Avon 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Contingencies

Avon is a defendant in a class action suit commenced in

1991 on behalf of certain classes of holders of Avon’s

Preferred Equity-Redemption Cumulative Stock

(“PERCS”). Plaintiffs allege various contract and securities

law claims related to the PERCS (which were fully

redeemed in 1991) and seek aggregate damages of approx-

imately $145.0, plus interest. A trial of this action took

place in the United States District Court for the Southern

District of New York and concluded in November 2001.

At the conclusion of the trial, the judge reserved decision

in the matter. Avon believes it presented meritorious

defenses to the claims asserted. However, it is not possible

to predict the outcome of litigation and it is reasonably

possible that the trial, and any possible appeal, could be

decided unfavorably. Management is unable to make a

meaningful estimate of the amount or range of loss that

could result from an unfavorable outcome but, under some

of the damage theories presented, an adverse award could

be material to the Consolidated Financial Statements.

14

PAGE 70

2002 Charges >

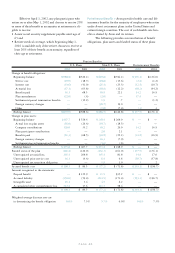

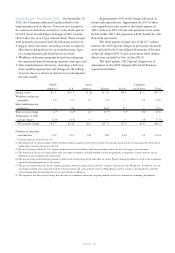

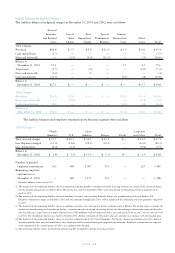

North Latin Corporate

America* U.S. America Europe Pacific and Other Total

Total Accrued Charges $ 4.7 $6.2 $4.1 $17.5 $7.2 $ 3.9 $43.6

Less: Expenses Charged (0.5) (.8) (2.1) (2.8) (2.3) (1.1) (9.6)

Balance at

December 31, 2002 $ 4.2(a) $5.4(b) $2.0(c) $14.7(d) $4.9(e) $ 2.8(f) $34.0

Number of planned

employee terminations 152 179 241 302 119 41 1,034

Remaining employee

terminations at

December 31, 2002 151 178 169 271 90 6 865

* Excludes amounts related to the U.S.

(a) The majority of the remaining liability relates to employee severance costs resulting from the closure of a manufacturing facility in Canada and the transi-

tion of production to existing facilities in the U.S. Employee terminations will begin in March 2003 and continue through September 2003, with the

majority of payments made by December 2003.

(b) The majority of the remaining liability relates to employee severance costs associated with workforce reduction programs within the sales and supply

chain functions. Employee terminations began in December 2002 and will continue through September 2003, with a majority of payments made by

December 2003.

(c) The majority of the remaining liability relates to employee severance costs associated with workforce reduction programs in Argentina, Central America

and Venezuela. Employee terminations began in October 2002 and will continue through September 2003, with all payments made by December 2003.

(d) The majority of the remaining liability relates to employee severance costs. Employee terminations began in November 2002, with all payments made by

December 2003.

(e) The majority of the remaining liability relates to employee severance costs related to supply chain initiatives. Employee terminations began in December

2002 and will continue through January 2003, with a majority of payments made by March 2003. The procurement center in Hong Kong and the sales

branches in Malaysia were closed in 2002.

(f) The remaining liability relates to remaining amounts payable to employees already receiving severance.

Avon is a defendant in an action commenced in the

Supreme Court of the State of New York by Sheldon Solow

d/b/a Solow Building Company, the landlord of the

Company’s former headquarters in New York City. Plaintiff

seeks aggregate damages of approximately $80.0, plus inter-

est, for the Company’s alleged failure to restore the leasehold

premises at the conclusion of the lease term in 1997. A trial

of this matter was scheduled for February 2002, but has been

stayed pending the determination of (i) an interlocutory

appeal by plaintiff of an order that denied the plaintiff’s

motion for summary judgment and granted partial summary

judgment in favor of the Company on one of the plaintiff’s

claims; and (ii) an appeal by plaintiff of a decision in an

action against another former tenant that dismissed plain-

tiff’s claims after trial. In January 2003, both appeals were

decided against the plaintiff. Trial has not yet been sched-

uled. While it is not possible to predict the outcome of liti-

gation, management believes that there are meritorious

defenses to the claims asserted and that this action should not

have a material adverse effect on the Consolidated Financial

Statements. This action is being vigorously contested.