Avon 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005ANNUALREPORT55

8LONG-TERM

INCENTIVEPLANS

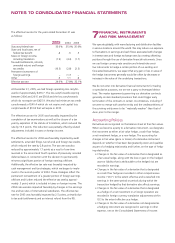

The Avon Products, Inc. 2005 Stock Incentive Plan (the “2005

Plan”) was adopted in March 2005. The 2005 Plan provides for sev-

eral types of equity-based incentive compensation awards including

stock options, stock appreciation rights, restricted stock, restricted

stock units and performance unit awards. Under the 2005 Plan, the

maximum number of shares that may be awarded is 31,000,000

shares, of which no more than 8,000,000 shares may be used for

restricted stock awards and restricted stock unit awards.

The Avon Products, Inc. 2000 Stock Incentive Plan (the “2000

Plan”) also provided for several types of equity-based incentive

compensation awards including stock options, stock apprecia-

tion rights, restricted stock, restricted stock units and performance

unit awards. Under the 2000 Plan, the maximum number of

shares that could be awarded was 36,500,000 shares, of which

no more than 12,000,000 shares may be used for restricted

stock awards. No additional awards will be made under the

2000 Plan.

Stock Options

Under the 2000 and 2005 Plans, stock options are awarded

annually and generally vest in thirds over the three-year period

following each option grant date. Stock options are granted at

a price no less than fair market value on the date the option is

granted and have a term of ten years from the date of grant.

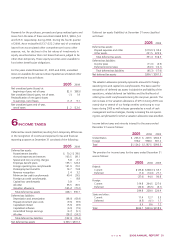

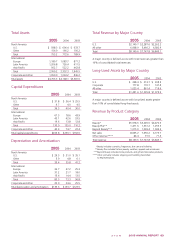

A summary of our stock option activity, weighted-average exercise

price and related information for the years ended December 31 is

as follows:

2005 2004 2003

Weighted- Weighted- Weighted-

Shares Average Shares Average Shares Average

(in 000’s) Price (in 000’s) Price (in 000’s) Price

Outstanding – beginning of year 20,196 $26.85 21,216 $ 22.52 22,686 $ 20.58

Granted 7,327 41.19 5,329 36.64 4,930 26.52

Exercised (Note 9) (2,881) 21.26 (6,035) 20.25 (5,364) 18.72

Forfeited (598) 36.28 (314) 27.26 (1,036) 18.64

Outstanding – end of year 24,044 $31.66 20,196 $ 26.85 21,216 $ 22.52

Options exercisable – end of year 12,302 $25.40 10,318 $ 21.96 11,408 $ 19.79

The following table summarizes information about stock options outstanding at December 31, 2005:

Options Outstanding Options Exercisable

Shares Average Average Shares Average

Exercise Prices (in 000’s) Price Term (in 000’s) Price

$9.88 – $19.96 2,184 $18.38 3 years 2,184 $18.38

$20.08 – $24.89 2,547 21.24 5 years 2,547 21.24

$25.69 – $31.26 7,446 26.55 7 years 5,838 26.53

$32.89 – $44.71 11,867 39.54 9 years 1,733 36.53

24,044 12,302

Restricted Stock and Restricted Stock Units

During 2005, 2004 and 2003, restricted stock and restricted stock

units with aggregate value and vesting periods were granted to

employees as follows: 2005 – 242,406 shares or units valued at

$9.0 generally vesting in three years; 2004 – 616,500 shares or

units valued at $21.3, generally vesting over three years; and

2003 – 220,500 shares or units valued at $5.7, generally vesting

over three years.

Compensation expense related to grants of restricted stock or

restricted stock units to employees was $9.8 in 2005 (2004 – $8.6;

2003 – $6.4). The unamortized cost of restricted stock and restricted

stock units as of December 31, 2005, was $15.9 (2004 – $17.2)

and was included in Additional paid-in capital.

2005-2007 Performance Cash Plan

In 2005, we established a three-year performance cash plan for

the period 2005-2007 (the “Plan”). Awards were set with the

objective of payouts ranging from 30% of target for the achieve-

ment of threshold financial objectives aligned with our long-term

business plan to 200% of target if maximum performance objec-

tives are achieved. The Compensation Committee of the Board of

Directors has designated total revenues and operating margin as

the key performance measures under the Plan. If the objectives

under the Plan are achieved, total cash payments in the range of

approximately $9 to $57 would be made in the first quarter of

2008. However, management has determined that the likelihood

of achieving the objectives is remote and, therefore, no expense

has been recognized during 2005.