Avon 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT43

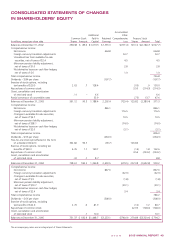

Accumulated

Additional Other

Common Stock Paid-In Retained Comprehensive Treasury Stock

In millions, except per share data Shares Amount Capital Earnings Loss Shares Amount Total

Balances at December 31, 2002 358.38 $ 89.6 $1,019.5 $1,735.3 $(791.4) 123.12 $(2,180.7) $(127.7)

Comprehensive income:

Net income 664.8 664.8

Foreign currency translation adjustments 53.7 53.7

Unrealized loss from available-for-sale

securities, net of taxes of $2.4 4.5 4.5

Minimum pension liability adjustment,

net of taxes of $1.0 2.8 2.8

Net derivative losses on cash flow hedges,

net of taxes of $.6 1.0 1.0

Total comprehensive income 726.8

Dividends – $.84 per share (197.7) (197.7)

Exercise of stock options, including

tax benefits of $29.5 2.63 .7 128.4 (.05) .9 130.0

Repurchase of common stock 3.50 (214.3) (214.3)

Grant, cancellation and amortization

of restricted stock .11 – 6.6 6.6

Partial conversion of convertible notes 33.9 (.75) 13.7 47.6

Balances at December 31, 2003 361.12 90.3 1,188.4 2,202.4 (729.4) 125.82 (2,380.4) 371.3

Comprehensive income:

Net income 846.1 846.1

Foreign currency translation adjustments 116.5 116.5

Changes in available-for-sale securities,

net of taxes of $5.7 10.5 10.5

Minimum pension liability adjustment,

net of taxes of $58.1 (74.0) (74.0)

Net derivative losses on cash flow hedges,

net of taxes of $2.0 (3.1) (3.1)

Total comprehensive income 896.0

Dividends – $.56 per share (264.3) (264.3)

Two-for-one stock split effected in the form

of a dividend (Note 9) 362.82 90.7 (90.7) 126.86

Exercise of stock options, including tax

benefits of $40.3 4.35 1.1 159.7 (.16) 1.8 162.6

Repurchase of common stock 4.56 (224.2) (224.2)

Grant, cancellation and amortization

of restricted stock .32 .1 8.7 8.8

Balances at December 31, 2004 728.61 182.2 1,356.8 2,693.5 (679.5) 257.08 (2,602.8) 950.2

Comprehensive income:

Net income 847.6 847.6

Foreign currency translation adjustments (42.9) (42.9)

Changes in available-for-sale securities,

net of taxes of $.9 (1.8) (1.8)

Minimum pension liability adjustment,

net of taxes of $19.7 (20.1) (20.1)

Net derivative losses on cash flow hedges,

net of taxes of $2.4 3.4 3.4

Total comprehensive income 786.2

Dividends – $.66 per share (308.0) (308.0)

Exercise of stock options, including

tax benefits of $22.4 2.76 .6 81.9 (.12) 1.2 83.7

Repurchase of common stock 22.93 (728.0) (728.0)

Grant, cancellation and amortization

of restricted stock .1 10.0 10.1

Balances at December 31, 2005 731.37 $ 182.9 $1,448.7 $3,233.1 $(740.9) 279.89 $(3,329.6) $ 794.2

The accompanying notes are an integral part of these statements.

CONSOLIDATEDSTATEMENTSOFCHANGES

INSHAREHOLDERS’EQUITY