Avon 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT37

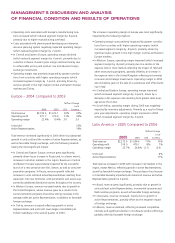

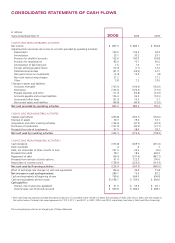

Debt and Contractual Financial Obligations and Commitments

At December 31, 2005, our debt and contractual financial obligations and commitments by due dates were as follows:

2011 and

2006 2007 2008 2009 2010 Beyond Total

Short-term debt (1) $ 877.6 $ – $ – $ – $ – $ – $ 877.6

Long-term debt (1) – 100.0 – 300.0 – 375.0 775.0

Capital lease obligations 4.9 3.6 3.5 .2 .1 – 12.3

Total debt 882.5 103.6 3.5 300.2 .1 375.0 1,664.9

Debt-related interest 30.5 25.8 21.7 21.5 – – 99.5

Total debt-related 913.0 129.4 25.2 321.7 .1 375.0 1,764.4

Operating leases 86.1 69.1 55.9 39.9 33.6 85.1 369.7

Purchase obligations 190.3 75.8 39.2 39.2 35.2 – 379.7

Benefit payments 107.9 109.5 113.1 118.4 119.3 598.0 1,166.2

Total debt and contractual financial

obligations and commitments (2) $ 1,297.3 $ 383.8 $ 233.4 $ 519.2 $ 188.2 $ 1,058.1 $ 3,680.0

(1) Amounts for debt do not include the $500.0 principal amount of notes payable issued in January 2006 (see Note 19, Subsequent Events).

(2) The amount of debt and contractual financial obligations and commitments excludes amounts due pursuant to derivative transactions. The table also excludes infor-

mation on recurring purchases of inventory as these purchase orders are non-binding, are generally consistent from year to year, and are short-term in nature.

See Note 4, Debt and Other Financing, and Note 12, Leases and Commitments, for further information on our debt and contractual financial

obligations and commitments. Additionally, as disclosed in Note 13, Restructuring Initiatives, we have a remaining liability of $29.2 associated

with the restructuring charges recorded during the fourth quarter of 2005, and we also expect to record additional restructuring expenses of

$3.8 during 2006 to implement the actions for which charges were recorded during the fourth quarter of 2005. The significant majority of

these liabilities will require cash payments during 2006.

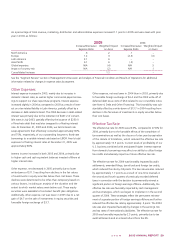

Off Balance Sheet Arrangements

At December 31, 2005, we had no material off-balance-sheet

arrangements.

Capital Resources

Total debt at December 31, 2005 increased $731.0 to $1,649.0

from $918.0 at December 31, 2004, primarily due to commercial

paper borrowings (see Note 4, Debt and Other Financing).

As of December 31, 2005, we had a five-year, $600.0 revolving

credit and competitive advance facility (the “old credit facility”),

which was due to expire in May, 2006. On August 23, 2005, we

entered into credit agreements with Bank of America, N.A. and

Citibank, N.A., under which each bank provided a $200.0 revolving

credit facility (together the “bridge credit facilities”) which were

due to expire on August 22, 2006. At December 31, 2005, there

were no borrowings outstanding under the old credit facility or the

bridge credit facilities and we were in compliance with all covenants

under the old credit facility and bridge credit facilities. Following our

issuance, in January, 2006 of $500.0 of long-term bonds (see Note

19, Subsequent Events), the bridge credit facilities terminated in

accordance with their terms.

On January 13, 2006, we entered into a five-year $1,000.0

revolving credit and competitive advance facility (the “new credit

facility”), and simultaneously terminated the old credit facility. The

new credit facility may be used for general corporate purposes.

The interest rate on borrowings under the new credit facility is

based on LIBOR or on the higher of prime or ½% plus the federal

funds rate. The new credit facility contains covenants, which are

customary for financings of this type, including, among other

things, limits on the incurrence of liens and a minimum interest

coverage ratio. The new credit facility also provides for a possible

extension of the term by up to two years and possible increases by

up to an aggregate incremental principal amount of $250.0, sub-

ject to the consent of the affected lenders under the credit facility.

Net cash used by investing

activities in 2005 was $63.7

higher than in 2004 resulting

primarily from the 2005 pur-

chase of the Avon direct selling

business from our licensee

in Colombia for $154.0.