Avon 2005 Annual Report Download - page 24

Download and view the complete annual report

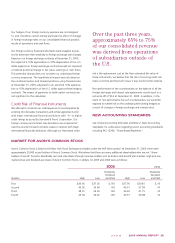

Please find page 24 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS

In millions, except per share and share data.

1DESCRIPTIONOFTHEBUSINESS

ANDSUMMARYOFSIGNIFICANT

ACCOUNTINGPOLICIES

Business

We are a global manufacturer and marketer of beauty and

related products. Our business is conducted worldwide primarily

in one channel, direct selling. Our reportable segments are based

on geographic operations in four regions: North America, Europe,

Latin America and Asia Pacific. In December 2005, we announced

changes to our global operating structure. Effective January 1,

2006, we began managing operations in Central and Eastern

Europe and also China as stand-alone operating segments, and

we began centrally managing Brand Marketing and the Supply

Chain. These changes increase the number of operating seg-

ments to six. Sales are made to the ultimate customers principally

by independent Avon Representatives. Product categories include

Beauty, which consists of cosmetics, fragrances, skin care and

toiletries; Beauty Plus, which consists of fashion jewelry, watches,

apparel and accessories; and Beyond Beauty, which consists of

home products and gift and decorative products. Sales from Health

and Wellness and mark. are included among these three categories

based on product type.

Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts

of Avon and our majority and wholly-owned subsidiaries.

Intercompany balances and transactions are eliminated.

Use of Estimates

The preparation of financial statements in conformity with gener-

ally accepted accounting principles in the U.S. requires us to make

estimates and assumptions that affect the reported amounts

of assets and liabilities, the disclosure of contingent assets and

liabilities at the date of the financial statements and the reported

amounts of revenues and expenses during the reporting period.

Actual results could differ materially from those estimates and

assumptions. On an ongoing basis, we review our estimates,

including those related to restructuring reserves, allowances for

doubtful accounts receivable, allowances for sales returns, provi-

sions for inventory obsolescence, income taxes and tax valuation

reserves, stock-based compensation, loss contingencies, and the

determination of discount rate and other actuarial assumptions for

pension, postretirement and postemployment benefit expenses.

Foreign Currency

Financial statements of foreign subsidiaries operating in other

than highly inflationary economies are translated at year-end

exchange rates for assets and liabilities and average exchange

rates during the year for income and expense accounts. The result-

ing translation adjustments are recorded within accumulated other

comprehensive loss. Financial statements of subsidiaries operating

in highly inflationary economies are translated using a combina-

tion of current and historical exchange rates and any translation

adjustments are included in current earnings.

Financial statement translation of subsidiaries operating in highly

inflationary economies and foreign currency transactions resulted

in net losses of $0, $9.5 and $15.9 in 2005, 2004 and 2003,

respectively, which are included in other expense, net. Included

in these amounts are transaction losses of $.2, $2.6 and $2.8

in 2005, 2004 and 2003, respectively, related to U.S. dollar-

denominated assets.

Revenue Recognition

Net sales primarily include sales generated as a result of

Representative orders less any discounts, taxes and other deduc-

tions. We recognize revenue upon delivery, when both title and

the risks and rewards of ownership pass to the independent

Representatives, who are our customers. Our internal financial

systems accumulate revenues as orders are shipped to the

Representative. Since we report revenue upon delivery, revenues

recorded in the financial system must be reduced for an estimate

of the financial impact of those orders shipped but not deliv-

ered at the end of each reporting period. We use estimates in

determining the adjustments to revenue and operating profit for

orders that have been shipped but not delivered as of the end of

the period. These estimates are based on daily sales levels, delivery

lead times, gross margin and variable expenses. We also estimate

We are a global manufacturer

and marketer of beauty and

related products. Our business

is conducted worldwide

primarily in one channel,

direct selling.