Avon 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Management’s Discussion and

Analysis of Financial Condition

and Results of Operations

22

Cautionary Statement

23

Overview

24

Critical Accounting Estimates

27

Results of Operations –

Consolidated

30

Segment Review

35

Liquidity and Capital Resources

38

Risk Management Strategies

and Market Rate Sensitive

Instruments

39

Market For Avon’s Common Stock

40

Consolidated Statements

of Income

41

Consolidated Balance Sheets

42

Consolidated Statements of

Cash Flows

43

Consolidated Statements of

Changes in Shareholders’ Equity

44

Notes to Consolidated

Financial Statements

72

Report of Management on Internal

Control Over Financial Reporting

73

Report of Independent Registered

Public Accounting Firm

74

Eleven-Year Review

C o n t e n t s

2005ANNUALREPORT21

Table of contents

-

Page 1

... of Independent Registered Public Accounting Firm Overview Risk Management Strategies and Market Rate Sensitive Instruments Consolidated Statements of Changes in Shareholders' Equity Eleven-Year Review Critical Accounting Estimates 39 40 Market For Avon's Common Stock Notes to Consolidated... -

Page 2

... to implement the key initiatives of our global business strategy, including our multi-year restructuring initiatives, product mix and pricing strategies, enterprise resource planning, and cash management, tax, foreign currency hedging and risk management strategies, and our ability to achieve... -

Page 3

... utilizing pricing and promotion, expanding our Sales Leadership program and improving the attractiveness of our Representative earnings opportunity as needed. • Elevating organization effectiveness by redesigning our structure to eliminate layers of management to take full advantage of our global... -

Page 4

... charges previously recorded directly to shareholders' equity and professional service fees related to these initiatives. Speciï¬c actions for this initial phase of our multi-year restructuring plan include: • organization realignment and downsizing in each region and global through a process... -

Page 5

...the U.S. The Representative purchases products directly from Avon and may or may not sell them to an end user. In general, the Representative, an independent contractor, remits a payment to Avon each sales campaign, which relates to the prior campaign cycle. The Representative is generally precluded... -

Page 6

... grants of stock-based awards, utilizing the modiï¬ed prospective method (see Note 2, New Accounting Standards). The impact of the adoption of FAS 123(R) will depend on levels of share-based payments granted in the future. Rate of return on assets Discount rate Rate of compensation increase Taxes... -

Page 7

... attributable primarily to unfavorable product mix and a decline in revenues. Additionally, gross margin included charges of $8.4 for inventory write-offs related to our restructuring initiatives. Gross margin improved .7 point in 2004 due to increases in our Latin American, European, and Asia Paci... -

Page 8

... partially offset by incremental net savings from workforce reduction programs associated with our supply chain initiatives that began in 2001, and have subsequently been completed, of approximately $45.0 in 2004 and a favorable comparison to 2003, which included costs from severance and asset write... -

Page 9

... year by expiration of the statute of limitations, which reduced the effective tax rate by approximately 10.5 points. Current levels of proï¬tability of our U.S. business combined with anticipated higher interest expense from domestic borrowings may affect our ability to utilize foreign tax credits... -

Page 10

... Rico, Dominican Republic, Avon Salon and Spa and U.S. Retail (see Note 16, Other Information). ** Global expenses include, among other things, costs related to our executive and administrative ofï¬ces, information technology, research and development, and marketing. Global expenses in 2004 and... -

Page 11

... programs in the ï¬rst quarter of 2004, • repositioning costs related to Beyond Beauty, speciï¬cally inventory write-offs for toys, and • higher costs for fuel, warehousing and storage. The declines were partially offset by higher Representative fees and a favorable mix of products sold... -

Page 12

... of a new personal care line, Senses, as well as consumer promotion programs. In Russia, revenue growth reï¬,ected increases in units sold and active Representatives resulting from expansion into new territories, with penetration and access supported by additional distribution points throughout the... -

Page 13

...of foreign exchange. Revenue also beneï¬ted from ï¬eld sales incentive programs and higher prices. • In Argentina, revenue increased signiï¬cantly, driven by growth in active Representatives and units sold, reï¬,ecting new product launches and consumer incentive programs. • In Mexico, revenue... -

Page 14

... in gross margin, reï¬,ecting savings associated with supply chain initiatives and the impact of a sales tax reform in 2004, which allows Avon Brazil to receive tax credits on inventory purchases. • In Mexico, operating margin decreased (which decreased segment margin by .5 point) primarily due to... -

