Avon 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT39

Our hedges of our foreign currency exposure are not designed

to, and, therefore, cannot entirely eliminate the effect of changes

in foreign exchange rates on our consolidated financial position,

results of operations and cash flows.

Our foreign-currency financial instruments were analyzed at year-

end to determine their sensitivity to foreign exchange rate changes.

Based on our foreign exchange contracts at December 31, 2005,

the impact of a 10% appreciation or 10% depreciation of the U.S.

dollar against our foreign exchange contracts would not represent

a material potential change in fair value, earnings or cash flows.

This potential change does not consider our underlying foreign

currency exposures. The hypothetical impact was calculated on

the combined option and forward positions using forward rates

at December 31, 2005, adjusted for an assumed 10% apprecia-

tion or 10% depreciation of the U.S. dollar against these hedging

contracts. The impact of payments to settle option contracts are

not significant to this calculation.

Credit Risk of Financial Instruments

We attempt to minimize our credit exposure to counterparties by

entering into derivative transactions and similar agreements only

with major international financial institutions with “A” or higher

credit ratings as issued by Standard & Poor’s Corporation. Our

foreign currency and interest rate derivatives are comprised of

over-the-counter forward contracts, swaps or options with major

international financial institutions. Although our theoretical credit

risk is the replacement cost at the then estimated fair value of

these instruments, we believe that the risk of incurring credit risk

losses is remote and that such losses, if any, would not be material.

Non-performance of the counterparties on the balance of all the

foreign exchange and interest rate agreements would result in a

net write-off of $5.2 at December 31, 2005. In addition, in the

event of non-performance by such counterparties, we would be

exposed to market risk on the underlying items being hedged as

a result of changes in foreign exchange and interest rates.

NEWACCOUNTINGSTANDARDS

See Critical Accounting Estimates and Note 2, New Accounting

Standards, for a discussion regarding recent accounting standards,

including FAS 123(R), “Share-Based Payments.”

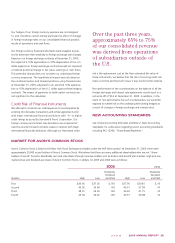

Over the past three years,

approximately 65% to 75%

of our consolidated revenue

was derived from operations

of subsidiaries outside of

the U.S.

MARKETFORAVON’SCOMMONSTOCK

Avon’s Common Stock is listed on the New York Stock Exchange and trades under the AVP ticker symbol. At December 31, 2005, there were

approximately 20,000 record holders of Avon’s Common Stock. We believe that there are many additional shareholders who are not “share-

holders of record” but who beneficially own and vote shares through nominee holders such as brokers and benefit plan trustees. High and low

market prices and dividends per share of Avon’s Common Stock, in dollars, for 2005 and 2004 were as follows:

2005 2004

Dividends Dividends

Declared Declared

Quarter High Low and Paid High Low and Paid

First $45.66 $37.30 $.165 $37.95 $30.81 $.14

Second 45.02 35.64 .165 46.31 37.58 .14

Third 38.01 26.30 .165 46.65 41.75 .14

Fourth 29.94 24.22 .165 44.37 36.08 .14