 $11.4 $1.1 $ 55.4

Non-cash write-offs associated with employee-related costs are the result of settlement or curtailment charges for pension plans due to the

initiatives implemented.

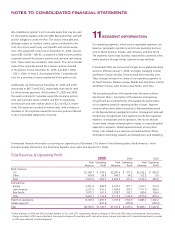

The charges by reportable business segment were as follows:

North Latin Asia

America America Europe Pacific Corporate Total

Current quarter charges: $ 6.9 $ 3.5 $ 12.7 $ 22.4 $ 6.1 $ 51.6

Costs recorded to date: 6.9 3.5 12.7 22.4 6.1 51.6

Total expected costs: 6.9 3.5 15.5 23.4 6.1 55.4

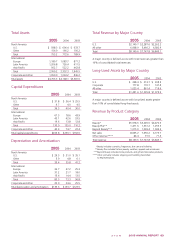

In addition to the charges included in the table above, we will

incur other costs to implement such as accelerated deprecia-

tion and consulting and other professional services. As noted

previously, we expect to incur $300.0 to $500.0 to implement all

restructuring initiatives, including other costs to implement these

initiatives, over the next several years. The amounts shown in

the table above relate to initiatives that have been approved and

recorded in the financial statements to date as the costs are prob-

able and estimable.

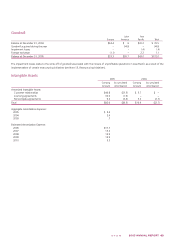

Special Charges – Fourth Quarter 2001

In 2001, we recorded Special charges of $97.4 pretax primarily

associated with facility rationalizations and workforce reduc-

tion programs related to implementation of certain Business

Transformation initiatives. While project plans associated with

these initiatives did not change, we experienced favorable adjust-

ments to our original cost estimates and, as a result, reversed

pretax amounts totaling $2.5 and $2.1 in 2004 and 2003, respec-

tively, in the marketing, distribution and administrative line in the

Consolidated Statements of Income. The favorable adjustments

primarily related to certain employees pursuing reassignments in

other Avon locations, lower severance costs resulting from higher

than anticipated lump-sum distributions (associates who elected

lump-sum distributions did not receive benefits during the sever-

ance period) and favorable contract termination negotiations.

There was no remaining liability at December 31, 2005.