Avon 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT35

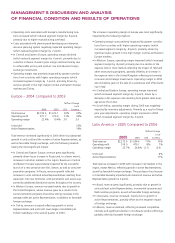

• In China, revenue increased primarily due to growth in units

sold driven by advertising and consumer promotion programs,

as well as growth in the number of and increased activity at

the Beauty Boutiques.

• In Australia and Taiwan, revenue increased primarily due to growth

in active Representatives as well as favorable foreign exchange.

• In Malaysia, revenue increased mainly due to benefits associated

with the 2003 reorganization of sales branches in that country.

The increase in operating margin in Asia Pacific was most signifi-

cantly impacted by the following markets:

• In China, operating margin improved (which increased seg-

ment margin by .6 point) reflecting a higher gross margin

benefiting from savings associated with supply chain Business

Transformation initiatives.

• In Malaysia, operating margin improved (which increased seg-

ment margin by .5 point) primarily due to benefits associated

with the 2003 reorganization of sales branches in that country

and the resulting leverage achieved from this reorganization.

• In Australia, operating margin improved (which increased seg-

ment margin by .5 point) primarily due to a higher gross margin,

reflecting favorable foreign exchange on inventory purchases.

• In Japan, operating margin improved (which increased segment

margin by .4 point), resulting primarily from an increase in gross

margin driven by savings associated with supply chain Business

Transformation initiatives, partially offset by higher expenses

associated with customer acquisition programs.

In addition, expenses in the region included strategic investments

in organization capacity (which decreased segment margin by

1.0 point).

We have operations in four of the countries (India, Indonesia,

Malaysia and Thailand) that were affected by the December 2004

tsunami and earthquake in Southeast Asia. The earthquake and

tsunami did not have a material impact on property or 2004 or

2005 operating profit.

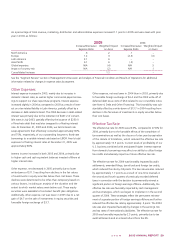

Global Expenses

Global expenses decreased $5.0 in 2005, primarily due to lower

expense for performance-based compensation plans, partially

offset by costs for organization downsizing, under our restructur-

ing initiatives.

Global expenses increased $66.5 in 2004 primarily due to higher

bonus and benefit-related accruals of approximately $25.0, higher

professional fees and expenses of $22.4 (including $6.2 related to

the settlement of one Solow lawsuit, see Note 14, Contingencies)

and incremental investments of $15.4 for research and develop-

ment, and marketing.

LIQUIDITYANDCAPITALRESOURCES

Our principal sources of funds historically have been cash flows

from operations, commercial paper and borrowings under lines of

credit. We currently believe that cash from operations (including

the impacts of cash required for restructuring initiatives) and avail-

able sources of public and private financing are adequate to meet

anticipated requirements for working capital, dividends, capital

expenditures, the stock repurchase program, possible acquisitions

and other cash needs.

Balance Sheet Data

2005 2004

Cash and cash equivalents $1,058.7 $ 769.6

Total debt 1,649.0 918.0

Working capital 419.3 896.9

Cash Flows

2005 2004 2003

Net cash provided by

operating activities $ 895.5 $ 882.6 $ 745.3

Net cash used by

investing activities (343.1) (279.4) (178.4)

Net cash used by

financing activities (226.7) (567.0) (495.5)

Effect of exchange rate

changes on cash

and equivalents (36.6) 39.4 15.8

In late February 2006, Avon

was granted a direct selling

license by China’s Ministry

of Commerce. That license

will allow Avon to commence

direct selling in China under

the regulations issued by that

government in late 2005.