Avon 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’SDISCUSSIONANDANALYSIS

OFFINANCIALCONDITIONANDRESULTSOFOPERATIONS

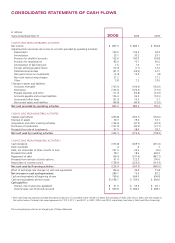

Net Cash Provided by Operating Activities

Net cash provided by operating activities in 2005 was $12.9

favorable to 2004 principally reflecting higher net income

(adjusted for non-cash items) and lower income tax audit settle-

ment payments ($71.2 in 2004 versus $12.5 in 2005) offset by

increased inventory levels.

Additionally, operating cash flow was favorably impacted by the

timing of accounts payable payments and unfavorably affected

by higher contributions of approximately $21.0 to the U.S. and

international pension plans in 2005 (approximately $162.0 in

2005 versus $141.0 in 2004) and lower accruals for perfor-

mance-based compensation.

We maintain defined benefit pension plans and unfunded supple-

mental pension benefit plans (see Note 10, Employee Benefit Plans).

Our funding policy for these plans is based on legal requirements

and cash flows. The amounts necessary to fund future obligations

under these plans could vary depending on estimated assumptions

(as detailed in “Critical Accounting Estimates”). The future funding

for these plans will depend on economic conditions, employee

demographics, mortality rates, the number of associates electing to

take lump-sum distributions, investment performance and funding

decisions. Based on current assumptions, we expect to contribute

approximately $89.0 and $42.0 to our U.S. and international pen-

sion plans, respectively, in 2006.

Inventories of $801.7 at December 31, 2005, were higher than

$740.5 at December 31, 2004. Inventory days were 97 days at

December 31, 2005, up from 93 days at December 31, 2004.

Our objective is to increase our focus on inventory management.

However, the addition or expansion of product lines, which are

subject to changing fashion trends and consumer tastes, as well as

planned expansion in high growth markets, may cause inventory

levels to grow periodically.

Net Cash Used by Investing Activities

Net cash used by investing activities in 2005 was $63.7 higher than

in 2004 resulting primarily from the 2005 purchase of the Avon

direct selling business from our licensee in Colombia for $154.0.

2004 included the purchase of a portion of the ownership interest

in our subsidiary in China for $45.6.

Capital expenditures during 2005 were $206.8 compared with

$250.1 in 2004. The decrease in capital spending was primarily

driven by investments in 2004 for a new manufacturing facility in

Russia and the construction of a new research and development

facility in the U.S., partially offset by spending in 2005 for an enter-

prise resource planning (“ERP”) system. Numerous construction

and information systems projects were in progress at December 31,

2005, with an estimated cost to complete of approximately $92.3.

Capital expenditures in 2006 are currently expected to be approxi-

mately $235.0 and will be funded by cash from operations. These

expenditures will include continued investments for cost reductions,

capacity expansion, and information systems (including the contin-

ued development of the ERP system).

In November 2005, we entered into an agreement to purchase

the remaining 6.155% of the outstanding shares in our two joint

venture subsidiaries in China from a minority interest shareholder,

for approximately $39.0. We expect to consummate the transaction

in the first quarter 2006, subject to the approval and registration of

the transaction by appropriate government authorities in China.

Net Cash Used by Financing Activities

Net cash used by financing activities in 2005 was $340.3 lower than

in 2004, mainly driven by higher commercial paper borrowings, par-

tially offset by higher repurchases of common stock, lower proceeds

from stock option exercises, and higher dividend payments.

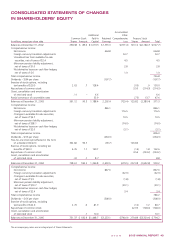

We purchased approximately 22.9 million shares of Avon com-

mon stock for $728.0 during 2005, as compared to approximately

5.7 million shares of Avon common stock for $224.2 during 2004

under our previously announced share repurchase programs and

through acquisition of stock from employees in connection with

tax payments upon vesting of restricted stock.

In September 2000, our Board approved a share repurchase pro-

gram for $1,000.0 of our outstanding stock over a five-year period.

This program was completed in August 2005. In February 2005,

we announced that we would begin a new five-year, $1,000.0

share repurchase program upon completion of the September 2000

share repurchase program. In August 2005, we announced that

our Board of Directors authorized us to repurchase an additional

$500.0 of our common stock. This $500.0 program was completed

in December 2005.

In January 2005, our Board approved an increase in the quarterly

dividend to $.165 per share from $.14. Dividends of $.66 per

share were declared and paid in 2005 as compared to $.56 per

share in 2004. In January 2006, our Board approved an increase

in the quarterly dividend to $.175 per share.

Net cash provided by operating

activities reached $895.5 in

2005, $12.9 favorable to 2004.