Page 15

...units sold driven by advertising and consumer promotion programs, as well as growth in the number of and increased activity at the Beauty Boutiques. • In Australia and Taiwan, revenue increased primarily due to growth in active Representatives as well as favorable foreign exchange. • In Malaysia... -

Page 16

...our Board approved an increase in the quarterly dividend to $.175 per share. Net Cash Used by Investing Activities Net cash used by investing activities in 2005 was $63.7 higher than in 2004 resulting primarily from the 2005 purchase of the Avon direct selling business from our licensee in Colombia... -

Page 17

... to the consent of the affected lenders under the credit facility. Net cash used by investing activities in 2005 was $63.7 higher than in 2004 resulting primarily from the 2005 purchase of the Avon direct selling business from our licensee in Colombia for $154.0. 2005฀ANNUAL฀REPORT฀฀37 -

Page 18

... that date, sustained for one year, would not represent a material potential change in fair value, earnings or cash ï¬,ows. This potential change was calculated based on discounted cash ï¬,ow analyses using interest rates comparable to our current cost of debt. RISK฀MANAGEMENT฀STRATEGIES฀ AND... -

Page 19

... and Note 2, New Accounting Standards, for a discussion regarding recent accounting standards, including FAS 123(R), "Share-Based Payments." MARKET฀FOR฀AVON'S฀COMMON฀STOCK Avon's Common Stock is listed on the New York Stock Exchange and trades under the AVP ticker symbol. At December 31... -

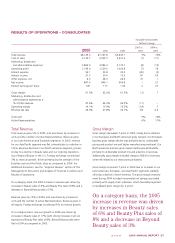

Page 20

...except per share data Years ended December 31 Net sales Other revenue Total revenue Costs, expenses and other: Cost of sales Marketing, distribution and administrative expenses Operating proï¬t Interest expense Interest income Other expense, net Total other expenses Income before taxes and minority... -

Page 21

..., plant and equipment, at cost Land Buildings and improvements Equipment Less accumulated depreciation Other assets Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Debt maturing within one year Accounts payable Accrued compensation Other accrued liabilities Sales and taxes... -

Page 22

... stock Net cash used by ï¬nancing activities Effect of exchange rate changes on cash and equivalents Net increase in cash and equivalents Cash and equivalents at beginning of year Cash and equivalents at end of year Cash paid for: Interest, net of amounts capitalized Income taxes, net of refunds... -

Page 23

...$2.0 Total comprehensive income Dividends - $.56 per share Two-for-one stock split effected in the form of a dividend (Note 9) Exercise of stock options, including tax beneï¬ts of $40.3 Repurchase of common stock Grant, cancellation and amortization of restricted stock Balances at December 31, 2004... -

Page 24

...centrally managing Brand Marketing and the Supply Chain. These changes increase the number of operating segments to six. Sales are made to the ultimate customers principally by independent Avon Representatives. Product categories include Beauty, which consists of cosmetics, fragrances, skin care and... -

Page 25

... inventory into various categories based upon their stage in the product life cycle, future marketing sales plans and disposition process. We assign a degree of obsolescence risk to products based on this classiï¬cation to determine the level of obsolescence provision. Property, Plant and Equipment... -

Page 26

... weighted-average assumptions: 2005 Risk-free interest rate Expected life Expected volatility Expected dividend yield 2004 2003 4.2% 2.4% 2.4% 4 years 4 years 4 years 25% 30% 45% 1.6% 1.5% 1.6% The weighted-average grant date fair values per share of options granted during 2005, 2004 and 2003... -

Page 27

...all grants of stock-based awards utilizing the modiï¬ed prospective method. The fair value of options granted will be calculated using a Black-Scholes model. The impact of the adoption of FAS 123(R) will depend on levels of share-based payments granted in the future. Net income in each of the years... -

Page 28

...FINANCING Debt Debt at December 31 consisted of the following: 2005 Debt maturing within one year: Notes payable Commercial paper 1.06% Yen Notes, due September 2006 Current portion of long-term debt Total Long-term debt: 1.06% Yen Notes, due September 2006 6.55% Notes, due August 2007 7.15% Notes... -

