Avon 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 60

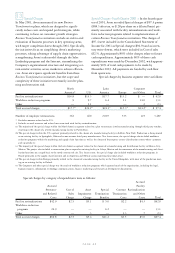

Pension Benefits

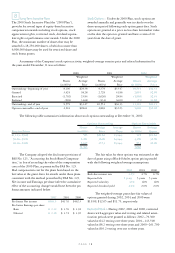

U.S. Plans Non-U.S. Plans Postretirement Benefits

2002 2001 2002 2001 2002 2001

Change in benefit obligations:

Beginning balance $(588.6) $(520.1) $(410.8) $(394.1) $(176.1) $ (136.0)

Service cost (19.0) (18.7) (18.8) (15.6) (2.2) (1.2)

Interest cost (43.6) (41.9) (25.4) (23.3) (12.5) (10.7)

Actuarial loss (47.1) (63.8) (18.8) (12.2) (18.2) (44.2)

Benefits paid 61.3 68.5 30.9 22.1 14.2 16.9

Plan amendments (22.0) (.4) (2.0) —17.4 —

Settlements/special termination benefits —(12.2) 1.9 .7 —(1.2)

Foreign currency changes ——(38.7) 19.0 ——

Other ——(2.8) (7.4) (.1) .3

Ending balance $(659.0) $(588.6) $(484.5) $(410.8) $(177.5) $(176.1)

Change in plan assets:

Beginning balance $467.7 $ 529.4 $ 248.9 $ 269.9 $ — $—

Actual loss on plan assets (56.6) (26.4) (19.7) (18.5) ——

Company contributions 126.0 33.2 40.2 26.0 14.2 16.9

Plan participant contributions ——2.0 2.1 ——

Benefits paid (61.3) (68.5) (30.9) (22.1) (14.2) (16.9)

Foreign currency changes ——16.3 (7.9) ——

Settlements/special termination benefits ——(3.6) (.6) ——

Ending balance $ 475.8 $ 467.7 $ 253.2 $ 248.9 $ — $—

Funded status of the plan (183.2) (120.9) (231.3) (161.9) (177.5) (176.1)

Unrecognized actuarial loss 365.4 209.8 145.4 81.8 34.8 17.0

Unrecognized prior service cost 16.1 (4.4) 6.9 6.6 (50.7) (37.8)

Unrecognized net transition obligation ——1.8 1.9 .3 .2

Accrued benefit cost $ 198.3 $ 84.5 $ (77.2) $ (71.6) $(193.1) $ (196.7)

Amount recognized in the statements:

Prepaid benefit —$ 122.9 $ 21.5 $35.2 $ — $—

Accrued liability (130.0) (59.4) (214.5) (171.4) (193.1) (196.7)

Intangible asset 16.1 3.4 4.5 6.2 ——

Accumulated other comprehensive loss 312.2 17.6 111.3 58.4 ——

$ 198.3 $ 84.5 $ (77.2) $ (71.6) $(193.1) $ (196.7)

Weighted-average discount rate use

in determining the benefit obligation 6.8% 7.3% 5.7% 6.0% 6.8% 7.3%

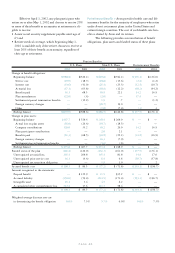

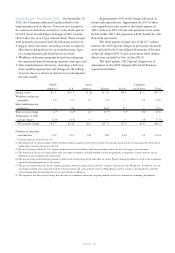

Effective April 1, 2002, any plan participant who

retires on or after May 1, 2002 and chooses to receive 20%

or more of their benefit as an annuity at retirement is eli-

gible to receive:

• A new social security supplement payable until age of

65 and

• Retiree medical coverage, which beginning May 1,

2002 is available only if the retiree chooses to receive at

least 20% of their benefit as an annuity, regardless of

their age at retirement.

Postretirement Benefits > Avon provides health care and life

insurance benefits for the majority of employees who retire

under Avon’s retirement plans in the United States and

certain foreign countries. The cost of such health care ben-

efits is shared by Avon and its retirees.

The following provides a reconciliation of benefit

obligations, plan assets and funded status of these plans: