Avon 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 59

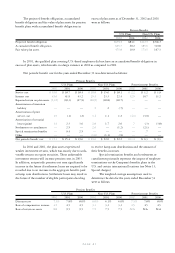

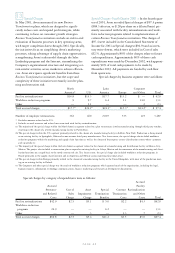

Compensation expense under all stock-based

compensation plans in 2002 was $6.6 (2001–$7.5;

2000–$6.6). The unamortized cost of restricted shares

as of December 31, 2002, was $5.6 (2001–$8.5) and

was included in Additional paid-in capital on the

Consolidated Balance Sheets.

Transformation Long-Term Incentive Plans > In 2002, Avon

established a three-year Transformation Long-Term

Incentive Plan providing for performance cash awards

based on the achievement of cumulative Business

Transformation goals over the period 2002 to 2004. It

is reasonably possible that total cash payments of approxi-

mately $50.0 will be made in the first quarter of 2005

in connection with this program. No expense has been

recognized under this plan due to the aggressive nature

of the goals and cumulative aspect of the award formula.

The Company does not anticipate that this incremental

expense will affect its ability meet its financial targets due

to the self-funding nature of this plan.

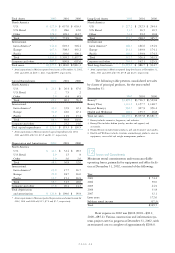

Board of Directors Remuneration > Each non-management

director is annually granted options to purchase 4,000

shares of common stock, at an exercise price based on the

fair market price of the stock on the date of grant. The

annual grant of restricted shares made in 2002 and 2001

consisted of 36,000 and 32,000 options, respectively, with

an exercise price of $53.11 and $43.12, respectively.

Effective January 1, 2002, the annual cash retainer

paid to non-management directors consists of thirty thou-

sand dollars cash (twenty-five thousand dollars prior to

January 1, 2002) plus an annual grant of restricted shares

having a value of thirty thousand dollars (twenty-five

thousand dollars prior to January 1, 2002) based on the

average closing market price of the stock for the 10 days

preceding the date of grant. These shares are restricted as

to transfer until the director retires from the Board. The

annual grant of restricted shares made in 2002 and 2001

consisted of a total of 4,869 and 5,024 shares, respectively.

In addition, non-management directors are paid one thou-

sand dollars cash for attendance at committee and special

Board meetings. Non-management directors appointed to

chair a committee are also paid three thousand dollars cash

within 30 days following appointment.

Shareholders’ (Deficit) Equity

Share Rights Plan > Avon has a Share Rights Plan under

which one right has been declared as a dividend for each

outstanding share of its common stock. Each right,

which is redeemable at $.005 at any time at Avon’s option,

entitles the shareholder, among other things, to purchase

9

one share of Avon common stock at a price equal to one-

half of the then current market price, if certain events have

occurred. The right is exercisable if, among other events,

one party obtains a beneficial ownership of 20% or more of

Avon’s voting stock.

Stock Repurchase Program > In September 2000, Avon’s

Board approved a new share repurchase program under

which the Company may buy up to $1,000.0 of its out-

standing stock over the next five years. As of December

31, 2002, the Company had repurchased approximately

7.4 million shares at a total cost of approximately $337.4

under this program.

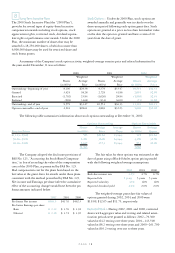

Employee Benefit Plans

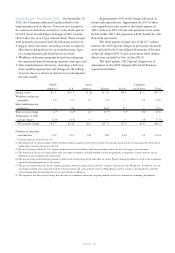

Savings Plan > The Company offers a qualified defined

contribution plan for U.S.-based employees, the Avon

Products, Inc. 401(k) Personal Savings Account, which

allows eligible participants to contribute 1% to 20% of

qualified compensation through payroll deductions (effec-

tive January 1, 2003, 1% to 25% of qualified compensa-

tion). Avon matches employee contributions dollar for

dollar up to the first 3% of eligible compensation and

fifty cents for each dollar contributed from 4% to 6%

of eligible compensation. In 2002, 2001 and 2000,

matching contributions approximating $14.0, $13.3 and

$12.7, respectively, were made to this plan in cash,

which was then used by the plan to purchase Avon shares

in the open market.

Retirement Plans > Avon and certain subsidiaries have con-

tributory and noncontributory retirement plans for sub-

stantially all employees. Benefits under these plans are

generally based on an employee’s years of service and aver-

age compensation near retirement. Plans are funded on a

current basis except where funding is not required. Plan

assets consist primarily of equity securities, corporate and

government bonds and bank deposits.

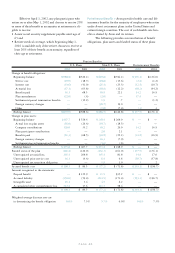

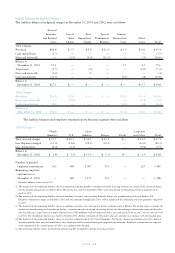

Effective July 1998, the defined benefit retirement

plan covering U.S.-based employees was converted to a

cash balance plan with benefits determined by compensa-

tion credits related to age and service and interest credits

based on individual account balances and prevailing inter-

est rates. This conversion also included a 10-year transi-

tional benefit arrangement for certain employees covered

under a pre-existing defined benefit retirement plan who

retire during that 10-year period, which provides them

with the higher of the benefit they would have received

under the previous defined benefit retirement plan and the

current cash balance plan.

10