Avon 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PAGE 28

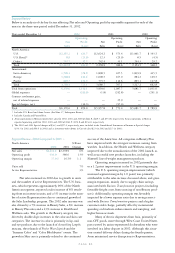

investments of $22.0 (including brochure enhancements

and sampling), higher bonus accruals of $16.0 and merit

salary increases of $15.0 for certain marketing, distribu-

tion and administrative personnel around the world. These

increases in expenses were partially offset by net savings

from workforce reduction programs associated with Avon’s

Business Transformation initiatives of $30.0.

As a percentage of Total revenue, Marketing, distri-

bution and administrative expenses improved .4 point in

2002 due to lower expense ratios in Europe (1.9 points,

which reduced the consolidated ratio by .4 point), the

Pacific (1.9 points, which reduced the consolidated ratio

by .3 point) and North America (.3 point, which reduced

the consolidated ratio by .1 point), partially offset by a

higher expense ratio in Latin America (.3 point, which

increased the consolidated ratio by .1 point). Additionally,

the consolidated expense ratio was negatively impacted by

greater contributions from markets with higher expense

ratios (which increased the consolidated ratio by .3 point).

Marketing, distribution and administrative

expenses increased $128.1 in 2001 primarily due to a 5%

sales increase (which resulted in an increase in expenses

of approximately $82.0), an increase in consumer-related

investments of $32.0 (including incremental spending

on advertising, sampling and brochure enhancements),

expenses associated with the U.S. Retail business (which

was launched in 2001) of $20.0 and merit salary increases

of $16.0 for certain marketing, distribution and adminis-

trative personnel around the world.

As a percentage of Total revenue, Marketing, distri-

bution and administrative expenses improved .1 point in

2001 due to a lower expense ratio in Europe (2.0 points,

which reduced the consolidated ratio by .4 point), par-

tially offset by higher expense ratios in North America (.5

point, which increased the consolidated ratio by .2 point),

Latin America (.3 point, which increased the consolidated

ratio by .1 point), and the Pacific (.8 point, which

increased the consolidated ratio by .1 point). Additionally,

the consolidated expense ratio benefited from greater con-

tributions from markets with lower expense ratios (which

reduced the consolidated ratio by .1 point).

See the “Segment Review” sections of Management’s

Discussion and Analysis of Financial Condition and

Results of Operations for additional information related

to changes in expense ratios by segment.

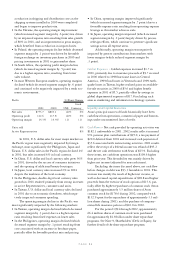

Other (Income) Expense > Interest expense decreased in

both 2002 and 2001 primarily as a result of continued

declines in domestic interest rates.

Interest income increased in 2002 and 2001 prima-

rily due to higher Cash and cash equivalent balances.

Other (income) expense, net was favorable in 2002

as compared to 2001, mainly due to favorable foreign

exchange in 2002 ($23.7), a charge in 2001 related to the

settlement of a disputed excise tax liability in Argentina

($6.4) (see Note 14, Contingencies), and lower legal

expenses in 2002 ($4.6). Net foreign exchange was favorable

in 2002 primarily due to an increase in foreign exchange

gains of $19.8 on net U.S. dollar denominated assets pri-

marily in Argentina, Venezuela, Brazil and Mexico.

Other (income) expense, net was unfavorable in

2001 as compared to 2000, mainly due to a charge in

2001 related to the settlement of a disputed excise tax

liability in Argentina ($6.4) (see Note 14, Contingen-

cies), additional legal expenses in 2001 ($5.4), and

unfavorable foreign exchange movements ($3.8) on the

Mexican peso, British pound and Philippine peso foreign

currency contracts, partially offset by transaction gains on

a U.S. dollar intercompany loan receivable in Argentina

($8.0) and favorable foreign exchange movements in 2001

on Japanese yen contracts ($2.4).

Effective Tax Rate > The effective tax rate was higher in

2002 because the net Special charges of $36.3 (see Note

13, Special Charges) gave rise to a lower tax benefit due

to the loss positions of certain international subsidiaries

incurring a portion of the charges. In addition, the tax rate

increased due to changes in the earnings mix. The increase

in the rate was partially offset by the favorable impact of

repatriation planning and changes in the tax rates of inter-

national subsidiaries.

The effective tax rate was higher in 2001 compared

to 2000 due to a federal income tax refund in 2000 dis-

cussed below and the impact of the 2001 Special charges

(see Note 13, Special Charges), partially offset by the

favorable impact of repatriation planning, the earnings

mix and tax rates of international subsidiaries.

The 2000 results included the settlement of a fed-

eral income tax refund, which was received in January

2001, consisting of $32.5 of tax and $62.7 of interest

related to the years ended December 31, 1982, 1983,

1985 and 1986. For the year ended December 31, 2000,

Avon recognized $40.1 ($.16 per diluted share) as an

income tax benefit in the Consolidated Statements of

Income, resulting from the impact of the tax refund offset

by taxes due on interest received and other related tax

obligations (see Note 6, Income Taxes).

Cumulative Effect of Accounting Changes > Effective

January 1, 2001, Avon adopted FAS No. 133,

“Accounting for Derivative Instruments and Hedging

Activities,” as amended by FAS No. 138, “Accounting for

Certain Derivative Instruments and Hedging Activities,”

which establishes accounting and reporting standards for

derivative instruments and hedging activities. In accor-

dance with the provisions of FAS No. 133 and FAS No.

138, Avon recorded a charge to earnings of $0.3, net of a

tax benefit of $0.2, in the first quarter of 2001 and a

charge to Shareholders’ (deficit) equity of $3.9, net of a tax

benefit of $2.1, which is included in Accumulated other

comprehensive loss in the Consolidated Balance Sheets.

These charges are reflected as a Cumulative effect of an

accounting change in the accompanying Consolidated

Financial Statements (see Note 2, Accounting Changes).