Page 29

... federal funds rate. The new credit facility has an annual facility fee, payable quarterly, of $.65, based on our current credit ratings. The new credit facility contains various covenants that are substantially similar to the old credit facility, including a ï¬nancial covenant which requires Avon... -

Page 30

... grantor trust and mutual funds that are used to make beneï¬t payments under non-qualiï¬ed beneï¬t plans are classiï¬ed as available-for-sale and recorded at current market value (see Note 10, Employee Beneï¬t Plans). The cost, gross unrealized gains and losses and market value of the available... -

Page 31

... recognition Minimum tax credit carryforwards Foreign tax credit carryforwards Capital loss carryforwards All other Valuation allowance Total deferred tax assets Deferred tax liabilities: Depreciation and amortization Prepaid retirement plan costs Capitalized interest Capitalized software Unremitted... -

Page 32

...in the earnings mix and tax rates of international subsidiaries. The effective tax rate for 2003 was favorably impacted by 2.5 points, primarily due to tax audit settlements and an interest refund from the IRS. Accounting Policies Derivatives are recognized on the balance sheet at their fair values... -

Page 33

... swap agreements and swap agreements no longer designated as fair value hedges, which are being amortized to interest expense over the remaining terms of the underlying debt. There was no hedge ineffectiveness for the years ended December 31, 2005, 2004 or 2003, related to these interest rate swaps... -

Page 34

... one year and long-term debt The fair values of all debt and other ï¬nancing were determined based on quoted market prices. Foreign exchange forward and option contracts The fair values of forward and option contracts were determined based on quoted market prices from banks. Interest rate swap... -

Page 35

... option grant date. Stock options are granted at a price no less than fair market value on the date the option is granted and have a term of ten years from the date of grant. A summary of our stock option activity, weighted-average exercise price and related information for the years ended December... -

Page 36

...any time at our option, entitles the shareholder, among other things, to purchase one share of Avon common stock at a price equal to one-half of the then current market price, if certain events have occurred. The right is exercisable if, among other events, one party obtains beneï¬cial ownership of... -

Page 37

... deï¬ned beneï¬t retirement plan covering U.S.-based employees was converted to a cash balance plan with beneï¬ts determined by pay-based credits related to age and service and interest credits based on individual account balances and prevailing interest rates. A ten-year transitional period was... -

Page 38

...Beginning balance Actual return on plan assets Company contributions Plan participant contributions Beneï¬ts paid Foreign currency changes Settlements/special termination beneï¬ts Ending balance Funded Status: Funded status at end of year Unrecognized actuarial loss Unrecognized prior service cost... -

Page 39

... The discount rate used for determining future pension obligations for each individual plan is based on a review of long-term bonds that receive a high rating from a recognized rating agency. Additionally, for the U.S. Plan, the discount rate was based on the internal rate of return for a portfolio... -

Page 40

... the net cost for the year ended December 31, 2005, the assumed rate of return on assets globally was 7.70%, which represents the weighted-average rate of return on all plan assets, including the U.S. and non-U.S. plans. The majority of our pension plan assets relate to the U.S. pension plan. The... -

Page 41

...insurance policies. The Plan allows for the deferral of up to 50% of a participant's base salary, the deferral of up to 100% of incentive compensation bonuses, and the deferral of contributions to the Avon Personal Savings Account Plan (the "PSA") but that are in excess of U.S. Internal Revenue Code... -

Page 42

... do not allocate income taxes, foreign exchange gains or losses, or corporate global expenses to segments. Global expenses include, among other things, costs related to our executive and administrative ofï¬ces, information technology, research and development, and marketing. Summarized ï¬nancial... -

Page 43

... includes cosmetics, fragrances, skin care and toiletries. ****Beauty Plus includes fashion jewelry, watches, apparel and accessories. ****Beyond Beauty includes home products, and gift and decorative products. ****Other primarily includes shipping and handling fees billed to Representatives. 2005... -

Page 44

...ï¬c actions for this initial phase of our multi-year restructuring plan include: • organization realignment and downsizing in each region and global through a process called "delayering", taking out layers to bring senior management closer to operations; • the exit of unproï¬table lines of... -

Page 45

The liability balances for these charges were as follows: Employee Related Costs $30.4 (.5) (.7) - $29.2 $30.4 $32.7 2005 Charges Cash payments Non-cash write-offs Foreign exchange Ending Balance Total charges incurred to date Total expected charges Asset Inventory AFCT Contract Write-offs Write-... -

