Avon 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 40

forward rate, interest rate cap contracts and treasury lock

agreements only with major international financial insti-

tutions with “A” or higher credit ratings as issued by

Standard & Poor’s Corporation. Avon’s foreign currency

and interest rate derivatives are comprised of over-the-

counter forward contracts, swaps or options with major

international financial institutions. Although Avon’s

theoretical credit risk is the replacement cost at the then

estimated fair value of these instruments, management

believes that the risk of incurring credit risk losses is

remote and that such losses, if any, would not be material.

Non-performance of the counterparties on the balance

of all the foreign exchange and interest rate swap and for-

ward rate agreements would not result in a material write-

off at December 31, 2002. In addition, in the event of non-

performance by such counterparties, Avon would be exposed

to market risk on the underlying items being hedged as a

result of changes in foreign exchange and interest rates.

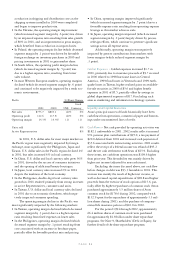

Accounting Changes

See Note 2, Accounting Changes, for a discussion regard-

ing recent accounting standards, including the following:

• Emerging Issues Task Force “EITF” 00-14, “Accounting

for Certain Sales Incentives,”

• EITF 00-25, “Accounting for Consideration from a

Vendor to a Retailer in Connection with the Purchase or

Promotion of the Vendor’s Products,”

• FAS No. 133, “Accounting for Derivative Instruments

and Hedging Activities,”

• FAS No. 141, “Business Combinations,”

• FAS No. 142, “Goodwill and Other Intangible Assets,”

• FAS No. 143, “Accounting for Asset Retirement

Obligations,”

• FAS No. 144, “Accounting for the Impairment or

Disposal of Long-Lived Assets,”

• FAS No. 146, “Accounting for Costs Associated with

Exit or Disposal Activities,”

• FAS No. 148, “Accounting for Stock-Based

Compensation-An Amendment of FAS No. 123,”

• FASB Interpretation No. 45, “Guarantor’s Accounting

and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others,” and

• SAB No. 101, “Revenue Recognition in Financial

Statements.”

Contingencies

Avon is a defendant in a class action suit commenced in

1991 on behalf of certain classes of holders of Avon’s

Preferred Equity-Redemption Cumulative Stock

(“PERCS”). Plaintiffs allege various contract and securities

law claims related to the PERCS (which were fully

redeemed in 1991) and seek aggregate damages of approx-

imately $145.0, plus interest. A trial of this action took

place in the United States District Court for the Southern

District of New York and concluded in November 2001.

At the conclusion of the trial, the judge reserved decision

in the matter. Avon believes it presented meritorious

defenses to the claims asserted. However, it is not possible

to predict the outcome of litigation and it is reasonably

possible that the trial, and any possible appeal, could be

decided unfavorably. Management is unable to make a rea-

sonable estimate of the amount or range of loss that could

result from an unfavorable outcome but, under some of the

damage theories presented, an adverse award could be

material to the Consolidated Financial Statements.

Avon is a defendant in an action commenced in the

Supreme Court of the State of New York by Sheldon Solow

d/b/a Solow Building Company, the landlord of the

Company’s former headquarters in New York City.

Plaintiff seeks aggregate damages of approximately $80.0,

plus interest, for the Company’s alleged failure to restore

the leasehold premises at the conclusion of the lease term

in 1997. A trial of this matter was scheduled for February

2002, but was stayed pending the determination of (i) an

interlocutory appeal by plaintiff of an order that denied

the plaintiff’s motion for summary judgment and granted

partial summary judgment in favor of the Company on

one of the plaintiff’s claims; and (ii) an appeal by plaintiff

of a decision in an action against another former tenant

that dismissed plaintiff’s claims after trial. In January

2003, both appeals were decided against the plaintiff.

Trial has not yet been re-scheduled. While it is not possi-

ble to predict the outcome of litigation, management

believes that there are meritorious defenses to the claims

asserted and that this action should not have a material

adverse effect on the Consolidated Financial Statements.

This action is being vigorously contested.

Avon Products Foundation, Inc. (the “Avon

Foundation”) is a defendant in an arbitration proceeding

brought by Pallotta TeamWorks (“Pallotta”) on September

3, 2002, before Judicial Arbitration and Mediation

Services, Inc. (“JAMS”). Pallotta asserts claims of breach of

contract, misappropriation of opportunity, tortious inter-

ference with prospective contractual arrangement and

unfair competition arising out of the Avon Foundation’s

decision to use another party to conduct breast cancer

fundraising events, and seeks unspecified damages and

attorneys’ fees. In January 2003, Pallotta’s misappropria-

tion claim was dismissed by the arbitrator. In February

2003, Pallotta’s unfair competition claim was also dis-

missed by the arbitrator. The Avon Foundation believes

that it has meritorious defenses to the claims asserted by

Pallotta and has filed a number of counterclaims, and ini-

tiated a separate arbitration proceeding before JAMS. The

Avon Foundation is a registered 501(c)(3) charity and is a

distinct entity from Avon Products, Inc., which is not a

party to these proceedings. While it is not possible to pre-

dict the outcome of litigation, management believes that

these proceedings should not have a material adverse effect

on the Consolidated Financial Statements.

On December 20, 2002, a Brazilian subsidiary of

the Company received a series of tax assessments from

the Brazilian tax authorities asserting that the establish-

ment in 1995 of separate manufacturing and distribution