Avon 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

complaint asserts breaches of fiduciary duties and prohibited

transactions in violation of ERISA arising out of, inter alia, alleged

false and misleading public statements regarding Avon’s business

made during the class period and investments in Avon stock by

the Plan and Plan participants.

It is not possible to predict the outcome of litigation and it is

reasonably possible that there could be unfavorable outcomes

in the In re Avon Products, Inc. Securities Litigation, In re Avon

Products, Inc. Securities Litigation (derivative action) and In re

Avon Products, Inc. ERISA Litigation matters. Management is

unable to make a meaningful estimate of the amount or range of

loss that could result from unfavorable outcomes but, under some

circumstances, adverse awards could be material to our consoli-

dated financial position, results of operations or cash flows.

Various other lawsuits and claims, arising in the ordinary course of

business or related to businesses previously sold, are pending or

threatened against Avon. In management’s opinion, based on its

review of the information available at this time, the total cost of

resolving such other contingencies at December 31, 2005, should

not have a material adverse effect on our consolidated financial

position, results of operations or cash flows.

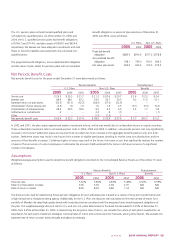

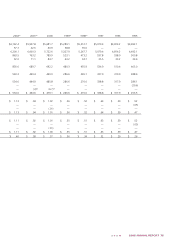

15SUPPLEMENTALINCOME

STATEMENTINFORMATION

For the years ended December 31, 2005, 2004 and 2003, the

components of other expense, net were as follows:

2005 2004 2003

Foreign exchange losses, net $ 5.8 $ 9.5 $15.9

Net (gains) losses on available-for-sale

securities (Note 5) (2.5) 13.7 –

Amortization of debt issue costs and

other financing 8.9 7.0 14.1

Gain on de-designated treasury

lock agreement (2.5) – –

Other (1.7) (1.9) (1.4)

Other expense, net $ 8.0 $28.3 $28.6

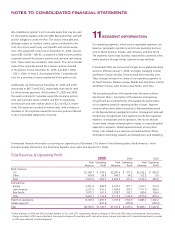

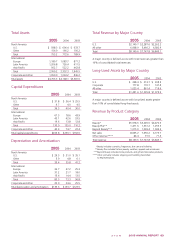

16

OTHERINFORMATION

In January 2003, we announced that we agreed with J.C. Penney

to end the business relationship, which began in 2001, pursuant to

which our beComing line of products had been carried in approxi-

mately 90 J.C. Penney stores. For the year ended December 31,

2003, costs associated with ending this business relationship

were $18.3, including severance costs ($4.1), asset and inventory

write-downs ($12.1) and other related expenses ($2.1). These costs,

which were incurred in the first and second quarters, were included

in the Consolidated Statements of Income in marketing, distribution

and administrative expenses ($10.5) and in cost of sales ($7.8).

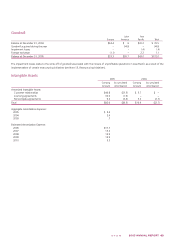

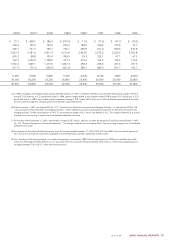

17GOODWILLAND

INTANGIBLEASSETS

On October 18, 2005, we purchased the Avon direct-selling busi-

ness of our licensee in Colombia for approximately $154.0 in cash,

pursuant to a share purchase agreement that Avon International

Holdings Company, a wholly-owned subsidiary of the Company,

entered into with Sarastro Ltd. Ldc. on October 7, 2005. The

acquired business is being operated by a new wholly-owned

subsidiary under the name “Avon Colombia” and is included

in our Latin America operating segment. We had a pre-existing

license arrangement with the acquired business. The negotiated

terms of the license agreement were considered to be at market

rates; therefore, no settlement gain or loss was recognized upon

acquisition. The preliminary purchase price allocation resulted in

goodwill of $94.8, licensing agreement of $32.0 (four-year useful

life), customer relationships of $35.1 (seven-year weighted-aver-

age useful life), and a noncompete agreement of $3.9 (three-year

useful life). We are in the process of gathering sufficient data to

support certain assumptions for the final valuation; therefore, the

allocation of the purchase price is subject to adjustment.

In June 2004, we purchased 20% of the outstanding shares in our

two subsidiaries in China from a minority interest shareholder for

$45.6, including transaction costs. We previously owned 73.845%

of these subsidiaries and consolidated their results, while record-

ing minority interest for the portion not owned. As a result of this

transaction, we reduced the minority interest in the net assets

of these subsidiaries as of June 30, 2004. The purchase of these

shares did not have a material impact on our consolidated net

income. Avon China is included in our Asia Pacific operating

segment. We allocated $5.7 of the purchase price to customer

relationships and approximately $30.5 to goodwill.

In the second quarter of 2003, we purchased the outstanding 50%

of shares of our Turkish business, Eczacibasi Avon Kozmetik (EAK)

from our partner, Eczacibasi Group, for $18.4, including transaction

costs. As a result of the acquisition agreement, we consolidated the

remaining 50% of our Turkish joint venture business in the second

quarter of 2003. Prior to the second quarter of 2003, the invest-

ment was accounted for under the equity method. The impact

on net sales and operating profit in 2003 was $47.2 and $14.6,

respectively. Avon Turkey is included in our European operating

segment. We allocated approximately $17.0 of the purchase

price to goodwill.

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS