Avon 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 75

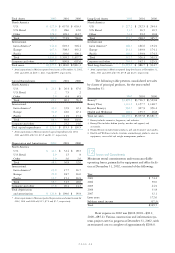

1998 1997 1996 1995 1994 1993 1992

$5,212.7 $5,079.4 $4,814.2 $4,492.1 $4,266.5 $ 3,844.1 $3,660.5

35.0(4) ——————

5,247.7 5,079.4 4,814.2 4,492.1 4,266.5 3,844.1 3,660.5

473.2(11) 537.8 538.0 500.8 489.5 427.4 339.9(13)

34.7 35.5 33.2 34.6 44.7 39.4 38.4

455.9(11) 534.9 510.4 465.0 433.8 394.6 290.0(13)

265.1(11) 337.0 319.0 288.6 270.3 243.8 169.4(13)

270.0(11) 338.8 317.9 286.1 264.8 236.9 164.2(13)

— — — (29.6) (23.8) 2.7 10.8

————(45.2)(12) (107.5)(12) —

270.0(11) 338.0 317.9 256.5 195.8 132.1 175.0(13)

$ 1.03(11) $ 1.28 $ 1.19 $ 1.05 $ .94 $ .82 $ .57(13)

— — — (.11) (.09) .01 .04

————(.16) (.37) —

1.03(11) 1.28 1.19 .94 .69 .46 .61(13)

$ 1.02(11) $ 1.27 $ 1.18 $ 1.05 $ .93 $ .82 $ .57(13)

— — — (.11) (.08) .01 .04

————(.16) (.37) —

1.02(11) 1.27 1.18 .94 .69 .46 .61(13)

$ .68 $ .63 $ .58 $ .53 $ .48 $ .43 $ .38

———————

$ 11.9 $ (11.9) $ (41.7) $ (30.3) $ 9.3 $ 23.1 $ (99.5)

189.5 169.4 103.6 72.7 99.9 58.1 62.7

669.9 611.0 566.6 537.8 528.4 476.2 476.7

2,433.5 2,272.9 2,222.4 2,052.8 1,978.3 1,918.7 1,692.6

55.3 132.1 97.1 47.3 61.2 70.4 37.3

201.0 102.2 104.5 114.2 116.5 123.7 177.7

256.3 234.3 201.6 161.5 177.7 194.1 215.0

285.1 285.0 241.7 192.7 185.6 314.0 310.5

8,000 8,100 7,800 8,000 7,900 8,000 8,700

25,900 26,900 25,900 23,800 22,500 21,500 20,700

33,900 35,000 33,700 31,800 30,400 29,500 29,400

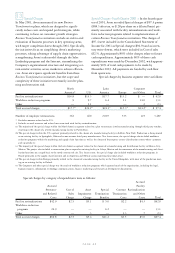

(8) Two-for-one stock splits were distributed in September 1998 and June 1996.

All per share data in this report, unless indicated, have been restated to reflect

the splits.

(9) Effective for the year ended December 31, 1997, the Company adopted

Statement of Financial Accounting Standards (“FAS”) No. 128, “Earnings per

Share.” FAS No. 128 establishes standards for computing and presenting earnings

per share (“EPS”) and replaces the presentation of previously disclosed EPS with

both basic and diluted EPS. Based upon the Company’s capitalization structure,

the EPS amounts calculated in accordance with FAS No. 128 approximated the

Company’s EPS amounts in accordance with Accounting Principles Board

Opinion No. 15, “Earnings per Share.” All prior period EPS data have been

restated in accordance with FAS No. 128.

(10) Avon’s calculation of full-time equivalents, or number of employees,

was revised in 1999. Restatements of prior year data are not available, and,

therefore, year-over-year comparisons are not meaningful. Approximately 27%

of Avon’s U.S. associates are men. Men hold approximately 16% of all U.S.

officer and manager positions, and approximately 12% of all U.S. office and

clerical positions.

(11) In 1998, Avon began a worldwide business process redesign program in

order to streamline operations and recorded Special charges of $154.4 ($122.8

after tax, or $.46 per share on a diluted basis). In 1999, Special charges related

to this program totaled $136.4 ($111.9 net of tax, or $.43 per share on a diluted

basis). In 1999, Avon recorded an Asset impairment charge of $38.1 pretax

($24.0 after tax, or $.09 per share on a diluted basis) related to the write-off of

an order management software system that had been under development.

(12) Effective January 1, 1994, Avon adopted FAS No. 112, “Employers’

Accounting for Postemployment Benefits”, for all applicable operations, and FAS

No. 106, “Employers’ Accounting for Postretirement Benefits Other Than

Pensions”, for its foreign benefit plans. Effective January 1, 1993, Avon adopted

FAS No. 106 for its U.S. retiree health care and life insurance benefit plans and

FAS No. 109, “Accounting for Income Taxes.”

(13) In 1992, Avon recorded a provision of $96.0 ($64.4 after tax, or $.22 per

share on a basic and diluted basis) for restructuring of its worldwide manufactur-

ing and distribution facilities.