Avon 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT49

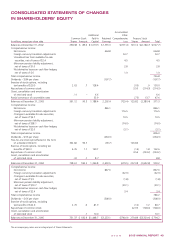

In July 2003, the holders of $48.3 of zero coupon convertible senior

notes due 2020 (the “Convertible Notes”), which were originally

issued in 2000, converted their notes into approximately 1,502,000

shares of Avon Common Stock in accordance with the conversion

feature of the Convertible Notes. The conversion reduced Treasury

Stock by $13.7 and increased Additional paid-in capital by $34.6.

In July 2003, we redeemed the remaining Convertible Notes by

paying $398.9, which represented the redemption price of $531.74

for each $1,000 principal amount at maturity of Convertible Notes

that were then outstanding. As a result of the redemption, deferred

issuance costs related to the Convertible Notes of approximately

$6.4 were expensed to other expense, net and $.7 were reclassified

to additional paid-in capital in 2003.

In June 2003, we issued to the public $250.0 principal amount of

registered senior notes (the “4.20% Notes”) under our $1,000.0

debt shelf registration statement. The 4.20% Notes mature on

July 15, 2018, and bear interest at a per annum rate of 4.20%,

payable semi-annually. The net proceeds were used to repay a

portion of our Convertible Notes, discussed above. The carrying

value of the 4.20% Notes represents the $250.0 principal amount,

net of the unamortized discount to face value of $1.1 at both

December 31, 2005 and 2004.

In April 2003, the call holder of $100.0, 6.25% Notes due May

2018 (the “Notes”), embedded with put and call option features,

exercised the call option associated with these Notes, and thus

became the sole note holder of the Notes. Pursuant to an agreement

with the sole note holder, we modified these Notes into $125.0

aggregate principal amount of 4.625% notes due May 15, 2013.

The modified principal amount represented the original value of

the putable/callable notes, plus the market value of the related call

option and approximately $4.0 principal amount of additional notes

issued for cash. In May 2003, $125.0 principal amount of registered

senior notes were issued in exchange for the modified notes held by

the sole note holder. No cash proceeds were received by us. The reg-

istered senior notes mature on May 15, 2013, and bear interest at

a per annum rate of 4.625%, payable semi-annually (the “4.625%

Notes”). The 4.625% Notes were issued under our $1,000.0 debt

shelf registration statement. The transaction was accounted for as an

exchange of debt instruments and, accordingly, the premium related

to the original notes is being amortized over the life of the new

4.625% Notes. At December 31, 2005 and 2004, the carrying value

of the 4.625% Notes represents the $125.0 principal amount, net of

the unamortized discount to face value of $.6 and $.7, respectively,

and the premium related to the call option associated with the

original notes of $16.1 and $17.7, respectively.

The indentures under which the above notes were issued contain

certain covenants, including limits on the incurrence of liens and

restrictions on the incurrence of sale/leaseback transactions and

transactions involving a merger, consolidation or sale of substan-

tially all of our assets. At December 31, 2005, we were in compli-

ance with all covenants in our indentures.

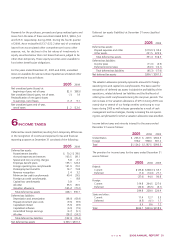

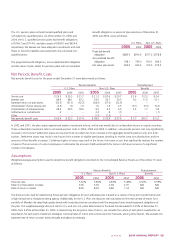

Annual maturities of long-term debt (including unamortized

discounts and premiums and excluding the adjustments for debt

with fair value hedges) outstanding at December 31, 2005, are

as follows:

After

2006 2007 2008 2009 2010 2010 Total

Maturities $ 4.9 $103.6 $ 3.5 $300.2 $ .1 $375.0 $787.3

Other Financing

As of December 31, 2005, we had a five-year, $600.0 revolving

credit and competitive advance facility (the “old credit facil-

ity”), which was due to expire in May 2006. In August 2005,

we entered into credit agreements with Bank of America, N.A.

and Citibank, N.A., under which each bank provided a $200.0

revolving credit facility (together the “bridge credit facilities”)

which were due to expire in August 2006. At December 31,

2005, there were no borrowings outstanding under the old

credit facility or the bridge facilities and we were in compliance

with all covenants under the old credit facility and bridge credit

facilities. Following our issuance, in January 2006 of $500.0 of

long-term bonds (see Note 19, Subsequent Events), the bridge

credit facilities terminated in accordance with their terms.

In January 2006, we entered into a five-year $1,000.0 revolving

credit and competitive advance facility (the “new credit facility”),

and simultaneously terminated the old credit facility. The new credit

facility may be used for general corporate purposes. The interest

rate on borrowings under the new credit facility is based on LIBOR

or on the higher of prime or ½% plus the federal funds rate. The

new credit facility has an annual facility fee, payable quarterly, of

$.65, based on our current credit ratings. The new credit facility

contains various covenants that are substantially similar to the old

credit facility, including a financial covenant which requires Avon’s

interest coverage ratio (determined in relation to our consolidated

pretax income and interest expense) to equal or exceed 4:1.