Avon 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

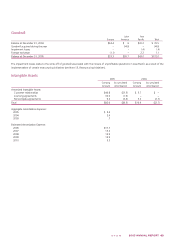

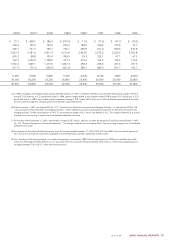

During the fourth quarter of 2004, we recorded a write-down of

$13.7 ($12.2 after tax) resulting from declines in the fair values of

investments in equity securities below their cost bases that were

judged to be other-than-temporary. These equity securities are

available to fund select benefit plan obligations.

19

SUBSEQUENTEVENTS

On January 26, 2006, we announced an increase in our quarterly

cash dividend to $.175 per share from $.165 per share. The first

dividend at the new rate will be paid on March 1, 2006, to share-

holders of record on February 14, 2006. With this increase, the

indicated annual dividend rate is $.70 per share.

In January 2006, we issued in a public offering $500.0 principal

amount of notes payable that mature on January 15, 2011, and

bear interest, payable semi-annually, at a per annum rate equal

to 5.125%. The net proceeds from the offering were used for

general corporate purposes, including the repayment of short-

term debt.

In January 2006, we entered into a five-year $1,000.0 revolving

credit and competitive advance facility (the “new credit facility”),

and simultaneously terminated the old credit facility. The new credit

facility may be used for general corporate purposes. The interest

rate on borrowings under the new credit facility is based on LIBOR

or on the higher of prime or ½% plus the federal funds rate.

On January 26, 2006, we

announced an increase in our

quarterly cash dividend to

$.175 per share from $.165

per share. With this increase,

the indicated annual dividend

rate is $.70 per share.

2005ANNUALREPORT71