Avon 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 63

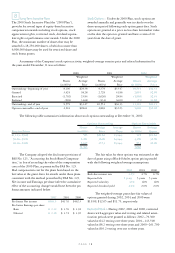

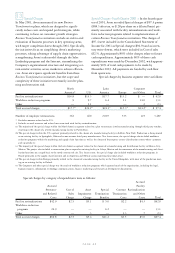

2001

Gross Gross

Unrealized Unrealized Market

Cost Gains Losses Value

Equity securities $44.4 $1.5 $(15.2) $30.7

U.S. government

bonds 2.1 — — 2.1

State and municipal

bonds 21.9 .4 (.1) 22.2

Mortgage backed

securities 2.8 — — 2.8

Corporate Bonds .6 — — .6

Total available-for-

sale securities 71.8 1.9 (15.3) 58.4

Cash and

equivalents 3.7 — — 3.7

Total $75.5 $1.9 $(15.3) $62.1

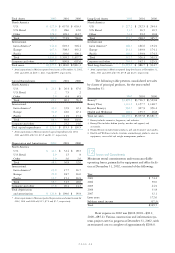

Payments, proceeds and net realized gains from the

purchases and sales of these securities totaled $50.9, $58.3

and $.1, respectively, during 2001. For the purpose of

determining realized gains and losses, the cost of securities

sold was based on specific identification.

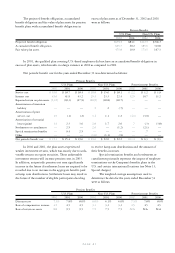

Postemployment Benefits > Avon provides postemployment

benefits, which include salary continuation, severance

benefits, disability benefits, continuation of health care

benefits and life insurance coverage to eligible former

employees after employment but before retirement. At

December 31, 2002, the accrued cost for postemployment

benefits was $37.9 (2001–$32.7) and was included in

Employee Benefit Plans.

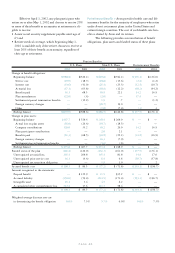

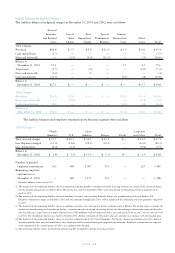

Segment Information

The Company’s reportable segments are based on geo-

graphic operations and include a North American business

unit and international business units in Latin America,

Europe and Pacific regions. With the exception of the U.S.

retail business, the segments have similar business charac-

teristics and each offers similar products through common

customer access methods.

The accounting policies of the reportable segments

are the same as those described in Note 1, Description of

the Business and Summary of Significant Accounting

Policies. The Company evaluates the performance of its

operating segments based on operating profits or losses.

Segment revenues reflect direct sales of products to

Representatives based on their geographic location.

Intersegment sales and transfers are not significant. Each

segment records direct expenses related to its employees

and its operations. The Company does not allocate income

taxes, foreign exchange gains or losses, or corporate over-

head expenses to operating segments.

Effective July 2002, Avon consolidated the manage-

ment of its two Latin American operating business units

into one Latin American operating business unit and, there-

fore, Latin America is presented as one business unit for

segment reporting purposes. Prior year amounts have been

reclassified to conform to the current period presentation.

Summarized financial information concerning

Avon’s reportable segments as of December 31 is shown in

the following tables. In the following tables, U.S. Retail

includes the U.S. Retail business and Avon Centre, and

North America Other includes Canada and Puerto Rico.

11

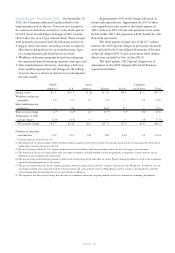

Net Sales and Operating Profit >

Years ended December 31 2002 2001 2000

Operating Operating Operating

Net Profit Net Profit Net Profit

Sales (Loss) Sales (Loss) Sales (Loss)

North America:

U.S. $ 2,151.2 $ 424.7 $ 2,024.2 $ 373.4 $ 1,901.7 $ 343.5

U.S. Retail 8.8 (25.9) 12.3 (25.9) 8.5 (4.5)

Other 252.2 32.2 242.4 33.1 244.3 29.2

Total 2,412.2 431.0 2,278.9 380.6 2,154.5 368.2

International:

Latin America* 1,700.1 378.8 1,898.5 427.5 1,839.9 415.5

Europe 1,228.6 212.4 1,008.5 167.0 884.2 129.5

Pacific 829.7 133.9 773.7 112.6 803.1 117.8

Total 3,758.4 725.1 3,680.7 707.1 3,527.2 662.8

Total from operations 6,170.6 1,156.1 5,959.6 1,087.7 5,681.7 1,031.0

Global expenses — (249.8) (1.8) (242.8) — (241.1)

Contact settlement gain, net of

related expenses ——— 25.9 — —

Special charges, net†— (36.3) — (97.4) — —

Total $ 6,170.6 $ 870.0 $ 5,957.8 $ 773.4 $ 5,681.7 $ 789.9

* Avon’s operations in Mexico reported net sales for 2002, 2001 and 2000 of $661.8, $619.7 and $554.8, respectively. Avon’s operations in Mexico

reported operating profit for 2002, 2001 and 2000 of $163.9, $154.8 and $136.0, respectively.

† The 2002 and 2001 Special charges of $36.3 and $97.4, respectively, are included in the Consolidated Statements of Income as Special charges.

($34.3 in 2002 and $94.9 in 2001) and as inventory write-downs in Cost of sales ($2.0 in 2002 and $2.5 in 2001).