Page 46

... the unordered products to Avon, and did not receive credit for those returned products." The complaint seeks unspeciï¬ed compensatory and punitive damages, restitution and injunctive relief for alleged unjust enrichment and violation of the California Business and Professions Code. This action was... -

Page 47

... District of New York (Master File Number 05-CV-06803) under the caption In re Avon Products, Inc. ERISA Litigation naming Avon, certain ofï¬cers, Avon's Retirement Board and others. The consolidated action purports to be brought on behalf of the Avon Products, Inc. Personal Savings Account Plan... -

Page 48

...฀ 15 SUPPLEMENTAL฀INCOME฀ STATEMENT฀INFORMATION On October 18, 2005, we purchased the Avon direct-selling business of our licensee in Colombia for approximately $154.0 in cash, pursuant to a share purchase agreement that Avon International Holdings Company, a wholly-owned subsidiary of... -

Page 49

...31, 2004 Goodwill acquired during the year Impairment losses Foreign exchange Balance at December 31, 2005 $34.4 - - (1.1) $33.3 $ .9 94.8 - - $95.7 $41.2 - (.4) 2.2 $43.0 $ 76.5 94.8 (.4) 1.1 $172.0 The impairment losses relate to the write-off of goodwill associated with the closure of unpro... -

Page 50

... 287.6 185.0 $ 183.2 $ $ .40 .40 Year $8,065.2 84.4 5,015.9 1,149.0 1,124.2 854.5 $ 847.6 $ 1.82(1) $ 1.81(1) Net sales Other revenue Gross proï¬t Operating proï¬t Income before taxes and minority interest Income before minority interest Net income Earnings per share Basic Diluted 2004 Net sales... -

Page 51

... are available to fund select beneï¬t plan obligations. 19 ฀ SUBSEQUENT฀EVENTS On January 26, 2006, we announced an increase in our quarterly cash dividend to $.175 per share from $.165 per share. The ï¬rst dividend at the new rate will be paid on March 1, 2006, to shareholders of record on... -

Page 52

... term is deï¬ned in Rule 13a-15(f) under the Securities Exchange Act of 1934 (the "Exchange Act"). Internal control over ï¬nancial reporting is deï¬ned as a process designed by, or under the supervision of, Avon's principal executive and principal ï¬nancial ofï¬cers and effected by Avon's board... -

Page 53

REPORT฀OF฀INDEPENDENT฀REGISTERED฀฀ PUBLIC฀ACCOUNTING฀FIRM To the Board of Directors and Shareholders of Avon Products, Inc.: We have completed integrated audits of Avon Products, Inc.'s 2005 and 2004 consolidated ï¬nancial statements and of its internal control over ï¬nancial ... -

Page 54

...-YEAR฀REVIEW In millions, except per share and employee data 2005 (2) 2004 $7,656.2 91.6 7,747.8 1,229.0 33.8 1,187.5 856.9 846.1 - - $ 846.1 $ 1.79 - - 1.79 1.77 - - 1.77 .56 2003 $6,773.7 71.4 6,845.1 1,042.8 33.3 993.5 674.6 664.8 - - $ 664.8 $ 1.41 - - 1.41 1.39 - - 1.39 .42 Income Data... -

Page 55

2002(3) $6,142.4 57.7 6,200.1 863.5 52.0 835.6 543.3 534.6 - - $ 534.6 $ 1.13 - - 1.13 1.11 - - 1.11 .40 2001(4) $5,957.8 42.5 6,000.3 763.2 71.1 689.7 449.4 444.9 - (.3)(6) $ 444.6 $ .94 - - .94 .92 - - .92 .38 2000 $5,681.7 40.9 5,722.6 789.9 84.7 692.2 490.0 485.8 - (6.7)(7) $ 479.1 $ 1.02 - (.... -

Page 56

... 9,400 36,500 45,900 Balance sheet data Working capital Capital expenditures Property, plant and equipment, net Total assets Debt maturing within one year Long-term debt Total debt Shareholders' equity (deficit) Number of employees United States International Total employees(9) $ 419.3 206.8 1,050... -

Page 57

... earnings per share for the years ended December 31, 2003, 2002, 2001 and 2000, after tax interest expense of $5.7, $10.4, $10.0 and $4.5, respectively, applicable to Convertible Notes, has been added back to Net income. (9) Our calculation of full-time equivalents, or number of employees, was...