Avon 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 52

Accounting for Costs Associated with Exit or Disposal

Activities > In June 2002, the FASB issued FAS No. 146,

“Accounting for Costs Associated with Exit or Disposal

Activities”. This statement supersedes EITF No. 94-3

“Liability Recognition for Certain Employee Termination

Benefits and Other Costs to Exit an Activity (including

Certain Costs Incurred in a Restructuring)”. FAS No. 146

requires that a liability for a cost associated with an exit

or disposal activity be recognized when the liability is

incurred. Under EITF 94-3, a liability is recognized at the

date an entity commits to an exit plan. FAS No. 146 also

establishes that the liability should initially be measured

and recorded at fair value. The provisions of FAS No. 146

will be effective for any exit and disposal activities initi-

ated after December 31, 2002.

Guarantees > In November 2002, the FASB issued

Interpretation (“FIN”) No. 45, “Guarantor’s Accounting

and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others”, which

requires certain guarantees to be recorded at fair value

rather than the current practice of recording a liability

only when a loss is probable and reasonably estimable and

also requires a guarantor to make new guaranty disclo-

sures, even when the likelihood of making any payments

under the guarantee is remote. The accounting require-

ments of FIN No. 45 are effective for guarantees issued or

modified after December 31, 2002, and the disclosure

requirements are effective for financial statements of

interim or annual periods ending after December 15,

2002. The Company does not expect the adoption of FIN

No. 45 to have a material impact on the Consolidated

Financial Statements. Avon has a 40% interest in

Mirabella Realty Company, (“Mirabella”), a Philippine

company formed to purchase land in the Philippines. The

remaining 60% interest is held by Company-sponsored

retirement plans. The investment is accounted for under

the equity method. At December 31, 2002, Avon guaran-

tees $2.5 of Mirabella’s third-party borrowings. Based on

current facts and circumstances and Mirabella’s financial

position, the likelihood of a payment pursuant to such

guarantee is remote.

Accounting for Stock-Based Compensation >In December

2002, the FASB issued FAS No. 148, “Accounting

for Stock-Based Compensation and Disclosure–An

Amendment of FAS No. 123,” which provides companies

with three transition methods if they choose to adopt

the accounting provisions of FAS No. 123. FAS No. 148

also requires new disclosure requirements that are incre-

mental to FAS No. 123, which have been included in

Note 1, Description of the Business and Summary of

Significant Accounting Policies, and Note 8, Long-Term

Incentive Plans.

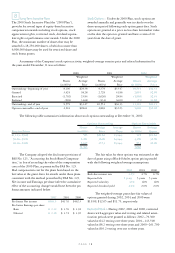

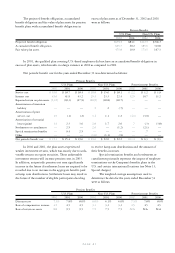

Inventories

Inventories at December 31 consisted of the following:

2002 2001

Raw materials $165.6 $167.0

Finished goods 449.1 445.5

Total $614.7 $612.5

Debt and Other Financing

Debt > Debt at December 31 consisted of the following:

2002 2001

Maturing within one year:

Notes payable $ 63.7 $ 87.6

Convertible Notes, due July 2020*438.4 —

6.25% Bonds, due May 2018†100.0 —

Current portion of long-term debt 3.1 1.2

Total $605.2 $ 88.8

Long-term debt:

1.06% Unsecured Yen Notes,

due September 2006 $ 75.0 $ 68.8

Convertible Notes, due July 2020*—422.4

6.90% Unsecured Notes,

due November 2004 200.0 200.0

7.15% Unsecured Notes,

due November 2009 300.0 300.0

6.25% Bonds, due May 2018†—100.0

6.55% Notes, due August 2007 100.0 100.0

Other, payable through 2008

with interest from 3% to 19% 9.7 5.6

Total long-term debt 684.7 1,196.8

Adjustments for debt with

fair value hedges‡85.4 40.7

Less current portion (3.1) (1.2)

Total $767.0 $1,236.3

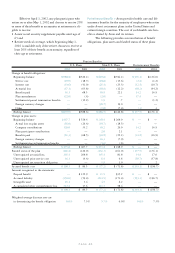

* The Convertible Notes are zero-coupon convertible senior notes (the

“Convertible Notes”) with $840.8 principal amount at maturity. The

Convertible Notes have a 3.75% yield to maturity and are convertible at

any time into Avon’s common stock at a conversion rate of 8.2723 shares

of common stock per $1,000 principal amount at maturity of the

Convertible Notes (equivalent to a conversion price of $57.50 per share

based on the initial offering price of the Convertible Notes). The

Convertible Notes may be redeemed at the option of Avon on or after

July 12, 2003, at a redemption price equal to the issue price plus

accrued original issue discount to the redemption date. The holders can

require Avon to purchase all or a portion of the Convertible Notes on

July 12, 2003, July 12, 2008, and July 12, 2013, at the redemption

price per Convertible Note of $531.74, $640.29 and $771.00, respec-

tively. The holders may also require Avon to repurchase the Convertible

Notes if a fundamental change, as defined, involving Avon occurs prior

to July 12, 2003. Avon has the option to pay the purchase price or, if a

fundamental change has occurred, the repurchase price in cash or com-

mon stock or a combination of cash and common stock. At December

31, 2002, the Company reclassified $438.4 from Long-term debt to

Debt maturing within one year since the holders can require Avon to

purchase all or a portion of the Convertible Notes on July 12, 2003.

4

3