Avon 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS

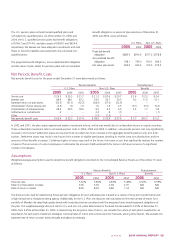

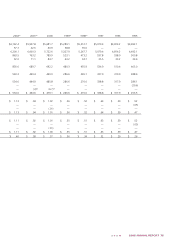

Special Charges – Third Quarter 2002

In 2002, we recorded Special charges of $43.6 pretax primar-

ily associated with supply chain initiatives, workforce reduction

programs and sales transformation initiatives. While project plans

associated with these initiatives did not change, we experienced

favorable adjustments to our original cost estimates. As a result,

we reversed pretax amounts totaling $.9, $.7 and $1.8 in 2005,

2004 and 2003, respectively, in the marketing, distribution and

administrative line in the Consolidated Statements of Income. The

favorable adjustments in 2003 primarily relate to certain employees

pursuing reassignments to other locations and favorable contract

termination negotiations, partially offset by higher than expected

severance costs for certain initiatives. The favorable adjustments in

2004 primarily related to lower than expected spending in Europe.

The favorable adjustments in 2005 primarily related to govern-

ment regulations in Venezuela that prohibited us from terminating

employees, as well as lower than expected spending in Europe.

There was no remaining liability at December 31, 2005.

14

CONTINGENCIES

We are a defendant in an action commenced in 1975 in the

Supreme Court of the State of New York by Sheldon Solow d/b/a

Solow Building Company (“Solow”), the landlord of our former

headquarters in New York City. Solow alleges that we misappro-

priated the name of our former headquarters building and seeks

damages based on a purported value of one dollar per square foot

of leased space over the term of the lease. A trial of this action

took place in May 2005 and, in January 2006, the judge issued a

decision in our favor. The plaintiff has not yet indicated whether

he intends to appeal the decision of the trial judge. While it is

not possible to predict the outcome of litigation, management

believes that there are meritorious defenses to the claims asserted

and that this action should not have a material adverse effect on

our consolidated financial position, results of operations or cash

flows. This action is being vigorously contested.

Blakemore, et al. v. Avon Products, Inc., et al. is a purported class

action pending in the Superior Court of the State of California

on behalf of Avon Sales Representatives who “since March 24,

1999, received products from Avon they did not order, there-

after returned the unordered products to Avon, and did not

receive credit for those returned products.” The complaint seeks

unspecified compensatory and punitive damages, restitution and

injunctive relief for alleged unjust enrichment and violation of

the California Business and Professions Code. This action was

commenced in March 2003. We filed demurrers to the original

complaint and three subsequent amended complaints, asserting

that they failed to state a cause of action. The Superior Court

sustained our demurrers and dismissed plaintiffs’ causes of action

except for the unjust enrichment claim of one plaintiff. The court

also struck plaintiffs’ class allegations. Plaintiffs sought review of

these decisions by the Court of Appeal of the State of California

and, in May 2005, the Court of Appeal reinstated the dismissed

causes of action and the class allegations. In January 2006, we

filed a motion to strike the plaintiffs’ asserted nationwide class.

In February 2006, the trial court declined to grant our motion but

instead certified the issue to the Court of Appeal on an interlocu-

tory basis. We believe that this action is a dispute over purported

customer service issues and is an inappropriate subject for con-

sideration as a class action. While it is not possible to predict the

outcome of litigation, management believes that there are meri-

torious defenses to the claims asserted and that this action should

not have a material adverse effect on our consolidated financial

position, results of operations or cash flows. This action

is being vigorously contested.

In December 2002, our Brazilian subsidiary received a series of

excise and income tax assessments from the Brazilian tax authorities

asserting that the establishment in 1995 of separate manufactur-

ing and distribution companies in that country was done without

a valid business purpose. The assessments assert tax deficiencies

during portions of the years 1997 and 1998 of approximately $89.0

at the exchange rate on December 31, 2005, plus penalties and

accruing interest totaling approximately $163.0 at the exchange

rate on December 31, 2005. In July 2003, a first-level appellate

body rejected the basis for income tax assessments representing

approximately 77% of the total assessment, or $194.0 (including

interest). In March 2004, that rejection was confirmed in a manda-

tory second-level appellate review. The remaining assessments

relating to excise taxes (approximately $57.0) were not affected. In

December 2003, an additional assessment was received in respect

of excise taxes for the balance of 1998, totaling approximately

$106.0 at the exchange rate on December 31, 2005, and asserting

a different theory of liability based on purported market sales data.

In January 2005, an unfavorable first administrative level decision

was received with respect to the appeal of that assessment and a

further appeal has been taken. In December 2004, an additional

assessment was received in respect of excise taxes for the period

from January 1999 to December 2001, totaling approximately

$228.0 at the exchange rate on December 31, 2005, and asserting

the same theory of liability as in the December 2003 assessment.

We appealed that assessment. In September 2005, an unfavor-

able first administrative level decision was received with respect

to the appeal of the December 2004 assessment, and a further

appeal is being taken. In the event that assessments are upheld in

the earlier stages of review, it may be necessary for us to provide

security to pursue further appeals, which, depending on the

circumstances, may result in a charge to income. It is not possible