Avon 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 51

Accounting Changes

Accounting for Certain Sales Incentives >Effective

January 1, 2002, Avon adopted Emerging Issues Task

Force (“EITF”) No. 00-14, “Accounting for Certain

Sales Incentives,” which requires the cost of certain prod-

ucts and cash incentives used in Avon’s promotional activi-

ties, previously reported in Marketing, distribution and

administrative expenses, to be classified as Cost of sales or

as a reduction of Net sales.

Effective January 1, 2002, Avon adopted EITF No.

00-25, “Accounting for Consideration from a Vendor to a

Retailer in Connection with the Purchase or Promotion of

the Vendor’s Products” and EITF No. 01-09, “Accounting

for Consideration Given by a Vendor to a Customer or

Reseller of the Vendor’s Products,” which require certain

expenses related to the U.S. Retail business previously

included in Marketing, distribution and administrative

expenses to be classified as a reduction of Net sales.

The adoptions of EITF No. 00-14, EITF No. 00-25

and EITF No. 01-09 had no impact on Operating profit,

Net income or Earnings per share; however, gross margin

decreased by approximately .7 point in 2002, 2001 and

2000, offset by a similar decrease in Marketing, distribu-

tion and administrative expenses.

Accounting for Goodwill and Other Intangibles Assets >

Effective January 1, 2002, Avon adopted FAS No. 142,

“Goodwill and Other Intangible Assets.” Under FAS No.

142, goodwill and intangible assets with indefinite lives

are no longer amortized, but are assessed for impairment

annually and upon the occurrence of an event that indi-

cates impairment may have occurred. In accordance with

FAS No. 142, Avon completed its annual goodwill impair-

ment assessment based on an evaluation of estimated

future cash flow and no adjustments to goodwill were

recorded. Goodwill totaled $25.4 and $23.7 at December

31, 2002 and 2001, respectively. Intangible assets totaled

$.6 and $.7 at December 31, 2002 and 2001, respectively.

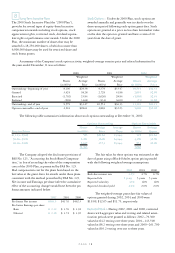

The pro-forma effect of FAS No. 142 assuming

Avon had adopted this standard on January 1, 2001, was

not material to Avon’s Income from continuing operations

before cumulative effect of accounting changes, Net

income or Basic and Diluted earnings per share for the

years ended December 31, 2001 and 2000.

Long-Lived Assets > Effective January 1, 2002, Avon

adopted FAS No. 144, “Accounting for the Impairment

or Disposal of Long-Lived Assets,” which addresses the

accounting and reporting for the impairment and disposal

of long-lived assets. The adoption of FAS No. 144 was

not material to the Consolidated Financial Statements.

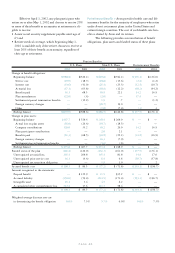

2Derivatives and Hedging Activities > Effective January 1,

2001, Avon adopted FAS No. 133, “Accounting for

Derivative Instruments and Hedging Activities,” as

amended by FAS No. 138, “Accounting for Certain

Derivative Instruments and Hedging Activities,” which

establishes accounting and reporting standards for deriva-

tive instruments and hedging activities. FAS No. 133,

as amended, requires that all derivative instruments be

recorded at their fair values on the Consolidated Balance

Sheets as either assets or liabilities. In accordance with

the provisions of FAS No. 133, Avon recorded a charge to

earnings of $.3, net of a tax benefit of $.2, as of January 1,

2001 to reflect the change in the time value of Avon’s out-

standing options from the dates of the options’ inceptions

through the date of transition (January 1, 2001). Avon also

recorded a charge to Shareholders’ (deficit) equity of $3.9,

net of a tax benefit of $2.1, included in Accumulated other

comprehensive loss in the Consolidated Balance Sheets, to

recognize the fair value of all derivatives designated as cash

flow hedging instruments, which Avon reclassified into

earnings during 2001. These charges are reflected as a

Cumulative effect of an accounting change in the accom-

panying Consolidated Financial Statements.

Revenue Recognition > Effective January 1, 2000, Avon

adopted Staff Accounting Bulletin (“SAB”) No. 101,

“Revenue Recognition in Financial Statements.” SAB

No. 101 provides the Securities and Exchange

Commission’s views in applying generally accepted

accounting principles to revenue recognition in the finan-

cial statements. As a result of adopting SAB No. 101,

Avon changed its revenue recognition policy to recognize

revenue upon delivery, when both title and risks and

rewards of ownership pass to the independent Represen-

tative. In accordance with the provisions of SAB No. 101,

the Company recorded a charge to earnings of $6.7, net

of a tax benefit of $3.5 in 2000, to reflect the accounting

change. This charge is reflected as a Cumulative effect of

an accounting change in the accompanying Consolidated

Statements of Income.

Asset Retirement Obligations > In August 2001, the

Financial Accounting Standards Board (“FASB”) issued

FAS No. 143, “Accounting for Asset Retirement

Obligations,” which addresses the accounting and report-

ing for obligations associated with the retirement of

tangible long-lived assets and the associated retirement

costs. FAS No. 143 is effective January 1, 2003, for Avon.

The adoption of FAS No. 143 was not material to the

Consolidated Financial Statements.