Avon 2001 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 69

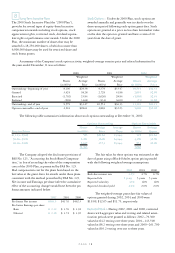

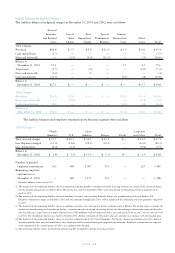

Liability Balances for Special Charges >

The liability balances for Special charges at December 31, 2001 and 2002, were as follows:

Accrued

Severance Cost of Asset Special Contract

and Related Sales Impairment Termination Termination Other

Costs Charge Charge Benefits Costs Costs Total

2001 Charges:

Provision $69.8 $ 2.5 $ 5.4 $ 11.2 $ 3.5 $ 5.0 $ 97.4

Cash expenditures (2.7) ———— —(2.7)

Non-cash write-offs — (2.5) (5.4) (11.2) — (.5) (19.6)

Balance at

December 31, 2001 67.1———3.54.575.1

Adjustment (5.7) — (.6) — — (1.0) (7.3)

Non-cash write-offs (1.0) — .6 — — (.4)

Cash expenditures (33.3) — — — (3.5) (.8) (37.6)

Balance at

December 31, 2002 $27.1 $ — $ — $ — $ — $ 2.7 $ 29.8

2002 Charges:

Provision $34.9 $ 2.0 $ — $ — $ 2.4 $ 4.3 $ 43.6

Non-cash write-offs — (2.0) — (1.3) (3.3)

Cash expenditures (4.1) — — — (1.4) (.8) (6.3)

Balance at

December 31, 2002 $30.8 $ — $ — $ — $ 1.0 $ 2.2 $ 34.0

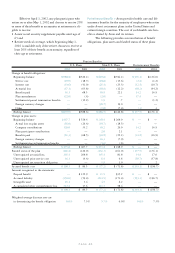

The liability balances and employee terminations by business segment were as follows:

2001 Charges >

North Latin Corporate

America* U.S. America Europe Pacific and Other Total

Total Accrued charges $ 17.7 $ 26.1 $ 24.1 $ 15.3 $— $ 14.2 $ 97.4

Less: Expenses charged (13.9) (14.6) (10.6) (10.2) — (11.0) (60.3)

Less: Adjustment (2.0) (4.4) — — (0.9) (7.3)

Balance at

December 31, 2002 $ 1.8(a) $ 7.1(b) $ 13.5(c) $ 5.1(d) $— $ 2.3(e) $ 29.8

Number of planned

employee terminations 362 460 2,007 533 — 125 3,487

Remaining employee

terminations at

December 31, 2002 — 180 1,173 233 — — 1,586

* Excludes amounts related to the U.S.

(a) The majority of the remaining liability relates to remaining amounts payable to employees already receiving severance as a result of the closure of Avon’s

jewelry manufacturing facility in Puerto Rico. The facility was closed in September 2002, with substantially all remaining severance payments to be

made in 2003.

(b) The majority of the remaining liability relates to employee severance costs resulting from the closure of a manufacturing facility in Suffern, NY.

Employee terminations began in September 2002 and will continue through June 2003, with a majority of the remaining severance payments completed

in 2003.

(c) The majority of the remaining liability relates to employee severance costs relating to a facility rationalization in Mexico. The facility project includes the

closure of a manufacturing and distribution facility, a construction plan to expand an existing facility and the moving of the manufacturing and distribu-

tion functions on a staged basis to a newly constructed site The workforce will be terminated over a transition period (700 in 2002, 600 in 2003 and 500

in 2004). The distribution facility was closed in October 2002. All key milestones of the project plan are currently in accordance with the original plan.

(d) The majority of the remaining liability relates to a facility rationalization in the United Kingdom. The facility closure was announced in 2002; however,

severance benefits were not paid immediately since employees will be retained during the migration of production. Employee terminations are expected

to be completed in the second quarter of 2003, in accordance with the plan.

(e) The remaining liability relates to remaining amounts payable to employees already receiving severance.