Avon 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT47

Contingencies

In accordance with FAS No. 5, “Accounting for Contingencies,”

we determine whether to disclose and accrue for loss contingen-

cies based on an assessment of whether the risk of loss is remote,

reasonably possible or probable. We record loss contingencies

when it is probable that a liability has been incurred and the

amount of loss is reasonably estimable.

Reclassifications

We have reclassified some prior year amounts in the

Consolidated Financial Statements and accompanying notes

for comparative purposes.

Earnings per Share

We compute basic earnings per share (“EPS”) by dividing net

income by the weighted-average number of shares outstanding

during the year. Diluted EPS are calculated to give effect to all

potentially dilutive common shares that were outstanding during

the year.

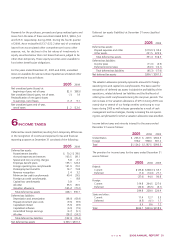

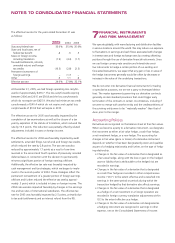

For each of the three years ended December 31, the components

of basic and diluted earnings per share were as follows:

Shares in millions 2005 2004 2003

Numerator:

Net income $847.6 $846.1 $664.8

Interest expense on convertible

notes, net of taxes – – 5.7

Net income for purposes of

computing diluted EPS $847.6 $846.1 $670.5

Denominator:

Basic EPS weighted-average

shares outstanding 466.28 472.35 471.08

Diluted effect of:

Stock options 3.19 5.61 4.73

Convertible notes – – 7.32

Diluted EPS adjusted weighted-

average shares outstanding 469.47 477.96 483.13

EPS:

Basic $ 1.82 $ 1.79 $ 1.41

Diluted $ 1.81 $ 1.77 $ 1.39

At December 31, 2005 and 2004, we did not include stock

options to purchase 12.1 million shares and .2 million shares of

Avon common stock, respectively, in the calculations of diluted

earnings per share because the exercise prices of those options

were greater than the average market price and their inclusion

would be anti-dilutive.

2NEWACCOUNTING

STANDARDS

Stock-Based Compensation

In December 2004, the FASB issued FASB Statement No. 123(R)

(revised December 2004), Share-Based Payment (“FAS 123(R)”),

which requires companies to expense the value of employee and

director stock options and similar awards. Beginning January 1,

2006, in accordance with FAS 123(R), we will record expense for

all grants of stock-based awards utilizing the modified prospective

method. The fair value of options granted will be calculated using

a Black-Scholes model. The impact of the adoption of FAS 123(R)

will depend on levels of share-based payments granted in the

future. Net income in each of the years of 2005, 2004 and 2003,

would have been lower by $31.1, $26.3 and $28.7, respectively, if

we had applied the fair value recognition provisions of FAS No. 123.

(See Note 1, Description of the Business and Summary of Significant

Accounting Policies.)

Inventory

In November 2004, the FASB issued FASB Statement No. 151,

Inventory Costs (“FAS 151”), which requires certain inventory-

related costs to be expensed as incurred. We will adopt FAS 151 on

January 1, 2006. We do not believe the adoption of FAS 151 will

have a material impact on the Consolidated Financial Statements.

Advertising costs, excluding

brochure preparation costs,

are expensed as incurred

and amounted to $135.9

in 2005, $127.6 in 2004

and $108.8 in 2003.