Avon 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 50

recognized. Contracts that require net-cash settlement and

contracts that give the counterparty a choice of net-cash

settlement or settlement in shares are recorded as assets or

liabilities and are initially measured at fair value with sub-

sequent changes in fair value recognized as gains or losses

in the income statement. At December 31, 2002, Avon

did not hold any forward contracts to purchase Avon com-

mon stock.

Research and Development > Research and development

costs are expensed as incurred and aggregated in

2002–$48.4 (2001–$45.9; 2000–$43.1).

Advertising > Advertising costs are expensed as incurred

and aggregated in 2002–$101.0 (2001–$97.2;

2000–$92.4). Direct response advertising costs, consist-

ing primarily of brochure preparation, are amortized

over the period during which the benefits are expected.

At December 31, 2002 and 2001, Prepaid expenses and

other included deferred brochure costs of $25.0 and

$26.4, respectively.

Income Taxes > Deferred income taxes have been provided

on items recognized for financial reporting purposes in

different periods than for income tax purposes at future

enacted rates. A valuation allowance is provided for

deferred tax assets if it is more likely than not these items

will either expire before Avon is able to realize their bene-

fit, or that future deductibility is uncertain.

U.S. income taxes have not been provided on

approximately $444.4 of undistributed income of sub-

sidiaries that has been or is intended to be permanently

reinvested outside the United States.

Shipping and Handling > Shipping and handling costs

are expensed as incurred and aggregated in 2002–$544.6

(2001–$538.0; 2000–$517.4). Shipping and handling

costs are included in Marketing, distribution and adminis-

trative expenses on the Consolidated Statements of

Income.

Contingencies > In accordance with FAS No. 5,

“Accounting for Contingencies,” Avon determines whether

to disclose and accrue for loss contingencies based on an

assessment of whether the risk of loss is remote, reasonably

possible or probable. Avon records loss contingencies when

it is probable that a liability has been incurred and the

amount of loss is reasonably estimable.

Reclassifications > To conform to the 2002 presentation,

certain reclassifications were made to the prior years’

Consolidated Financial Statements and the accompanying

footnotes.

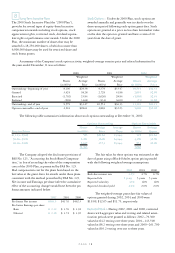

Earnings per Share > Basic earnings per share (“EPS”)

are computed by dividing net income by the weighted-

average number of shares outstanding during the year.

Diluted EPS are calculated to give effect to all potentially

dilutive common shares that were outstanding during

the year.

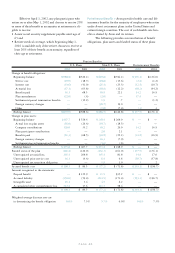

For each of the three years ended December 31,

the components of basic and diluted earnings per share

were as follows:

2002 2001 2000

Numerator:

Basic:

Income from continuing

operations before cumulative

effect of accounting changes $534.6 $444.9 $485.8

Cumulative effect of

accounting changes —(0.3) (6.7)

Net income $534.6 $444.6 $479.1

Diluted:

Income from continuing

operations before cumulative

effect of accounting changes $534.6 $444.9 $485.8

Interest expense on

Convertible Notes, net of taxes 10.4 10.0 4.5

Income for purposes of

computing diluted EPS before

cumulative effect of

accounting changes 545.0 454.9 490.3

Cumulative effect of

accounting changes —(0.3) (6.7)

Net income for purposes

of computing diluted EPS $545.0 $454.6 $483.6

Denominator:

Basic EPS weighted-average

shares outstanding 236.06 236.83 237.67

Dilutive effect of:

Assumed conversion of

stock options and settlement

of forward contracts 2.45* 2.26* 2.06*

Assumed conversion of

Convertible Notes 6.96 6.96 3.22

Diluted EPS adjusted

weighted-average shares

outstanding 245.47 246.05 242.95

Basic EPS:

Continuing operations $ 2.26 $ 1.88 $ 2.04

Cumulative effect of

accounting changes —— (.03)

$ 2.26 $ 1.88 $ 2.01

Diluted EPS:

Continuing operations $ 2.22 $ 1.85 $ 2.02

Cumulative effect of

accounting changes —— (.03)

$ 2.22 $ 1.85 $ 1.99

* At December 31, 2002, 2001 and 2000, stock options and forward

contracts to purchase Avon common stock totaling 2.8 million shares,

.3 million shares and 1.1 million shares, respectively, are not included

in the diluted EPS calculation since their impact is anti-dilutive.