Avon 2005 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT33

Latin America operating margin declined due to an unfavorable

expense ratio of 2.1 points, mainly affected by increased fixed

expenses, primarily salaries, and costs related to the implementa-

tion of restructuring initiatives. Gross margin was consistent with

the prior year as benefits from supply chain efficiencies were

offset by the impacts of unfavorable pricing and product mix and

higher obsolescence expense. Operating margin was also nega-

tively impacted by lower contributions from countries with higher

operating margins (which decreased segment margin by .7 point),

primarily driven by lower revenues in Mexico.

In Mexico, operating margin decreased (which decreased segment

margin by 1.3 points), primarily driven by a higher expense ratio due

to lower revenue, higher administrative expenses, costs to imple-

ment organization restructuring initiatives, and increased consumer

related investments, partially offset by a gain on the sale of prop-

erty. Additionally, operating margin was impacted by a lower gross

margin resulting primarily from an unfavorable mix of products sold,

higher obsolescence expense and pricing investments.

In February 2004, the Venezuelan government devalued the

Venezuelan bolivar (“VEB”) from 1598 to 1918 VEB for one U.S.

dollar. The currency remained stable for the remainder of 2004 but,

in February 2005, the Venezuelan government again devalued the

official exchange rate to 2150 VEB for one U.S. dollar. The currency

restrictions enacted by the Venezuelan government in 2003 limit

the ability of our subsidiary in Venezuela (“Avon Venezuela”) to

obtain foreign currency at the official rate to pay for imported

products. The lack of foreign currency has required Avon Venezuela

to rely on parent company support in order to continue importing a

portion of its material for its operations. Avon Venezuela’s results of

operations in U.S. dollars have been and are expected to continue

to be negatively impacted until foreign currency is made readily

available to importers. In spite of the difficulty in obtaining foreign

currency for imports, in 2004, Avon Venezuela remitted dividends

and royalties to its parent company at the official exchange rate. At

December 31, 2005, Avon Venezuela had cash balances of approxi-

mately $89.0, of which a significant portion is awaiting government

approval for remittance.

We use the official rate to translate the financial statements of Avon

Venezuela into U.S. dollars. In 2005, Avon Venezuela’s revenue and

operating profit represented approximately 3% and 6% of consoli-

dated revenue and consolidated operating profit, respectively.

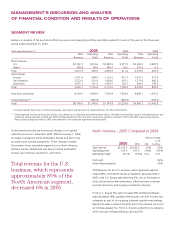

Latin America – 2004 Compared to 2003

%/Point Change

Local

2004 2003 US$ Currency

Total revenue $1,934.6 $1,717.9 13% 14%

Operating profit 479.1 406.3 18% 21%

Operating margin 24.8% 23.7% 1.1 1.1

Units sold 11%

Active Representatives 11%

Total revenue increased in 2004 with increases in nearly all

markets in the region, reflecting growth in units sold and active

Representatives, partially offset by the negative impact of foreign

exchange, primarily in Venezuela and Mexico.

• In Brazil, revenue increased, primarily reflecting an increase in

units sold and active Representatives, driven by field sales incen-

tive programs and new product launches, as well as favorable

foreign exchange.

• In Venezuela, revenue increased significantly, primarily due to

growth in units sold and active Representatives, partially offset

by the negative impact of foreign exchange. Revenue also ben-

efited from field sales incentive programs and higher prices.

• In Argentina, revenue increased significantly, driven by growth

in active Representatives and units sold, reflecting new product

launches and consumer incentive programs.

• In Mexico, revenue increased, driven by growth in units sold and

active Representatives, almost entirely offset by the negative

impact of foreign exchange. Revenue benefited from new prod-

uct launches and field sales incentive programs.

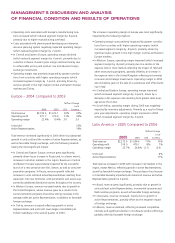

In Latin America, total

revenue increased in 2005

with increases in all markets

in the region, except Mexico.

The purchase of our licensee in

Colombia favorably impacted

the region’s revenue growth

by 2 points.